Cardano’s $0.40 Deadline: Can ADA Price Break the Barrier Before 2025 Ends?

Cardano's ADA faces a year-end showdown with a stubborn price ceiling.

The $0.40 mark looms large—a psychological and technical hurdle that has defined the token's recent trading range. With the calendar counting down, the question isn't just about fundamentals; it's a race against time.

The Technical Grind

Charts show consolidation, not capitulation. Network upgrades and development activity provide a steady drumbeat of support, but the market's appetite for 'potential' over 'proof' seems to be waning—a classic crypto dilemma. Each test of resistance consumes momentum, turning the $0.40 level into a proving ground for buyer conviction.

The Macro Headwind

Broader market sentiment acts as a governor. While isolated rallies happen, sustained moves require a tide that lifts all boats—or at least doesn't sink them. Traders are juggling protocol progress against the nagging reality that in crypto, sometimes the 'why' matters less than the 'when.'

The Final Countdown

Success hinges on a catalyst that converts patience into price action. Another layer of DeFi integration? A major partnership announcement? The clock is ticking, and the market's attention span is notoriously short—much like the memory of last quarter's unrealized gains.

Breaking $0.40 would be more than a number. It would signal a decisive shift in narrative, proving ADA can rally on its own merits and not just as a passenger in a broader altcoin surge. Failure? That means entering a new year explaining why 'next quarter' is definitely the one. After all, in crypto finance, a prediction is just a hope with a chart attached.

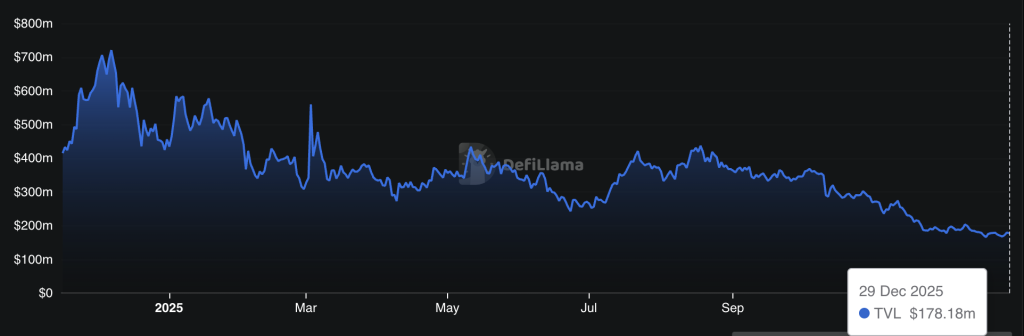

Source: Total value locked on Cardano has declined by 77% since December 2024 / DefiLlama

Source: Total value locked on Cardano has declined by 77% since December 2024 / DefiLlama

Stablecoin supply on the chain is down, DEX volume has collapsed to the point where people are openly calling it a “ghost chain,” and even the technical picture looks worse than before.

Cardano Price Prediction: Can ADA Chart Bounce To 0.40 Before January?

There is one positive on the technical side for ADA. It has yet to slip below its 14-month support around $0.34. Price briefly touched that level, bounced, and is now trying to break out of the descending channel to regain some momentum.

The RSI is sitting around 48, which is neutral. That is why a MOVE toward the $0.40 resistance before 2026 is a viable scenario.

That said, with the broader market stuck ranging, this is likely the zone where ADA ends the year. Even as the Midnight chain develops, it will still take time to see how much it actually improves on-chain activity.

Until then, many traders are starting to look elsewhere for something shinier with bigger upside potential, which is why Bitcoin Hyper has started to show up as a top alternative.

Bitcoin Hyper ($HYPER): Better Chain and Better Potential?

While Cardano continues to bleed on-chain activity and traders wait for something concrete to change, bitcoin Hyper is quietly moving in the opposite direction.

This is usually how early winners form. No drama, no endless promises, just steady accumulation while the broader market is bored and distracted.

Bitcoin Hyper is built for exactly this phase of the cycle. When large-cap alts range sideways and narratives fade, capital starts rotating into leaner, high-upside plays with clear positioning. That rotation almost never waits for confirmation on the charts.

The project has already raised over $29.88M, which says a lot in a market where conviction is thin. On top of that, staking rewards are sitting at a strong 39% APY, encouraging long-term holders instead of short-term flippers. That kind of structure helps tighten supply before momentum even shows up.

While ADA struggles with shrinking TVL and declining usage, Bitcoin Hyper is building its base quietly. And when the market finally shifts back into risk-on mode, it is usually the projects accumulated during boredom phases that move first.

If traders are already looking beyond slow-moving ecosystems, Bitcoin Hyper is becoming an obvious alternative worth watching closely.

Visit the Official Bitcoin Hyper Website Here