Russia’s Top Stock Exchanges Set to Launch Crypto Trading by 2026—A Major Pivot for Global Finance

Moscow's financial giants are building the on-ramps. By 2026, Russia's premier stock exchanges plan to launch regulated cryptocurrency trading, a move that could reshape capital flows and challenge Western financial dominance.

The Institutional Gateway Opens

Forget shadowy OTC desks. This initiative creates a formal, compliant channel for institutional and retail capital to access digital assets. It's a direct response to global demand—and a clever workaround for a financial system under pressure.

Numbers Don't Lie

The timeline is set: 2026. The players are Russia's largest, most established exchanges. This isn't a fringe experiment; it's a mainstream integration with a clear deadline, signaling serious intent and regulatory alignment.

A New Front in the Financial Cold War

This move does more than just offer a new asset class. It builds financial infrastructure that operates parallel to traditional systems, potentially bypassing sanctions and creating a new hub for Eurasian capital. Watch how traditional finance scrambles to call it 'too risky' while quietly building their own backdoors.

The cynical take? Another case of legacy finance adopting the technology it spent years lobbying against, just in time to capture the profits. The bullish reality? A major G20 economy is formally bridging the gap between traditional markets and crypto's frontier—and the clock is ticking down to 2026.

From Resistance to Regulated Markets

Russia’s path toward crypto regulation began gaining momentum in mid-2024, when the Ministry of Finance first proposed allowing qualified investors to trade digital currencies on licensed exchanges.

Anatoly Aksakov, head of the State Duma Financial Market Committee, said at the time that major exchanges were “already actively involved in developing the cryptocurrency market and organizing the necessary infrastructure.“

The regulatory framework divides market access between qualified and non-qualified investors under sharply different conditions.

Non-qualified investors will be limited to purchasing liquid cryptocurrencies from a defined list after passing mandatory knowledge tests, with annual purchases capped at 300,000 rubles (approximately $3,800) through a single intermediary.

Qualified investors face no volume restrictions but must demonstrate understanding of crypto risks through testing, though they will be barred from purchasing anonymous tokens that conceal transaction data.

Despite the forthcoming trading infrastructure, Russian authorities maintain their ban on using cryptocurrencies for domestic payments.

![]() Russian lawmaker Anatoly Aksakov said that payments in Russia must only be conducted in rubles, dismissing crypto becoming legal tender.#RussiaCrypto #CryptoPayments #CryptoRegulationhttps://t.co/BLk0c4qHcQ

Russian lawmaker Anatoly Aksakov said that payments in Russia must only be conducted in rubles, dismissing crypto becoming legal tender.#RussiaCrypto #CryptoPayments #CryptoRegulationhttps://t.co/BLk0c4qHcQ

State Duma Committee Chairman Anatoly Aksakov reinforced this position on December 17, declaring that cryptocurrencies “will never become money within our country” and can only function as investment instruments, with all domestic payments required in rubles.

The Bank of Russia originally called for a total ban on crypto exchanges and token trading, but Western sanctions prompted a policy shift.

Mining Boom Drives Economic Integration

Russia’s crypto ecosystem has expanded dramatically beyond trading speculation.

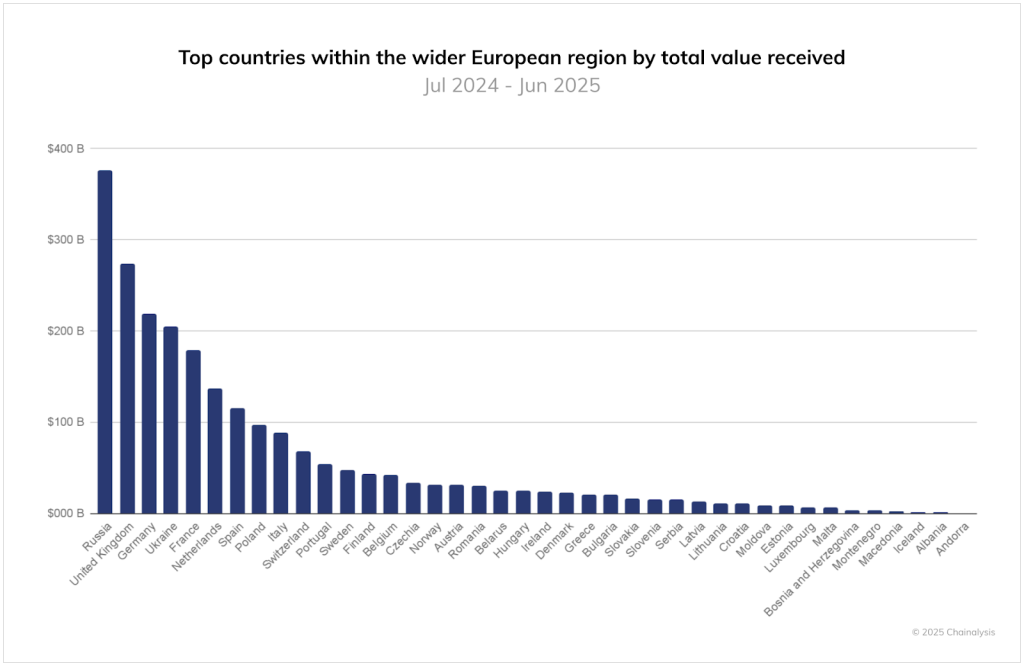

The country recorded $376.3 billion in received crypto transactions between July 2024 and June 2025, surpassing the United Kingdom’s $273.2 billion and making Russia Europe’s largest crypto market by transaction volume, according to Chainalysis data.

Large-scale transfers exceeding $10 million grew 86% in Russia during this period, nearly double the 44% growth seen across the rest of Europe, while DeFi activity surged eightfold in early 2025 before stabilizing at three and a half times the mid-2023 baseline.

Much of this growth has been tied to A7A5, a ruble-pegged stablecoin that reached $500 million in market capitalization despite Western sanctions, becoming the world’s largest non-dollar stablecoin.

The mining sector has also become particularly significant for Russia’s economy.

Senior Kremlin official Maxim Oreshkin recently argued that crypto mining should be classified as export activity since mined assets effectively FLOW abroad even without crossing physical borders.

Industry estimates suggest Russia produces tens of thousands of Bitcoins annually, generating approximately 1 billion rubles in daily mining revenue, and that the country accounted for over 16% of global hashrate during the summer months.

In fact, Central Bank Governor Elvira Nabiullina also recently acknowledged that crypto mining contributes to the ruble’s strength.

![]() Russia's Central Bank confirms crypto mining strengthens the ruble as Kremlin officials push for formal export classification amid persistent underground operations.#Russia #Crypto #Mininghttps://t.co/P0JGyFTYfp

Russia's Central Bank confirms crypto mining strengthens the ruble as Kremlin officials push for formal export classification amid persistent underground operations.#Russia #Crypto #Mininghttps://t.co/P0JGyFTYfp

However, she noted that quantifying its exact impact remains difficult, as much of the industry operates in gray areas, with illegal mining costing Russia billions of dollars annually through stolen electricity and unpaid taxes.

Russia legalized crypto mining on November 1, 2024, requiring legal entities to register with the Federal Tax Service.

Banks Enter Digital Assets Market

Russia’s largest lender, Sberbank, has begun offering regulated crypto-linked investments totaling 1.5 billion rubles in structured bonds and digital financial assets tied to Bitcoin, Ethereum, and broader crypto portfolios.

Deputy Chairman Anatoly Popov confirmed “” with the Bank of Russia on integrating crypto services within regulated frameworks while building proprietary blockchain infrastructure.

As it stands now, the regulatory timeline calls for legislative frameworks to be completed by July 1, 2026, with liability for illegal crypto intermediary activities taking effect from July 1, 2027.