Aave Founder Faces ’Governance Attack’ Allegations After $10M Token Purchase Ahead of Pivotal Vote

Aave's decentralized governance model just got a real-world stress test—and it's raising eyebrows across DeFi.

The Accusation

Founder activity sparked immediate controversy. A $10 million token acquisition right before a major protocol vote doesn't just look bad—it triggers the community's centralization alarms. Critics call it a 'governance attack,' a move that could sway outcomes by concentrating voting power at a critical moment.

The Core Conflict

This isn't about a simple trade. It's about the fundamental tension in decentralized finance: can a system be truly decentralized when founders hold significant influence? The timing cuts to the heart of protocol integrity. Supporters see strategic positioning; detractors see a bypass of the community's will.

The Bigger Picture

Every major DeFi protocol watches. The outcome sets a precedent for founder conduct and governance token mechanics. Will the community's voice hold, or will concentrated capital call the shots? It's a multi-million-dollar question that tests if DeFi's ideals can survive its own incentive structures—because in crypto, even decentralization sometimes has a single point of failure.

Aave Governance Turmoil Exposes Fault Lines Over Power and Transparency

Those concerns were echoed by prominent crypto user Sisyphus, who pointed to blockchain data suggesting Kulechov may have sold millions of dollars’ worth of AAVE between 2021 and 2025.

On AAVE:

I fail to understand why Stani, who must have dumped hundreds of millions of dollars of valueless governance tokens from 2021 to 2025, would rebuy $10 million dollars of tokens in order to try and take a — Sisyphus (@0xSisyphus) December 24, 2025

While no wrongdoing has been established, critics questioned the economic rationale of selling large amounts over several years before making a sizable purchase ahead of a contentious vote.

The debate has unfolded against a broader governance dispute within the Aave ecosystem over control of the protocol’s brand and associated assets.

On December 22, Aave Labs submitted a proposal to Snapshot concerning ownership of key brand assets, including the aave.com domain, social media accounts, GitHub organizations, and naming rights.

![]() Aave Labs unilaterally pushed a brand ownership proposal to vote without author notification, escalating governance tensions over protocol asset control and value extraction.#Dao #Aavehttps://t.co/2uRM8QM6Jy

Aave Labs unilaterally pushed a brand ownership proposal to vote without author notification, escalating governance tensions over protocol asset control and value extraction.#Dao #Aavehttps://t.co/2uRM8QM6Jy

The proposal had been authored by Ernesto Boado, co-founder of BGD Labs, but Boado publicly rejected the decision to push it to a vote, saying he had not been notified and did not support the version submitted.

Boado said the move broke trust during what he described as a productive forum discussion and argued that the proposal was intended to transfer brand assets into a DAO-controlled legal wrapper with strong protections against capture.

Tensions Rise Around Aave Over Brand Use, Fee Flows, and Whale Voting

The initiative followed mounting concerns from contributors that brand assets were being used to support private products without the DAO being the main beneficiary.

Recent examples cited by critics include Aave Labs replacing Paraswap with CowSwap, a change estimated to redirect around $10 million per year in fees away from the DAO, and the Horizon market launch, which generated roughly $100,000 in revenue while using about $500,000 in DAO incentives.

Marc Zeller of the Aave Chan Initiative said the DAO had effectively paid multiple times for these assets through the original LEND token sale, dilution, liquidity mining programs, and service provider fees.

Kulechov defended the rushed vote, saying discussion had already taken place and that submitting proposals outside extended processes was not unprecedented. He said the issue should ultimately be resolved through voting.

Those who wonder, yes the vote is legitimate

– The discussion has been going over the past 5 days already with various of opinions and takes, a timeline set on the ARFC temp check (see more https://t.co/KovomHiB6H)

– The Snapshot is in compliance of the governance framework

-… https://t.co/nZoixZvbwl

However, several observers, including crypto educator Duo Nine, raised concerns about conflicts of interest when founders retain influence through private companies while also shaping DAO outcomes.

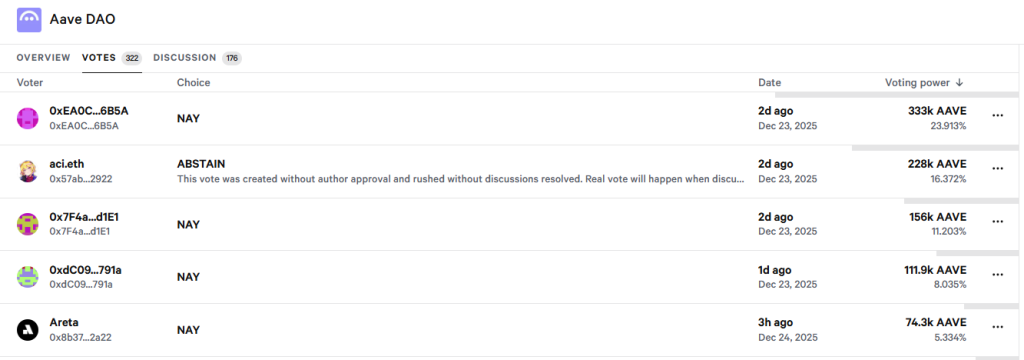

Voting data has further fueled the debate. Samuel McCulloch of USD.ai noted that a small number of large holders account for a significant share of voting power.

Snapshot data shows the top three voters control more than 58% of the vote, with the largest wallet holding over 27%.

The controversy comes shortly after regulatory pressure on Aave eased.

On December 16, Kulechov disclosed that the U.S. Securities and Exchange Commission had concluded its multi-year investigation into the protocol without recommending enforcement action, ending nearly four years of uncertainty.

Aave Labs has also secured MiCA authorization in Europe and is preparing for the launch of Aave V4.