NFT Market Crashes to 2025 Lows: Sales, Prices, and User Participation in Freefall

The digital collectibles party is over—for now. The NFT market just hit its lowest point of the year, with key metrics across the board painting a bleak picture.

Where Did All the Buyers Go?

Sales volume is tanking. The once-frenetic pace of transactions has slowed to a crawl, signaling a massive drop in market activity and liquidity. It's a classic case of fading hype meeting economic reality.

The Floor is Falling Out

It's not just about fewer sales—it's about lower prices. Valuations for even blue-chip collections are getting slashed, erasing gains and testing the conviction of long-term holders. The paper fortunes of 2021 are looking mighty thin.

A Ghost Town of Participation

The most telling sign? The crowd has thinned. Active wallets and new entrants are dwindling, turning once-vibrant marketplaces into digital ghost towns. When the tourists leave, you see what was really built on sand—or in this case, blockchain.

This isn't just a dip; it's a full-scale recalibration. The market cuts through speculation, bypassing the noise to ask the hard question: what's actually valuable? Sometimes, the most bullish thing a market can do is flush out the weak hands—even if it hurts on the way down. Just ask any traditional finance veteran watching from the sidelines with a cynical smirk; they've seen this movie before, just with different ticker symbols.

Read us on Google News

Read us on Google News

In brief

- NFT market value fell 72% in 2025, dropping to about $2.5 billion as December extended a long-running downturn.

- Weekly NFT sales stayed below $70 million in December, pressured by thin liquidity and fading speculative interest.

- Buyer and seller activity declined sharply, with unique sellers falling below 100,000 for the first time since 2021.

- Blue-chip NFTs saw double-digit price drops, while Sports Rollbots entered the top 10 by market capitalization.

December Deepens Downturn With Weak Sales and Fading Participation

Unlike other risk assets that often see seasonal support, NFTs failed to attract renewed interest. Weak trading volumes, falling prices, and reduced user activity suggested the market remained unstable.

Losses continued through December, pushing the total NFT market value to its lowest level of the year. According to market data, valuations fell to roughly $2.5 billion, down from $9.2 billion in January. Notably, that 72% drop reflects a prolonged cooling period after years of heavy speculation.

Sales activity showed little improvement following a weak November. Weekly NFT sales in December remained below $70 million during the first three weeks, trailing the prior month’s pace. Thin year-end liquidity added pressure, making any rebound difficult to sustain. Earlier interest in physical collectibles such as Labubu figures and Pokémon cards did not translate into broader NFT demand.

Participation across NFT markets continued to decline. Fewer users were trading, listing, or buying digital assets, reducing turnover and limiting price support. CryptoSlam data captured steady declines throughout the month, indicating waning interest from both new and returning participants.

NFT Rankings Shift as Sports Rollbots Replaces Mutant Ape Yacht Club

Several trends defined market conditions in December:

- Unique buyers fell from more than 204,000 in late November to about 135,000 by the third week of December.

- Unique sellers dropped 35.6% over the same period, slipping below 100,000 for the first time since April 2021.

- Weekly NFT transactions declined to roughly 800,000 by mid-December.

- No single week during the month exceeded 1 million transactions.

- Lower activity weighed on liquidity and price formation across collections.

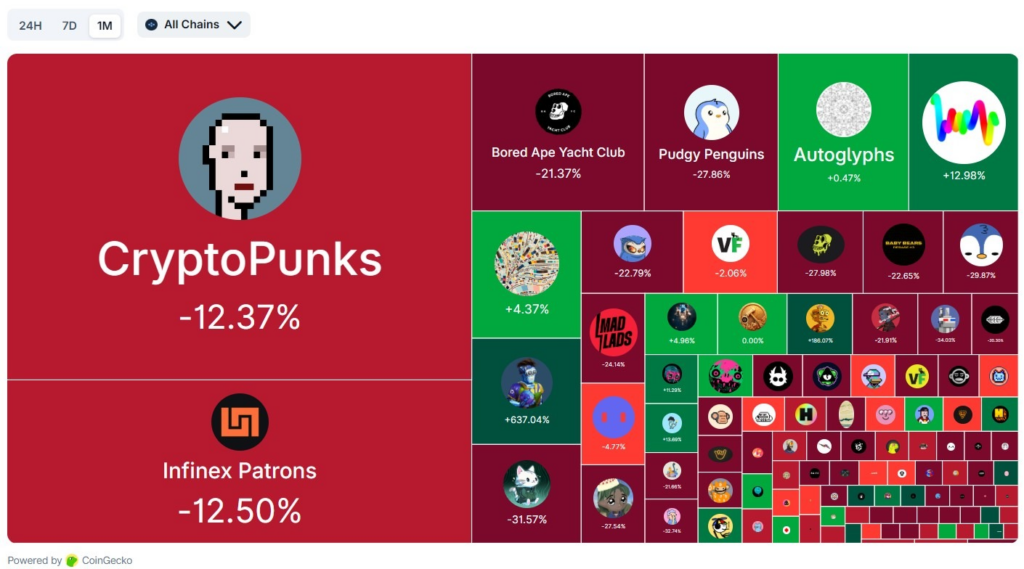

Price performance among major NFT projects reflected the broader downturn. CoinGecko data showed that most of the top 10 collections by market value posted double-digit losses over the past 30 days. CryptoPunks, Bored APE Yacht Club, and Pudgy Penguins recorded floor price declines ranging from 12% to 28%, indicating that even established names were affected.

Some segments showed relative resilience. Art-focused collections such as Autoglyphs, Fidenza by Tyler Hobbs, and Chromie Squiggle by Snowfro posted modest gains during the same period, supported mainly by long-term collectors rather than short-term trading.

A notable shift came from Sports Rollbots, which entered the top 10 NFT collections by market capitalization. With a floor price NEAR $5,800 and a valuation above $58 million, the project displaced Mutant Ape Yacht Club from the top tier.

Analysts say ongoing weakness in NFTs could weigh on Ethereum, which hosts many major collections. Still, Ethereum’s broader use across decentralized finance and other blockchain applications may limit the impact as NFT markets remain under pressure.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.