Koinly Email Breach: Third-Party Hack Exposes User Data – Is Your Crypto Tax Info at Risk?

Another day, another data leak—this time hitting crypto tax platform Koinly. A third-party email service provider got breached, exposing user email addresses. No financial data or passwords were compromised, according to the company. But let's be real: in crypto, your email is often the first domino.

The Real Vulnerability

Koinly insists the breach was limited. The affected vendor handled only email distribution. Internal systems and sensitive tax data? Allegedly untouched. Users got notified. Standard security advice followed. Yet the incident highlights a persistent weak link: the sprawling vendor ecosystems these platforms rely on. Your security is only as strong as their most vulnerable partner.

Why Crypto Users Should Sweat the Small Stuff

An email address might seem minor. For a crypto holder, it's a gateway. Phishing attempts, targeted social engineering, credential stuffing attacks—all start here. Pair a leaked email with poor password hygiene across exchanges, and you've got a recipe for disaster. This isn't just about spam; it's about painting a target.

The Tax-Time Target on Your Back

Crypto tax software holds a treasure map of your financial life—transaction histories, wallet addresses, exchange links. A breach here is a goldmine for attackers. While this event appears contained, it's a stark reminder: you're trusting these platforms with your most sensitive financial footprint. Convenience always comes with a third-party risk tax—sometimes literal.

Guarding Your Digital Gold

Update passwords. Enable two-factor authentication everywhere—especially on your email and exchange accounts. Watch for sophisticated phishing emails pretending to be from Koinly or your exchanges. Consider using unique email aliases for critical financial services. In crypto, paranoia is a feature, not a bug.

The bottom line? The industry's 'move fast and break things' ethos meets the cold, hard reality of data security. Your tax liability is complicated enough without worrying about someone else's vendor management. Stay vigilant, diversify your security, and maybe—just maybe—keep a cynical eye on who's really guarding the vault.

Source: degeneratenews

Source: degeneratenews

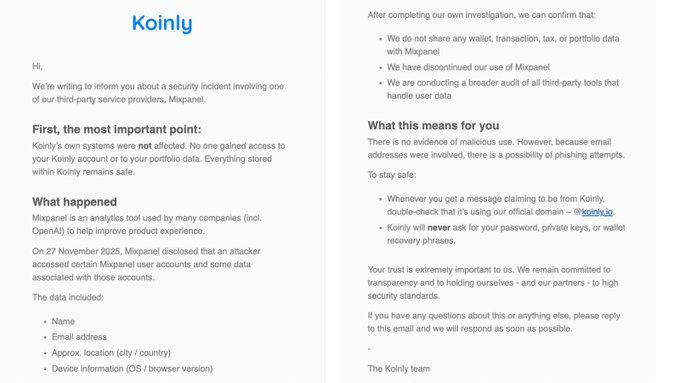

Koinly, in an email to the customers, claimed that the incident was based on Mixpanel, an analytics service it had been using to understand how the products were being used and ways of enhancing user experience.

What Was Exposed—and What Wasn’t: Koinly Addresses Third-Party Breach Fallout

Third-party breaches are a type of attack in which the attackers target vendors or service providers who have access to user information, and in most cases, they are using less secure security controls to indirectly gain access to information.

These attacks are prevalent in both crypto and non-crypto industries.

In these instances, Koinly said that Mixpanel had announced in November that one of its hackers had accessed some user accounts of Mixpanel and data belonging to these accounts.

Information disclosed could have contained names, email addresses, rough position details like city or country, and device data like the operating system and version of a browser.

Koinly reported that, according to its internal inquiries, it did not share any wallet information, transaction history, tax filings, or portfolio data with Mixpanel.

The company also stated that its main systems were not compromised, and it did not leave people with access to user accounts and financial records stored in Koinly.

Since then, it stopped using Mixpanel and initiated a larger exercise of auditing other third-party tools that process user information.

The company has failed to provide the number of users that could have been impacted and a specific timeframe in which the data exposure took place. It claimed that it is still in the process of collaborating with Mixpanel in order to know the extent of the incident.

Although Koinly asserted that it had no evidence that the information revealed had been abused, it gave a warning that users should be wary of potential exploitation by phishing.

The company also suggested that they confirm that any message that claims to be from Koinly originates from its official domain.

As Crypto Theft Hits $3.4B, Third-Party Vulnerabilities Come Into Focus

Koinly has a user base of over 1.5 million in the world, and it is active in over 20 countries.

The platform automatically imports transaction data from more than 900 exchanges, wallets, and blockchains and classifies the transactions, determines the gains and losses, and produces tax filings for tax authorities.

The size and reach of it ensure that even a small data exposure can concern the users who use it to store sensitive financial data.

The recent attacks in the crypto market and the technological industry in general demonstrate how harmful third-party hacks can be.

In September, Swiss crypto platform SwissBorg lost over $41 million of solana tokens because attackers hacked an API provider of one of its partners’ services.

![]() SwissBorg hit by $41.5M $SOL hack after API compromise amid cascade of crypto security failures, including Nemo and Aqua exploits.#CryptoHack #Solanahttps://t.co/ztUl2s0yxv

SwissBorg hit by $41.5M $SOL hack after API compromise amid cascade of crypto security failures, including Nemo and Aqua exploits.#CryptoHack #Solanahttps://t.co/ztUl2s0yxv

In October, Discord affirmed that they had unauthorized access to their third-party Zendesk system of support following their announcement that hackers had stolen millions of government ID pictures.

DeFi protocol Abracadabra also experienced numerous exploits this year because of code-level vulnerabilities, pointing out the scope of vulnerabilities to attacks on infrastructure.

![]() A new Abracadabra DeFi hack has resulted in a $1.8M loss for the protocol, marking the third major exploit since 2024. #DeFi #Abracadabra #hackhttps://t.co/ZQ0gSlGNZy

A new Abracadabra DeFi hack has resulted in a $1.8M loss for the protocol, marking the third major exploit since 2024. #DeFi #Abracadabra #hackhttps://t.co/ZQ0gSlGNZy

Chainalysis industry data reveal that thefts involving crypto reached more than 3.4 billion US dollars in 2025, and the losses are growing more and more concentrated in a few more extreme cases.