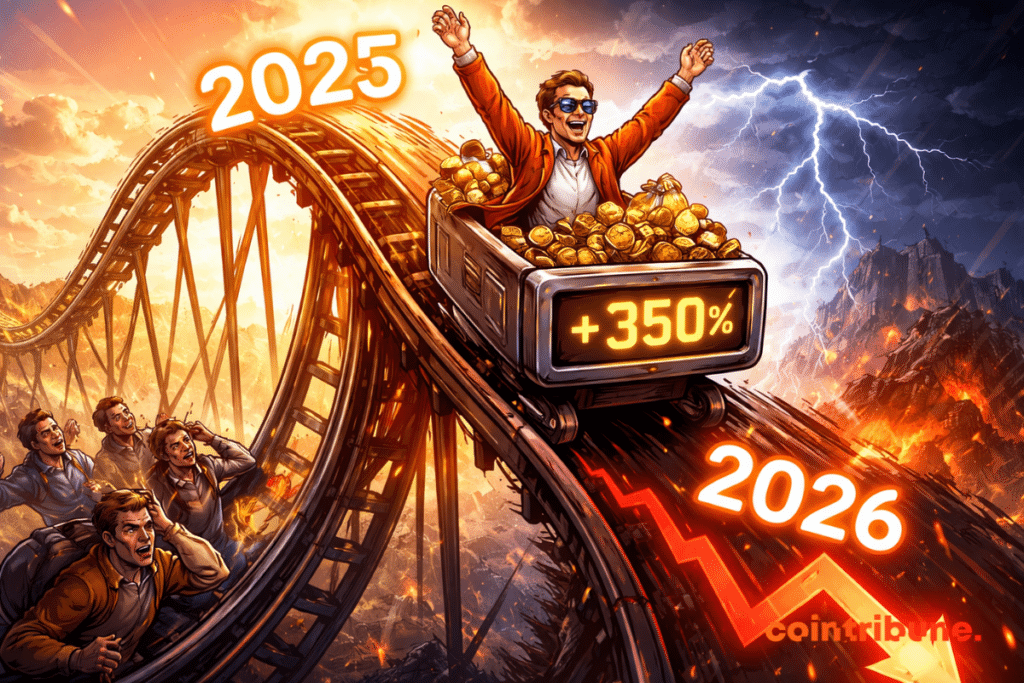

Crypto’s 2025 Surge: CTAs Fuel the Rally, But Is a 2026 Collapse Inevitable?

The floodgates are open. Commodity Trading Advisors (CTAs) have officially stormed the crypto markets, pouring billions into digital assets and sending valuations into the stratosphere. This isn't just institutional interest—it's a full-scale invasion, rewriting the rules of finance in real-time.

The CTA Onslaught

Forget the cautious dips of old. These systematic funds operate on momentum, and right now, the momentum screams 'buy.' Their algorithmic models, once blind to Bitcoin, now see it as just another asset class to exploit. The result? A tidal wave of capital that lifts all boats, from blue-chip tokens to the most speculative alts. It's pure, unadulterated fuel for the bull run.

The Looming Reckoning

But every algorithm has an exit strategy. The same signals that triggered the buying frenzy will, inevitably, flash red. When the trend reverses, these automated traders won't hesitate—they'll sell into weakness, accelerating any downturn. It's the double-edged sword of institutional adoption: they provide liquidity on the way up, and amplify panic on the way down. A sobering thought for anyone who believes Wall Street's embrace is an unconditional blessing.

Navigating the New Paradigm

The game has changed. Success now means understanding these new market mechanics. It's about recognizing when the machines are driving the action and positioning accordingly. The volatile, sentiment-driven crypto winter of old is being replaced by a new era of machine-driven cycles—potentially sharper and more brutal.

The 2025 party is in full swing, funded by cold, hard algorithmic logic. Just remember, in traditional finance, the most sophisticated models are often just beautifully back-tested ways to lose money for everyone except the fund manager. The countdown to 2026 has already begun.

Read us on Google News

Read us on Google News

In Brief

- CTAs exploded in 2025 by turning Bitcoin into a treasury showcase, but the model already shows its flaws as soon as the price wobbles.

- In 2026, many risk being ousted at the first real drawdown, especially those accumulating without strategy or discipline.

- To survive, CTAs will have to move from storytelling to yield and professional infrastructure, while facing competition from crypto ETFs.

The Rush to Crypto Treasury, Corporate Version

The figure is brutal and tells everything. According to Ryan Chow from Solv Protocol, we went from about 70 companies buying and holding bitcoin in early 2025 to more than 130 by mid-year. A growth resembling a frenzy, not cautious adoption.

Why this frenzy? Because a balance sheet boosted by Bitcoin is alluring. It grabs attention. It simplifies storytelling. “We accumulate,” period. Except a narrative, no matter how well-packaged, does not replace a treasury strategy.

And that’s precisely where the crack appears. The cited leaders describe a mechanism under pressure. When the price wobbles, the actions of these players sway, and the crypto model becomes more fragile than it appears.

The Market Does Not Forgive Showcase Treasuries

Altan Tutar sums up the atmosphere without poetry. 2026 looks bleak. On-the-ground translation: if you are just a SAFE hoping BTC will go up forever, you’re flipping a coin with your company.

Ryan Chow puts it differently, but the essence is the same. A Bitcoin treasury is not a magic solution for infinite dollar growth. And many WOULD be unlikely to survive the next real drawdown.

We got a glimpse in December. Bitcoin briefly fell to around 84,398 dollars, and volatility revived the topic of these valuation rollercoasters, complicating financing and trust. At that time, those who turned accumulation into marketing operations sometimes found themselves selling, just to cover costs. This is the most common scenario. And the most toxic.

Yield, Discipline, and the Showdown Against ETFs

The interesting point is that the execs don’t say: everything will collapse. They say: the model must evolve. The winners, according to Tutar, will be those who add real value beyond the stock. Products. Mechanisms generating regular returns and redistributing part to stakeholders.

Vincent Chok points to the silent enemy: crypto ETFs. For many investors, they offer regulated, simple, and increasingly competitive exposure. Conclusion: if CTAs want to compete, they must speak TradFi language. Transparency, auditability, compliance, professional infrastructure.

Chow pushes the logic further. Treat Bitcoin as a digital active capital, integrated into a yield strategy. He mentions using on-chain instruments to produce more sustainable yield, or collateralized assets to access liquidity when the market retreats. In short: stop putting BTC on a shelf and call it finance.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.