Japan’s $9 Trillion Bond Market on the Brink: Stablecoins Poised to Displace Central Bank Dominance

Stablecoins are shaking the foundations of Japan's debt markets—and the BOJ might just be watching from the sidelines.

The $9 trillion question: Can algorithmic yield outperform decades of monetary policy inertia?

DeFi's relentless march into sovereign finance continues as institutional players quietly test the waters. No permission slips needed.

Meanwhile, traditional bond traders still can't decide if this is 'disruption' or just another spreadsheet fantasy. Place your bets.

The startup has issued roughly $930,000 worth of tokens, with a target circulation of 10 trillion yen ($66 billion) within the next three years.

The tokens are fully convertible to yen and backed by bank deposits and JGBs, designed to MOVE seamlessly across blockchain networks.

JPYC Plans to Invest 80% of Stablecoin Proceeds in Government Bonds

Founder and CEO Noritaka Okabe told Reuters that stablecoin issuers could step into the role traditionally held by the BOJ, which has been tapering its bond purchases after years of aggressive monetary easing.

“With the BOJ tapering bond buying, stablecoin issuers could emerge as the biggest holders of JGBs in the next few years,” Okabe said.

He added that authorities could influence bond duration, but controlling total holdings WOULD be challenging.

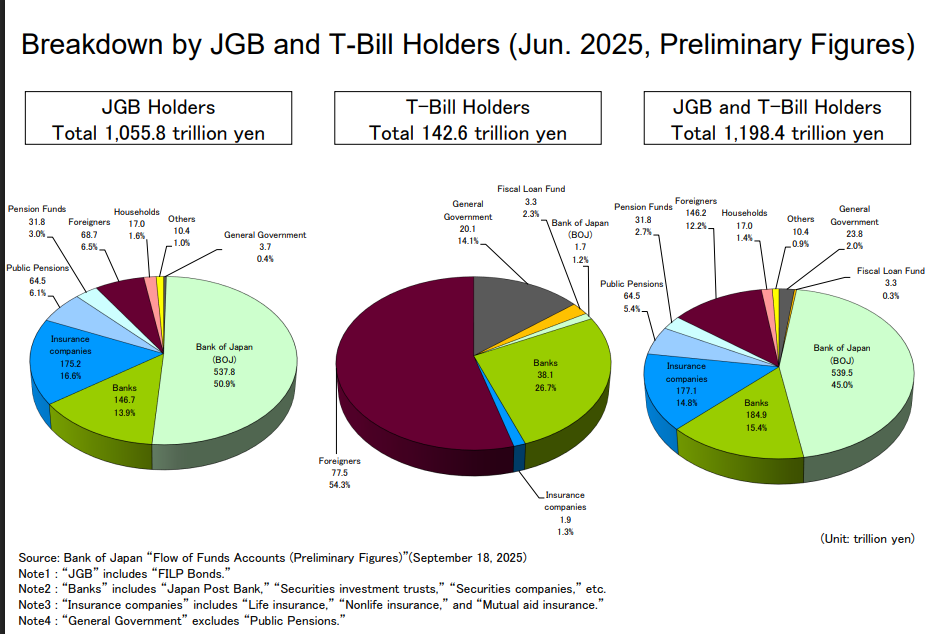

Currently, the BOJ is the dominant player in Japan’s JGB market, holding roughly 50% of the 1,055-trillion-yen market, followed by insurance companies and domestic banks. Foreign investors and public pensions account for smaller shares.

As the BOJ reduces its purchases, there is uncertainty over whether domestic financial institutions, which have trimmed holdings during the ultra-loose policy era, will absorb the new supply, especially as the government issues more debt to fund spending plans.

Okabe suggested that stablecoin issuers could fill this gap, with JPYC planning to invest 80% of its proceeds in JGBs and 20% in bank deposits.

The launch of JPYC comes as Japan embraces digital finance, with cashless payments rising to 42.8% in 2024, up from 13.2% in 2010.

The Financial Services Agency (FSA) has endorsed initiatives to integrate stablecoins into mainstream finance.

On November 7, the FSA officially supported a pilot program under its Payment Innovation Project involving Japan’s three largest banks, Mitsubishi UFJ Financial Group, Sumitomo Mitsui Financial Group, and Mizuho Financial Group.

![]() Japan's FSA said that it would provide support to a joint yen-backed stablecoin pilot project led by three Japanese major banks.#JapanFSA #YenStablecoin #StablecoinProjecthttps://t.co/kNuZ28y1mV

Japan's FSA said that it would provide support to a joint yen-backed stablecoin pilot project led by three Japanese major banks.#JapanFSA #YenStablecoin #StablecoinProjecthttps://t.co/kNuZ28y1mV

The pilot aims to develop a shared framework for issuing yen-backed stablecoins, initially targeting corporate clients with the potential for a future dollar-pegged coin.

JPYC Aims to Boost Yen’s Role in Digital Finance With Fee-Free Stablecoin Launch

Globally, stablecoins are mostly pegged to the U.S. dollar, representing over 99% of the market.

Okabe said dollar reliance increases hedging and transaction costs for Japanese firms, and JPYC could offer a domestic alternative while boosting the yen’s role in global digital finance.

The JPYC offers fee-free transactions at launch, earning income primarily from interest on JGB holdings. This approach aims to attract real-world adoption and test a regulated digital yen.

The initiative aligns with broader regional trends, as South Korea and Hong Kong explore regulated local stablecoins and crypto products.

Japan’s major banks are also moving toward stablecoin issuance. The three megabanks, with FSA support, plan to experiment with both yen- and dollar-pegged tokens, establishing a corporate settlement infrastructure and potentially challenging the dominance of U.S.-backed stablecoins such as USDT and USDC.

![]() Mitsubishi UFJ, Sumitomo Mitsui, and Mizuho launch yen stablecoins to challenge USDT and USDC with 1T yen ($6.64B) over 3 years planned.#Japan #Stablecoinhttps://t.co/PBXiMRTNY8

Mitsubishi UFJ, Sumitomo Mitsui, and Mizuho launch yen stablecoins to challenge USDT and USDC with 1T yen ($6.64B) over 3 years planned.#Japan #Stablecoinhttps://t.co/PBXiMRTNY8

Japanese authorities remain cautious. Policymakers have warned that poorly designed stablecoins could channel funds outside regulated banking systems and weaken commercial banks’ role in payments.

Any scaling of issuance is expected to undergo close scrutiny regarding asset backing, redemption rights, and segregation of reserves.