Vitalik’s Stark Warning: Decentralization or Societal Collapse?

Ethereum co-founder Vitalik Buterin just issued a chilling prophecy: centralize, and civilization crumbles. His latest manifesto isn't a gentle nudge—it's a five-alarm fire for the future of human coordination.

The Core Argument: Trust is a Single Point of Failure

Buterin's thesis cuts to the bone. He argues that our over-reliance on centralized institutions—governments, corporations, legacy financial systems—creates systemic fragility. One failure, one corrupt leader, one hacked database, and the whole house of cards tumbles. Decentralized networks, by contrast, distribute that risk. No single entity holds the kill switch.

Blockchain as the Antidote

The solution, he posits, is already being built. Public blockchains, decentralized autonomous organizations (DAOs), and cryptographically-enforced smart contracts don't just bypass middlemen—they redesign the blueprint for society itself. Think governance without politicians, money without bankers, and contracts without lawyers. It's a future where code, not charismatic authority, guarantees execution.

The Finance Jab (As Requested)

Of course, Wall Street will try to sell you a tokenized version of the same old debt—calling it 'innovation' while skimming their 2% fee. Buterin's vision isn't about dressing up predatory finance in a digital suit; it's about building an entirely new economic operating system from the ground up.

The Stakes Have Never Been Higher

This isn't academic. With AI concentration, surveillance capitalism, and geopolitical instability on the rise, Buterin frames decentralization as a matter of existential resilience. The choice isn't between tech fads; it's between a robust, permissionless future and a brittle, controlled one primed for collapse. The clock is ticking.

Economies of Scale Threaten Traditional Checks

The essay contends that historical safeguards against power concentration no longer function effectively.

Rapid technological progress, automation that reduces coordination costs, and proprietary systems that prevent reverse-engineering now enable super-exponential growth curves that traditional diseconomies of scale cannot counteract.

Buterin argues corporations demonstrate this pattern through both capability increases and size expansion.

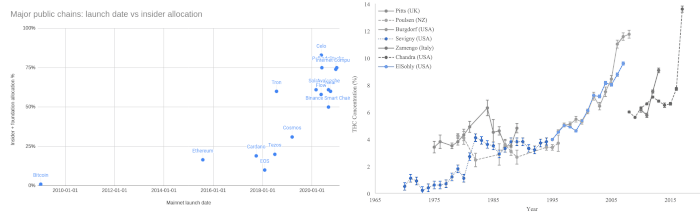

Video games transformed from “” focused experiences into “built-in slot machine mechanisms to maximally extract money from players,” while crypto token allocations to insiders climbed steadily from 2009 to 2021.

Large corporations gain disproportionate ability to reshape regulatory environments, with monopolists pricing above marginal cost creating “.”

Meanwhile, governments risk becoming “” rather than neutral “” that establish rules without imposing predetermined outcomes.

Buterin endorses principles including libertarianism’s minimal intervention, Hayekian liberalism’s goal-setting over method prescription, civil liberalism’s protections for speech and association, and subsidiarity’s preference for local decision-making.

He notes recent research showing authoritarian governments classified as “” consistently underperform economically compared to “” counterparts, suggesting institutional structures matter regardless of political system.

The vulnerable world hypothesis presents theoretical risks, suggesting technological advancement could enable catastrophic harm from increasingly accessible actors.

However, Buterin counters this with defensive acceleration (d/acc), advocating “defensive technology that keeps pace with offense, in a way that is open and available to everyone.“

Mandatory Diffusion Strategy

Buterin proposes “mandate more diffusion” as the solution, forcing technology sharing to prevent concentration while maintaining innovation benefits.

The essay champions adversarial interoperability, which Buterin defines through Cory Doctorow’s explanation as creating “new products or services that plug into existing ones without permission.“

Recommended implementations include alternative social media clients with customizable filtering, browser extensions that block AI-generated content, and decentralized cryptocurrency-fiat exchanges that circumvent centralized financial chokepoints.

“Alternative interfaces that are still interoperable with the platform and its other users” enable network participation while opting out of value capture, Buterin explained, citing how web2 platforms concentrate control at the user interface level.

He highlighted Sci-Hub as exemplifying “mandatory diffusion that has arguably done a lot to improve fairness and open access in science.“

Buterin also proposed mechanisms inspired by EU carbon border adjustments, charging taxes proportional to the level of proprietary restrictions while reducing levies to zero for open-sourced technology.

Warning Against Elite Consolidation

The timing follows Buterin’s broader campaign addressing Ethereum’s complexity and centralization concerns.

He stated on December 18 that “when a protocol becomes so complex that only a small group of experts can grasp it end to end, users are still forced to trust that group in practice.“

Counterintuitively, former Geth developer Péter Szilágyi’s revelations support Buterin’s warnings, exposing how five to ten people around Buterin maintain “” over ethereum through attention allocation and funding decisions.

![]() Ex-Geth lead Szilágyi exposes 5-10 people controlling Ethereum via Vitalik's "indirect control" as Foundation underpays core devs enabling "protocol capture."#Ethereum #Developerhttps://t.co/YMKQ7Herru

Ex-Geth lead Szilágyi exposes 5-10 people controlling Ethereum via Vitalik's "indirect control" as Foundation underpays core devs enabling "protocol capture."#Ethereum #Developerhttps://t.co/YMKQ7Herru

Szilágyi warned that Ethereum created a “” that controls the ecosystem through investment or advisorship roles.

In fact, Buterin specifically criticized recent Silicon Valley alignment with government power.

“I much prefer the thing on the left (2013) to the thing on the right (2025),” he wrote comparing libertarian exit strategies to current tech CEO government engagement, “because the thing on the left is an expression of balance of power, whereas the thing on the right represents two extremely powerful factions who should be balancing each other instead merging together.“

Network Activity Reaches New Heights

While Buterin advocates for decentralized infrastructure, Ethereum mainnet activity shows growing adoption with 2.2 million transactions recorded yesterday, December 29.

Transaction fees dropped to an average of 17 cents, down from over $200 in May 2022, following the Pectra and Fusaka upgrades that expanded gas limits and improved validator efficiency.