Crypto.com Hires Internal Market Maker – Is the Exchange Secretly Trading Against Its Own Users?

Crypto.com just made a move that's raising eyebrows across the crypto-sphere. The platform has brought its market-making operations in-house, a shift that promises tighter spreads and better liquidity. But the fine print has traders asking one sharp question: who's really on the other side of their trades now?

The Promise of a Smoother Ride

On paper, this is a win for efficiency. An internal team can theoretically move faster than a third-party firm, reacting to market swings in real-time to keep order books deep and prices stable. For the everyday user trying to swap tokens, that should mean less slippage and faster execution. It's the kind of backend upgrade that exchanges brag about in press releases.

The Elephant in the Trading Room

Here's where the skepticism kicks in. When an exchange becomes its own primary market maker, the line between facilitator and participant gets blurry. That internal desk sees the collective flow of every buy and sell order before anyone else. The potential for conflict is baked right into the business model—a classic case of 'if you're not paying for the product, you probably are the product,' but with more leverage.

Walking the Regulatory Tightrope

Trust is the only real currency in crypto, and this move puts it to the test. Exchanges live and die by their reputation for fair play. Crypto.com will now need to demonstrate, with crystal-clear transparency and perhaps even auditable proofs, that its internal market maker isn't using its privileged position to trade ahead of users or manipulate prices. It's a high-wire act over a pit of regulatory scrutiny and user skepticism.

One cynical finance veteran might quip that this is just Wall Street's old playbook—where the house always wins—getting a blockchain makeover. Ultimately, the market will vote with its wallets. If spreads tighten and service improves without any funny business, this could be a masterstroke. But if users start feeling like they're the liquidity for the house's profit, they'll find a platform that treats them as customers, not counterparties.

Liquidity or Conflict? Crypto.com’s Market-Making Role Sparks Debate

According to a recent Bloomberg report, the role WOULD sit on Crypto.com’s market-making desk and involve actively trading against customer orders to support liquidity across sports contracts and other derivatives offered on the company’s U.S. platform.

The hiring effort comes as prediction markets expand rapidly across both crypto and traditional finance.

These platforms allow users to trade contracts that settle based on real-world outcomes, such as sports results or political events, with prices reflecting the market’s implied probability.

While prediction markets have long presented themselves as neutral venues where participants trade against each other, the use of in-house market makers has raised questions about conflicts of interest.

Market making has become a sensitive issue for event-contract exchanges, particularly those operating under U.S. federal oversight.

Critics argue that when an exchange or its affiliate takes the opposite side of customer trades, the structure begins to resemble a traditional sportsbook that profits from customer losses.

Those concerns have already surfaced elsewhere in the industry. Kalshi, one of the most prominent regulated prediction market operators, runs an internal unit known as Kalshi Trading.

Polymarket, a major decentralized platform, is also reported to be building its own internal market-making team.

Crypto.com’s job listing states that the new hire would seek to “maximize profits while carefully managing risks,” language that has fueled debate over whether the firm is effectively trading against its users.

In response, in a report, a Crypto.com spokesperson said the company does not rely on proprietary trading as a revenue source and described its business model as providing customer access to digital assets and event contracts for a fee while remaining risk neutral.

The spokesperson added that the internal market Maker does not receive preferential access to customer order flow or proprietary data and operates under rules disclosed to the Commodity Futures Trading Commission, which oversees derivatives markets in the U.S.

Prediction Markets Hit Record Volumes, but Trading Rules Stir Concerns

The exchange has also taken steps to attract external liquidity providers. Like its competitors, Crypto.com has sought to bring in professional trading firms to ensure continuous buying and selling, particularly in high-volume sports markets.

However, company rules grant designated market makers on sports contracts a three-second head start over smaller traders, a policy that has drawn scrutiny for potentially allowing large participants to adjust prices ahead of retail users.

The broader industry continues to grow despite these concerns, with prediction markets linked to sports and politics having driven much of the recent surge in activity.

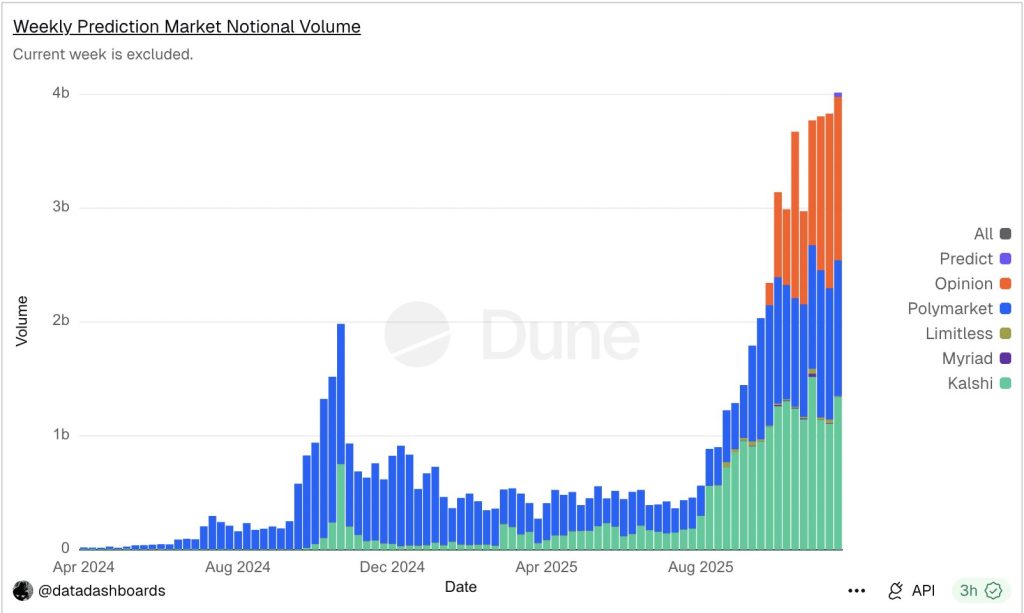

Platforms including Kalshi, Polymarket, and Limitless recorded a combined $44 billion in trading volume this year, with Kalshi reaching roughly $1 billion in weekly volume at its peak.

On-chain prediction markets have expanded even faster, with monthly volume climbing from under $100 million in early 2024 to more than $13 billion, according to joint research from Keyrock and Dune Analytics.

Major crypto firms are also entering the space. Coinbase recently rolled out prediction market trading on its platform and agreed to acquire The Clearing Company as part of its push to scale regulated event-based markets. The MOVE followed Kalshi’s $300 million Series D raise at a $5 billion valuation, showing investor interest in the sector.