XRP Price Prediction 2026: Exchange Reserves Hit Critical Lows – Is Explosive Price Action Imminent?

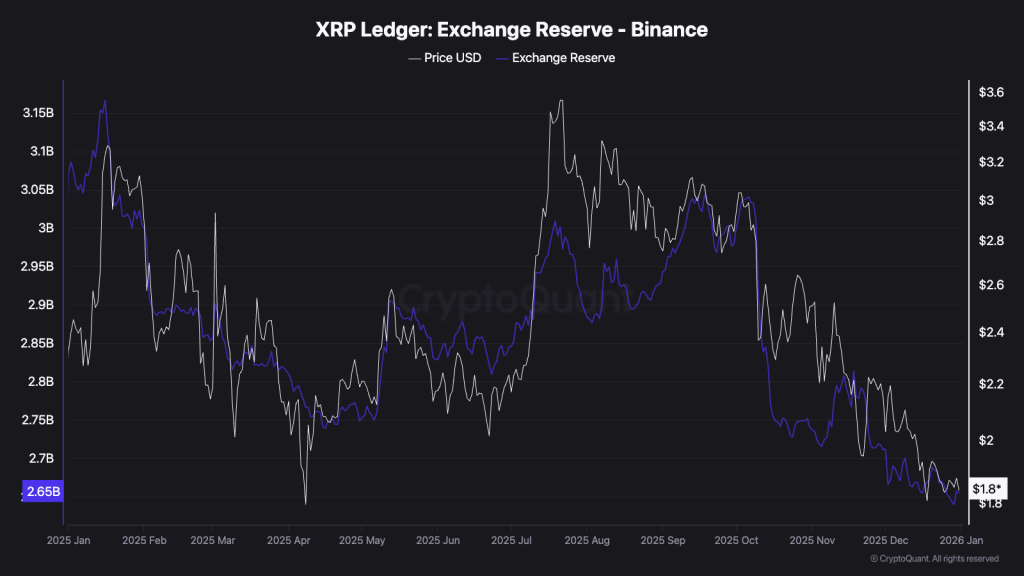

Exchange wallets are bleeding XRP. Supply on trading platforms plunges to multi-year lows—setting the stage for a classic crypto supply shock.

The Vanishing Act

You can't sell what you don't have. Major exchanges are reporting dwindling XRP reserves, a trend that historically precedes volatile price moves. When available liquidity shrinks, even moderate buying pressure can trigger outsized gains.

Liquidity vs. Leverage

Thin order books become a playground for algorithmic traders. The reduced sell-side depth means price discovery gets exaggerated—movements become sharper, faster, and less predictable. It's a high-wire act without a net.

The Institutional Siphon

This isn't retail FOMO. The drawdown points to sustained accumulation by larger players moving assets into cold storage or private custody solutions. They're not trading for lunch money; they're positioning for structural shifts.

Regulatory Tailwinds or Headwinds?

The legal landscape has clarified, but the market still prices in a lingering discount. Any further positive regulatory momentum could be the catalyst that ignites the tinderbox of low supply.

A Trader's Dilemma

Low liquidity cuts both ways—it can propel prices upward rapidly but also exacerbate crashes if sentiment sours. It's the financial equivalent of playing with nitroglycerin: potentially powerful, inherently unstable.

So, is explosive action coming? The mechanics are certainly in place. Just remember, in crypto, 'price discovery' is often a polite term for watching a crowd of speculators try to outguess each other—usually with other people's money.

Source: sharply declining XRP exchange reserves over the past months on Binance / CryptoQuant

Source: sharply declining XRP exchange reserves over the past months on Binance / CryptoQuant

One metric is not enough, but this holding behavior is better explained when you look at velocity. It is currently NEAR the lower end of its historical range.

Velocity describes how XRP supply circulates on the XRP Ledger. Velocity this low indicates it is barely moving, which has historically been seen during consolidation phases.

If this were a panic or capitulation phase, you WOULD see high velocity due to heavy redistribution of coins.

As we head into 2026, the xrp price is still holding above its 14-month support at $1.80. Out of everything, this might be the most bullish signal.

XRP Price Prediction: Explosive Price Action Coming?

XRP is closing out the year trading near $1.85 at the time of writing. It saw strong momentum in 2025, breaking above $3.40 before the broader market declined.

On the back of Ripple’s momentum in 2025, the company looks well-positioned for further growth in 2026.

Analysts from banking giant Standard Chartered have predicted XRP could skyrocket more than 300% to over $8 in 2026, driven by demand from spot XRP ETFs and the regulatory clarity the asset now has.

There are three key levels to focus on right now on the XRP chart. To remain in a bullish structure, XRP must continue holding above $1.80 as we MOVE into Q1.

If that level holds, a retest of the $2.00 psychological resistance should be expected. The RSI is around 48, which leaves room for a short-term rally toward $2.20.

Any sustained break below $1.80 would damage the bullish structure, and the $1.60 level becomes the critical support to watch on the downside.

Bitcoin Hyper ($HYPER) Raised 30M: New Milestone

While XRP sits in consolidation mode and exchange supply keeps drying up, Bitcoin Hyper is starting to stand out as one of the more aggressive plays heading into 2026.

As majors like XRP stabilize and ETFs absorb supply, traders often start looking further out on the risk curve for asymmetric upside. That is exactly where bitcoin Hyper positions itself. It is built around the Bitcoin narrative but designed for higher beta moves, making it attractive during periods when the broader market is coiling rather than trending.

Bitcoin Hyper has already raised over $30M, signaling strong early conviction even as overall market momentum cools. On top of that, its staking rewards sit around, which encourages holders to lock in supply instead of flipping short-term moves. That kind of structure tends to matter once risk appetite returns.

As XRP defends its long-term support and waits for the next catalyst, Bitcoin Hyper is doing what early cycle winners often do: building quietly during low-volatility phases before the market shifts gears.

If 2026 delivers the kind of expansion many expect, projects that were accumulated during consolidation periods are usually the first to move.

Visit the Official Bitcoin Hyper Website Here