Bitcoin Plunges Over Weekend, Sees Worst Monthly Performance Since 2018

Crypto winter bites back—BTC bleeds out in brutal weekend selloff.

November nightmare: Bitcoin logs its weakest month in seven years, leaving bulls scrambling for excuses.

Meanwhile, Wall Street bankers sip lattes and whisper 'told you so'—between counting their 8% Treasury yields.

Read us on Google News

Read us on Google News

In brief

- Bitcoin fell nearly 5% over the weekend, sliding to $86,950 and sparking heavy market liquidations.

- Over 180,000 traders lost positions as $539M was wiped out, mainly in Bitcoin and Ether longs.

- November ends with Bitcoin down 17.49%, marking its weakest monthly performance of 2025.

- Analysts highlight CME gap closure and liquidity reset as potential conditions for a market rebound.

Over 180,000 Traders Liquidated Amid Market Shakeout

Bitcoin spent most of the weekend holding NEAR $91,500, trading in a tight range that suggested steady month-end consolidation. Momentum shifted late Sunday when a wave of selling hit the market, sending the asset down almost 5% in just three hours. Prices slid to $86,950 on Coinbase, according to market data, ending Bitcoin’s attempt to push past key resistance levels.

Kobeissi Letter noted the pattern of abrupt weekend moves, commenting that Friday and Sunday sessions have repeatedly brought outsized volatility this year. No major news event sparked the slide, suggesting instead that internal market pressure was to blame.

Analysts attributed the drop to a sudden burst of sell orders that cascaded through heavily margined positions. Kobeissi described it as a domino-style MOVE driven by a buildup of fragile leverage rather than a shift in fundamentals.

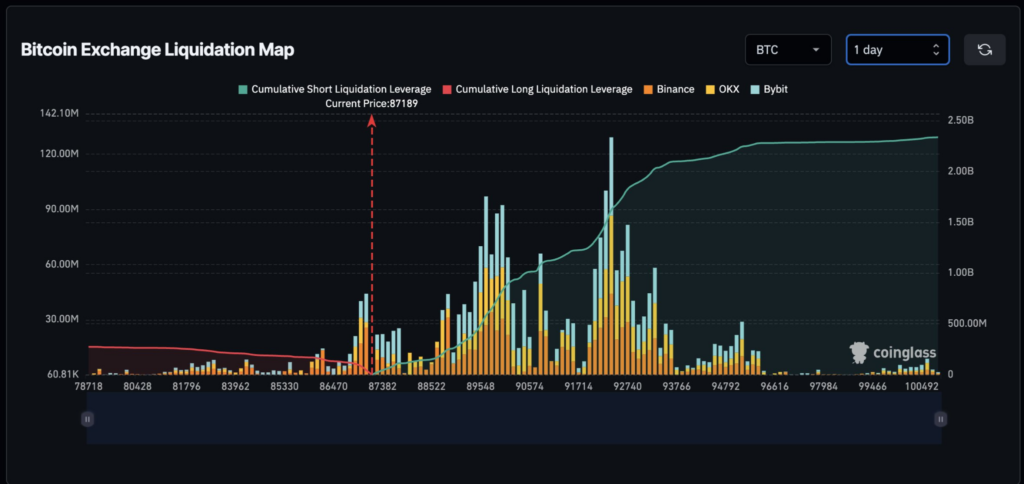

Liquidations surged across crypto markets, wiping out the positions of more than 180,000 traders in 24 hours. Total liquidations reached $539 million, largely concentrated in Bitcoin and Ether longs, according to CoinGlass.

The flush followed an earlier wipeout that erased $8 billion in open interest within days, a sign of an overheated market resetting aggressively.

Several on-chain and market metrics pointed to growing trader exhaustion:

- Nearly 90% of liquidations came from long positions.

- Open interest dropped sharply after weeks of elevated leverage.

- Short-term holder activity showed signs of capitulation.

- Market sentiment fell to 24 on the Fear & Greed Index chart.

- Bitcoin slipped below the 200-day simple moving average.

November closed with bitcoin down 17.49%, marking its weakest monthly performance of 2025. Interestingly, it also marks the coin’s worst November performance since 2018, when it fell more than 36% during a deep bear market.

CME Gap Closure Sets Stage for Potential Rebound

At the time of writing, Bitcoin is exchanging hands at $86,565, after posting only 12 green trading days in the past month. The OG crypto now trails 86% of the top 100 crypto assets in year-to-date performance.

Even though Bitcoin’s performance remains weak, some in the crypto community still hold a positive outlook on the asset. Analyst “Sykodelic” maintained an optimistic stance, calling the early-month pullback a healthy reset.

He noted that the CME gap has already closed and nearly $400 million in longs were cleared, removing excess leverage. Clearing downside liquidity first, he maintained, sets conditions for a stronger recovery.

Mister Crypto added that Bitcoin may have reached a local bottom, citing a weekly RSI near 30 and growing speculation around potential rate cuts. While broader on-chain data still points to a downward trend, several analysts view the recent washout as a step toward stabilizing the market.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.