Bloomberg Analysts Warn Bitcoin’s Slide Below $86K Is Just the Beginning of a Deeper Correction

Bitcoin's recent dip below $86,000 wasn't a blip—it was a warning shot. Bloomberg's market watchers are sounding the alarm, suggesting this could be the opening act for a more significant pullback.

Reading the Technical Tea Leaves

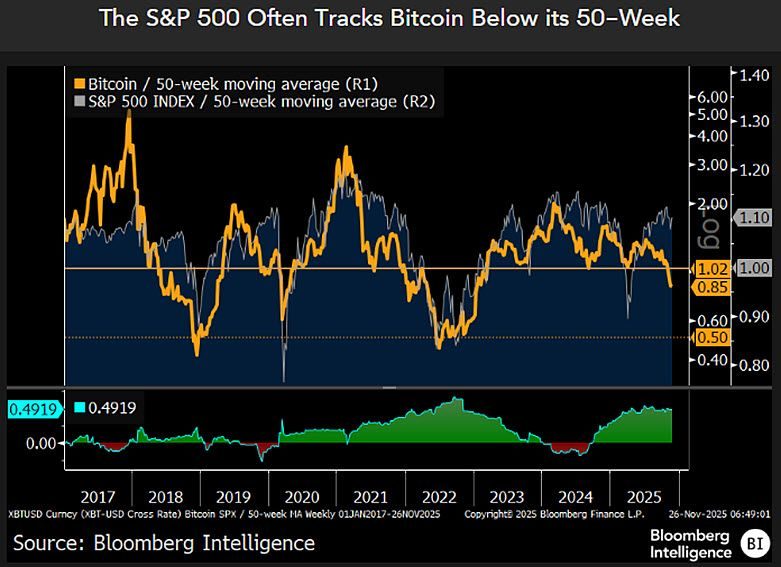

The move breaches key technical levels that many traders were watching. Analysts point to weakening momentum and a shift in market structure that often precedes a sustained downtrend. It's not just about price; it's about the underlying support crumbling.

A Reality Check for the Rally

Every parabolic move needs to catch its breath, and this might be that moment. The market got ahead of itself, fueled by narratives that are now facing a classic dose of financial gravity. Remember, on Wall Street, what goes up must come down—usually right after the retail crowd finally buys in.

What's Next for Crypto?

Watch the reaction. Does Bitcoin find a floor quickly, or does it continue to search for lower support? The next few weeks will test the conviction of long-term holders and separate the strategic accumulators from the panic sellers. One thing's clear: the easy money phase might be over, for now.

Source: LinkedIn

Source: LinkedIn

Yen Carry Trade Unwind Could See Bitcoin Drop Below $75k

The immediate catalyst for Bitcoin’s bearish market structure emerged from Tokyo, where mounting speculation around a December rate hike by the Bank of Japan has impacted Leveraged positions.

Polymarket bettors now assign a 52% probability to a 25-basis-point increase at the BOJ’s December 18-19 meeting, while bond investors place those odds even higher at

“Bitcoin dumped cause BOJ put Dec rate hike in play,” BitMEX co-founder Arthur Hayes wrote Monday, noting that a USD/JPY rate between 155 and 160 “makes BOJ hawkish.”

$BTC dumped cause BOJ put Dec rate hike in play. USDJPY 155-160 makes BOJ hawkish. pic.twitter.com/lG47l5cbCA

— Arthur Hayes (@CryptoHayes) December 1, 2025The connection runs deeper than surface correlation; conservative estimates peg the yen carry trade at $3.4 trillion, though realistic figures approach $20 trillion.

For three decades, global markets borrowed near-zero Japanese money to fund everything from tech stocks to treasuries to bitcoin itself.

That era ended last month, which triggered a sell-off in markets.

Traders are now increasingly reluctant to take directional risk without downside protection, hedging, and additional clarity about macroeconomic liquidity conditions.

Data from Glassnode reveals a massive overhead supply block sitting between $93,000 and $99,000, with a second resistance LAYER at $101,000 to $105,000.

“Every bounce into this zone faces sell-pressure from trapped buyers,” warned Laqira Protocol CEO Sina Osivand.

Meanwhile, the $83,000 to $86,000 band is emerging as the new cost basis for fresh demand; if this level fails to hold, liquidity hunts toward $78,000 to $75,000 become likely.

Analyst Warns Bitcoin Could Test $60-65k Support.

“Bitcoin’s drop below $90,000 is the result of a collision between the fragile market structure and weak liquidity conditions observed over the weekend,” VALR CEO Farzam Ehsani told Cryptonews.

MSCI’s anticipated decision to potentially exclude companies holding over half their assets in cryptocurrency also intensified selling pressure.

The rule change WOULD affect issuers collectively holding over $137 billion in digital assets and approximately 5% of all Bitcoin in existence, including Strategy, Marathon, Riot, Metaplanet, and American Bitcoin.

“Since index funds are required to adhere to a strict basket-forming methodology, any rule change automatically triggers a review of their holdings, potentially leading to forced sell-offs,” Farzam Ehsani added.

December sentiment and the crypto market’s dynamics heading into the New Year will depend partly on whether Michael Saylor’s company reaches an agreement with regulators and index firms.

![]() Strategy executives appear frustrated that their company hasn't been chosen to join America's flagship S&P 500#Bitcoin #MichaelSaylorhttps://t.co/RRkYgzJC0N

Strategy executives appear frustrated that their company hasn't been chosen to join America's flagship S&P 500#Bitcoin #MichaelSaylorhttps://t.co/RRkYgzJC0N

Traders on Kalshi have slashed odds of Bitcoin reclaiming $100,000 this year to just

Ehsani warned that if the market continues declining, Bitcoin could test the, though he noted that major institutional players might view those levels as accumulation opportunities.

“Strategy is a key player in the crypto market, and its potential problems could cause Bitcoin’s price to drop by another 30%,” he added.

The December 18 BOJ policy decision now stands as the critical pivot; a hike with hawkish stance could push Bitcoin toward, while a pause might trigger a short squeeze back towardwithin days