Bitcoin Core Surges in 2025: Network Activity Hits New Highs

Bitcoin's engine just kicked into overdrive. The core protocol isn't just holding steady—it's accelerating, with on-chain metrics painting a picture of a network in high demand. Forget the quiet periods; this is the sound of digital infrastructure being stress-tested by real-world use.

The Metrics That Matter

Transaction counts are climbing. Network hash rate—that ultimate measure of security—continues its relentless upward march, making the chain more immutable by the day. It’s a raw display of computational power dedicated to keeping the ledger intact, a bullish signal that miners are betting big on the future.

Beyond the Price Tag

While traders fixate on ticker symbols, the real story is written in blocks and bytes. This surge in fundamental activity suggests deepening utility, not just speculative fervor. Developers are building, nodes are propagating, and the system is processing value on a scale that would make a legacy payment processor blush—and probably charge a 3% fee for the privilege.

A Network Proving Its Mettle

This isn't a fluke. Sustained growth in core activity validates the foundational thesis: a decentralized, censorship-resistant settlement layer has profound value. It functions precisely when you need it to, bypassing gatekeepers and operating on a global clock. The cynic might say it's just a digital casino, but you don't fortify a casino with this much energy and innovation. The final take? The numbers don't lie. While Wall Street reinvents ETFs and debates basis points, Bitcoin's core network is quietly doing what it always does: processing transactions, securing billions, and building the groundwork for what comes next. The old guard is still trying to figure out the 'why,' while the network just keeps executing.

Read us on Google News

Read us on Google News

In brief

- Bitcoin Core saw a notable rise in participation in 2025 with 135 contributors, up from 112 in 2024.

- Activity on the Bitcoin Development Mailing List picked up in 2025, rising 60% after a 25% decline the previous year.

- Quarkslab’s audit reported two minor issues and 13 informational suggestions without any security risk.

Bitcoin Core Sees Increased Contributions

Activity on the bitcoin Development Mailing List rose by 60% in 2025 compared to the previous year, fueled by higher email volume. The list, a central platform for proposing updates and coordinating protocol improvements, rebounded from a 25% decline in 2024, reflecting renewed community participation.

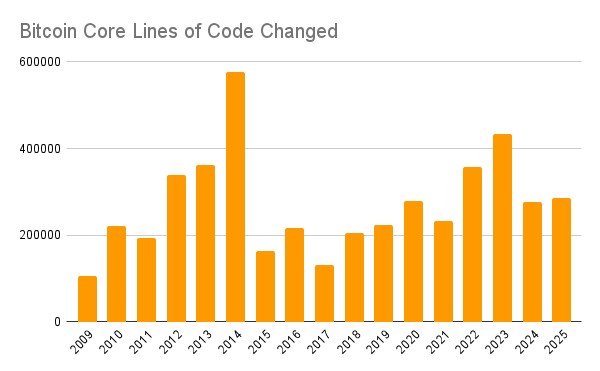

Code activity remained steady, with around 285,000 lines of code added or removed over the year, slightly above 2024’s 276,000. Participation also rose, with 135 contributors submitting code to the Bitcoin Core repository, up from 112 in 2024. Code commits edged up 1% to 2,541, reflecting a consistent and sustainable pace of development.

Bitcoin Core Security Review and Ongoing Support

The rise in contributions paralleled meaningful technical milestones. Bitcoin Core underwent its first publicly disclosed independent security assessment, led by cybersecurity firm Quarkslab with backing from the nonprofit Brink. The audit, designed to identify vulnerabilities, found two minor issues along with 13 recommendations for informational purposes. None posed actual security risks according to Bitcoin Core’s classification system.

The 100-day review followed a structured and methodical approach that covered key aspects of the codebase:

- It started with a careful manual inspection of critical components, giving particular attention to thread management and transaction validation

- The process then moved into dynamic testing, making use of tools already integrated into Bitcoin’s workflows to simulate real-world conditions

- Finally, advanced fuzz testing was applied to explore less conventional areas of the codebase and identify potential weaknesses

Funding for Bitcoin Core development has remained steady, with organizations continuing to provide financial support. In January 2025, VanEck reaffirmed its commitment to allocate 5% of profits from its spot Bitcoin ETF to Brink, ensuring ongoing resources for developer initiatives.

On-Chain Activity Reflects Network Strength

Meanwhile, Bitcoin’s blockchain activity remained robust in 2025. Estimates from CoinMetrics, which adjust for likely change outputs, show that roughly $4.5 trillion moved across the network, averaging $144,000 per second.

The network’s computational power also increased, with the hashrate rising 32% from 802 to 1,060 exahashes per second, reflecting both growing adoption and the network’s sustained security.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.