Bitcoin’s Make-or-Break Moment: Will BTC Soar to $105k or Crash Below $90k?

Crypto traders are holding their breath as Bitcoin teeters on a razor's edge—the next move could define the market for months.

The Technical Tightrope

Charts are screaming. Support levels are fraying. Every candlestick feels like a verdict. The digital gold narrative gets its next stress test right here, right now. Forget the hype—price action doesn't lie.

Institutional Whispers vs. Retail Panic

While hedge funds debate entry points, the average investor is checking their portfolio every five minutes. It's the classic Wall Street versus Main Street showdown, only this time it's playing out with a decentralized, volatile asset that sleeps for no one. Some analysts see this consolidation as healthy; others smell blood in the water.

The Macro Mirage

Traditional finance pundits are suddenly crypto experts, linking every dip to interest rates and every pump to inflation data. It's almost impressive how quickly they've mastered the art of fitting a square peg into a round, blockchain-shaped hole. Their track record on predicting this market remains, charitably, speculative.

The Verdict Awaits

One thing's certain: volatility is back on the menu. The path to $105,000 or the plunge below $90,000 will be decided by a cocktail of liquidity, sentiment, and pure market mechanics. Buckle up—this is where legends and margin calls are made.

Bitcoin price is once again at a critical pivotal zone as the price hovers NEAR the $90,000 zone, a level which acts as a psychological and technical support.

After failing to hold above recent highs, BTC price has entered a consolidation zone between $85k-$95k, reflecting hesitation across the broader crypto market.

While the bitcoin price hasn’t shown strong directional momentum, the market structure suggests that something bigger is cooking beneath the surface.

At press time, bitcoin price stayed calm above its 100 day EMA support at $90,550. Its market cap was at $1.8T.

Bitcoin Price Analysis: Why Is $85K-$95K So Important?

Bitcoin’s current price range between $85k-$95k shows a clear battle between buyers and sellers. Bulls are defending the $85-$90k support zone, while sellers continue to cap upside near $95k.

As long as BTC remains trapped between these levels, further consolidation could be seen ahead.

However, if Bitcoin price loses the $90k support zone, a retracement toward $80k or even $70k could be seen ahead. On the other hand, a strong bounce from this zone could reignite bullish momentum.

Despite price consolidation, technical indicators are slowly improving. The Relative Strength Index (RSI) has started moving upward on a weekly timeframe and may post a crossover ahead.

Furthermore, BTC price stays close to the trendline support, if momentum strengthens BTC could attempt a rebound toward $100k-$105k in the near term.

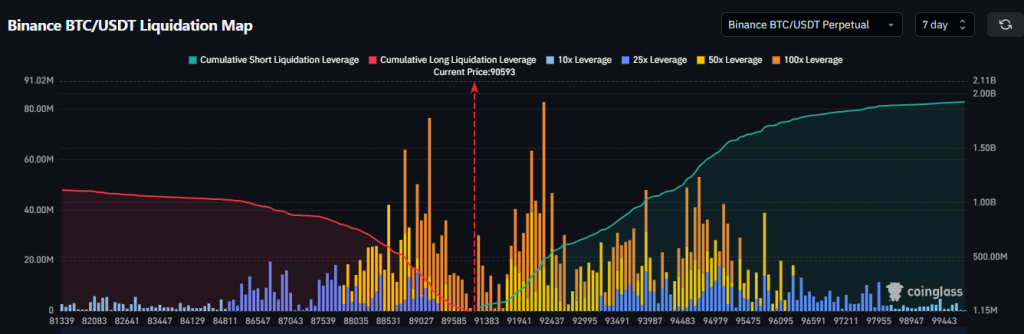

Adding to the bullish narrative, BTC’s liquidation map shows that nearly $1.5 billion worth of BTC short positions could be wiped out if Bitcoin rallies above the $95k mark.

This means a minor upward MOVE could force short sellers to cover their positions, triggering a massive short squeeze. This setup may increase the chance of a rapid breakout.

Final Takeaway

Amidst the battle between the bulls and bears, Bitcoin price has been stuck in a waiting phase. However, BTC appears to be preparing for its next major price swing.

For now patience remains key, because when BTC price breaks any side of this range, the move could be fast and decisive.