Wall Street Giants Morgan Stanley and Citigroup Predict Minimum 50Bps Fed Rate Cuts This Year

The monetary dam is cracking. Two of finance's biggest names just placed their bets on a major policy pivot.

The Big Picture: Liquidity's Coming Back

Forget soft landings and cautious trims. The forecast from these banking titans points to significant, deliberate easing. We're talking about a minimum of 50 basis points sliced from the federal funds rate—a direct injection of cheaper capital into the system. It's the kind of move that doesn't just adjust the economy; it reflates it.

Why This Isn't Just Another Forecast

When consensus forms at the very top, markets listen. This synchronized call from Morgan Stanley and Citigroup isn't a whisper; it's a signal flare. It tells institutional money to start repositioning. It tells corporate treasurers to reconsider their debt strategies. And for the average investor? It's a blinking neon sign pointing toward risk assets.

The Ripple Effect (And Where to Look)

Cheaper money flows downhill. It bypasses clogged traditional pipes and seeks the path of least resistance—and highest potential return. Historically, when the Fed turns the taps on, it doesn't just lift all boats; it creates entirely new currents. Sectors that thrive on leverage and growth get a turbocharge. Assets perceived as stores of value in a low-yield world suddenly look a lot more attractive.

A cynical take? The same institutions forecasting the cuts will be the first to profit from the volatility they create—charging fees on both the fear going in and the greed coming out. The real action starts when the smart money's narrative becomes the market's reality. Buckle up.

The Federal Reserve is expected to continue with its interest rate cut in 2026, amid the high executive pressures. As President Donald TRUMP prepares to name his pick for the Fed Chair to replace Jerome Powell, Wall Street analysts are now forecasting at least a 50 bps rate cut in 2026.

Morgan Stanley and Citigroup Forecast More Fed Rate Cuts in 2026

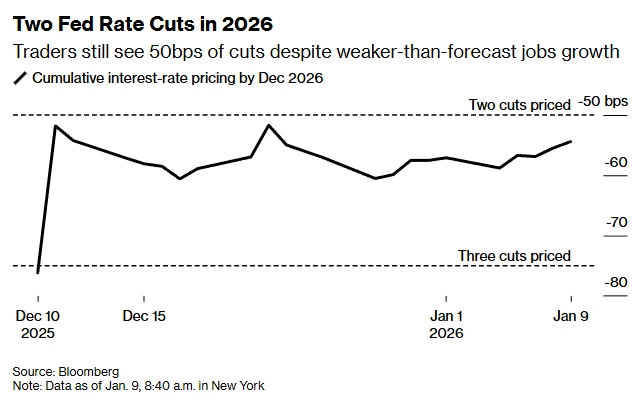

According to client notes from Morgan Stanley (NYSE: MS) and Citigroup Inc. (NYSE: C), the Federal Reserve will initiate at least two 25-bps rate cuts in 2026. Morgan Stanley changed its forecast of 25 bps rate cuts in January and April to June and September 2026.

Citigroup changed its forecast for 2026 Fed rate cuts from January, March, and September to March, July, and September. As such, Citigroup expects the Fed to initiate a up to 75 bps rate cut in 2026, thus pushing the range below 3%.

Why is Wall Street Anticipating More Rate Cuts?

Wall Street expects the Fed to continue with its rate cuts in 2026 after undertaking three cuts in 2025. With President Trump expected to name a new Fed Chair soon, Wall Street is confident of at least two rate cuts in the coming months.

Source: X

Despite the weaker than expected jobs growth, Treasury Secretary Scott Bessent has emphasized the need for lower interest rates to spur economic growth.

What’s the Expected Impact on Bitcoin and Crypto?

The expected Fed rate cuts have coincided with the ongoing liquidity injection under President Trump. The Fed kick-started its Quantitative Easing (QE) in early December 2025 and President Trump will inject $200 billion through the housing industry.

These events are extremely dovish for the crypto market. Furthermore, Wall Street investors have gradually turned on risk-on mode. With the expected capital rotation from the precious metals industry, amid the ongoing stock market bull rally, bitcoin and the wider altcoin industry will ultimately register a strong bull run in 2026.