Kalshi Surges Past Polymarket, Shatters Records with $2.3 Billion Weekly Volume

Move over, crypto—regulated prediction markets just stole the spotlight.

A seismic shift rattles the prediction market landscape. Kalshi, the CFEC-regulated platform, isn't just competing anymore; it's dominating. This week, it decisively overtook its crypto-native rival, Polymarket, to claim the top spot. The catalyst? A staggering, record-shattering weekly trading volume that signals a massive influx of capital and user confidence.

The New King of the Hill

Forget niche betting. This $2.3 billion tidal wave represents mainstream money voting with its wallet. It's a clear signal that when given a choice between the regulatory gray area of crypto-based platforms and a fully compliant, US-regulated alternative, significant capital is choosing the latter. The volume isn't just big—it's an order-of-magnitude statement.

What's Driving the Frenzy?

Look beyond the headline number. This surge is fueled by a potent mix: heightened political and economic uncertainty creating more 'tradable' events, sophisticated traders hedging real-world exposure, and a user base hungry for a clean, legal venue. Kalshi's structure turns global anxiety into a liquid asset class, and right now, the world is providing ample raw material.

A Warning Shot Across the Bow

This isn't a fluke; it's a blueprint. The record volume proves there's a massive, underserved appetite for speculative instruments that don't require a crypto wallet or a tolerance for regulatory ambiguity. Traditional finance giants are watching, noting that the public will embrace innovation—as long as it comes with a government seal of approval. It turns out, even in the wild world of prediction markets, nothing boosts confidence like the comforting embrace of bureaucracy.

The landscape has been redrawn. With $2.3 billion in weekly volume, Kalshi hasn't just won a race—it's defined the new track everyone else must now run on. The era of regulatory legitimacy as a competitive weapon is officially here.

Read us on Google News

Read us on Google News

In brief

- Kalshi recorded $2.3B in weekly trading volume, nearly doubling Polymarket’s total and marking its first close above $2B.

- TRON network support for TRX and USDT deposits expanded access and helped attract higher short-term trading activity.

- Sports markets led platform activity, with Pro Football Champion contracts exceeding $65.8M in traded volume.

- September data shows Kalshi holding 62% of global prediction market volume after expanding into Solana, Base, and Robinhood.

TRON Integration Drives Surge in Trading Activity

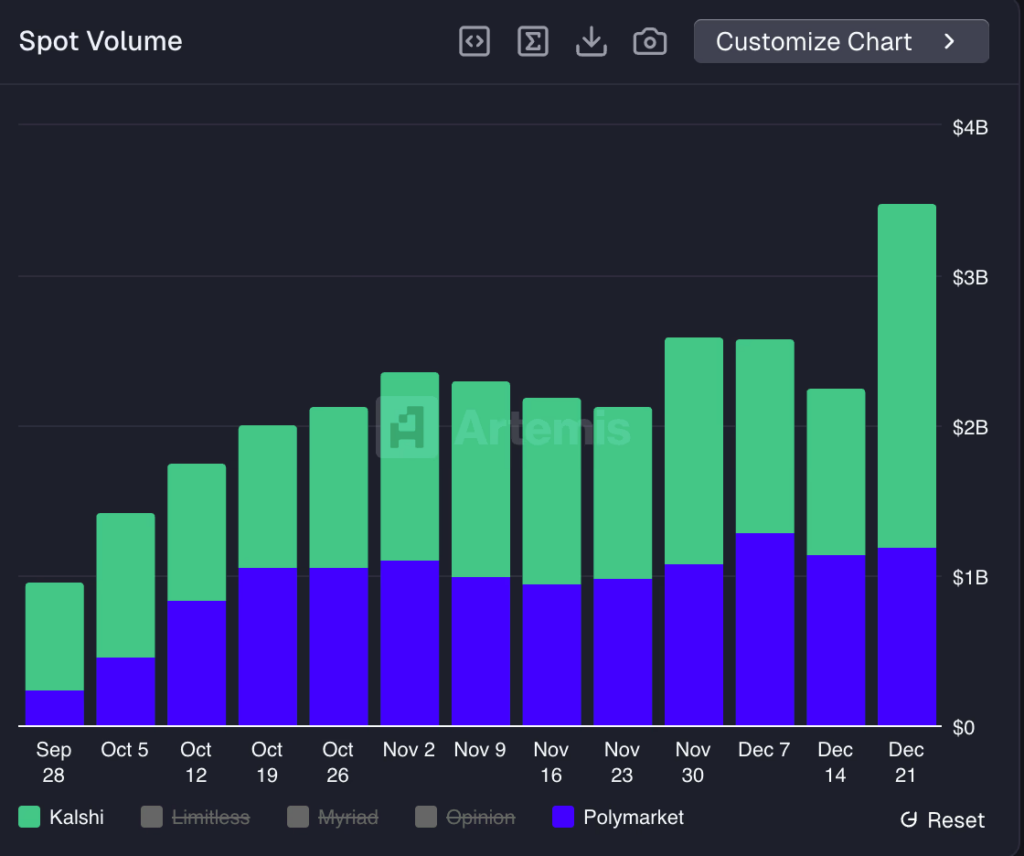

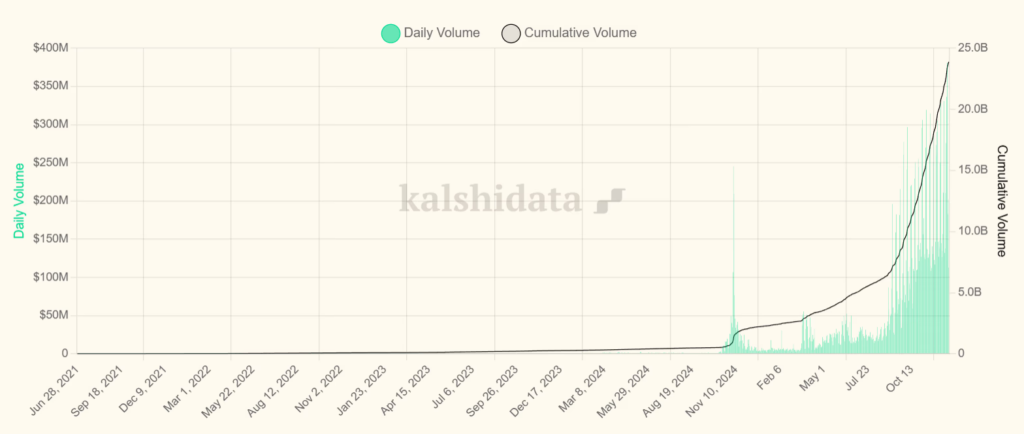

The platform recorded $2.3 billion in trading volume for the week ending Dec. 21, according to Artemis. That total was nearly double Polymarket’s $1.2 billion for the same week and marked Kalshi’s first weekly close above $2 billion. Adding to this performance, trading activity also increased across several market categories.

A key factor behind the increase in volume was Kalshi’s recent integration with the TRON network. Support for TRX and USDT deposits and withdrawals on TRON expanded access for traders seeking faster and lower-cost transactions. Additional payment options often contribute to short-term inflows from trading.

Kalshi’s performance over the past quarter reflects several platform developments:

- Weekly trading volume reached a record level above $2 billion.

- TRON integration added support for TRX and USDT transactions.

- Sports contracts accounted for the largest share of activity.

- Total platform volume surpassed $23.7 billion.

- Market share continued to increase relative to Polymarket since September.

Sports Trading Fuels Kalshi’s Market Share Gains Over Polymarket

Sports markets remain the platform’s largest category by a wide margin. Contracts linked to the next Pro Football Champion alone exceeded $65.8 million in trading volume as of press time. Earlier data showed Kalshi processing more than $1.1 billion in sports-related trades during a single week between Oct. 20 and Oct. 27, while political markets saw much lower activity.

During that same week, Polymarket reported $357 million in sports trading, reinforcing Kalshi’s lead in the category. Prediction markets attracted broader interest during the U.S. presidential election cycle last year, with Polymarket leading volumes for much of that period. The balance began shifting in September as Kalshi activity increased.

Blockchain-related expansions also supported growth. Earlier this month, Kalshi launched tokenized event contracts on Solana, giving traders access to crypto-based liquidity and additional privacy options. John Wang, Head of Crypto at Kalshi, said solana access opens billions of dollars in liquidity through developer tools known as Kalshi Builder Codes.

Figures from September show the platform holding 62% of global prediction market activity, compared with Polymarket’s 37%. Expansion into platforms such as Robinhood, Solana, and Base supported growth across sports and esports markets. Recent data points to sustained user participation as prediction markets continue to broaden their reach.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.