Michael Saylor’s Bitcoin Strategy Enters Critical Phase as mNAV Approaches Dangerous Threshold

MicroStrategy's billion-dollar Bitcoin bet faces its ultimate stress test.

The mNAV metric—market value divided by net asset value—now flirts with the psychologically critical 1.0 level. Cross that line, and the company's entire treasury strategy shifts from visionary to vulnerable.

Decoding the Danger Zone

For years, Saylor transformed MicroStrategy from a software firm into a Bitcoin proxy. The playbook was simple: issue debt, buy Bitcoin, watch the premium grow. Shareholders cheered as mNAV ratios reached dizzying heights—a 2.5x premium wasn't unusual during bull markets.

But premiums evaporate faster than crypto Twitter hype. The current squeeze reveals what traditional finance types have muttered all along: corporate treasuries shouldn't double as leveraged crypto hedge funds. When your core innovation is borrowing money to buy digital assets, you're one market downturn from becoming a cautionary tale in MBA programs.

The Mechanics of Margin

MicroStrategy doesn't just hold Bitcoin—it's leveraged to the satoshi. Convertible notes and strategic debt created the war chest for accumulation, but they also built a house of cards resting on Bitcoin's price stability. mNAV slipping toward 1 signals the market's growing skepticism about that premium's justification.

Watch the institutional flows, the quarterly filings, the debt maturity walls. The numbers don't lie, even when the narrative does. Another few percentage points downward, and MicroStrategy's experiment transitions from 'bold corporate strategy' to 'case study in duration mismatch.'

What happens when the market decides your Bitcoin treasury deserves no premium at all? Ask any crypto fund that tried to explain negative alpha during the last cycle—sometimes the most innovative financial engineering just means you lose money in new and creative ways.

Why Strategy’s Bitcoin Discount Is Raising Red Flags

The distinction matters because Strategy’s equity appeal has long rested on trading at a premium to its Bitcoin reserves.

When mNAV falls below 1.0, investors can theoretically buy Bitcoin more cheaply by purchasing the asset directly rather than holding a stock that represents it.

Historically, such conditions have triggered selling pressure, as the rationale for paying corporate risk, dilution, and management costs weakens.

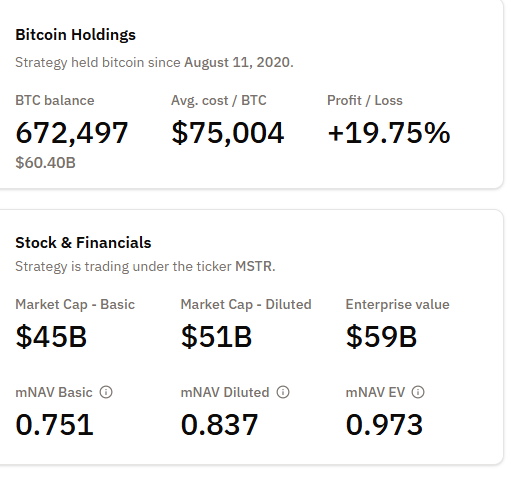

The company’s balance sheet reflects the tension. Strategy holds 672,497 bitcoin, the largest corporate stash in the world, accumulated since August 2020 at an average cost of about $75,000 per coin.

With Bitcoin trading around $90,000, those holdings are worth roughly $60.7 billion, leaving the company with an unrealized gain of about 20%.

Despite that, Strategy’s basic market capitalization sits closer to $45 billion, and its diluted valuation is around $50 billion, already implying a discount to the underlying assets.

On an enterprise value basis, which accounts for debt and cash, Strategy’s mNAV is estimated just under 1.0. That proximity has sharpened scrutiny because the company relies on issuing equity at a premium to fund further Bitcoin purchases.

If the stock trades persistently below the value of its reserves, raising capital through share sales becomes more difficult and potentially dilutive.

Management has taken steps to reduce near-term funding risk. In recent weeks, Strategy raised $747.8 million through stock sales under its ATM program.

![]() Billionaire Michael Saylor’s Strategy boosts USD reserves by $748M to $2.19B via its ATM program, while holding 671,268 BTC unchanged.#BTC #Bitcoinhttps://t.co/gOqBzbzzXy

Billionaire Michael Saylor’s Strategy boosts USD reserves by $748M to $2.19B via its ATM program, while holding 671,268 BTC unchanged.#BTC #Bitcoinhttps://t.co/gOqBzbzzXy

The company says the reserve now covers roughly 21 months of dividend and interest obligations, easing pressure to liquidate Bitcoin during periods of market stress.

Executives have described selling Bitcoin as a last resort, to be considered only if other financing options close and the firm’s valuation falls below its asset base.

Bitcoin Premium Shrinks as Strategy Stock Struggles

Still, another threshold looms below the mNAV line. If Bitcoin were to fall under Strategy’s average acquisition price NEAR $74,000, the company’s holdings would drop below cost, potentially testing investor confidence.

While some shareholders view such scenarios as long-term buying opportunities, they can also amplify volatility among traders less committed to the strategy.

The stock’s recent performance reflects that uncertainty, with Strategy shares having fallen more than 60% over the past six months and ending 2025 down nearly 50%, making it the worst performer in the Nasdaq-100 last year.

The decline followed a sharp rally earlier in 2025, when the stock surged alongside Bitcoin before reversing as risk sentiment shifted in the second half.

Bitcoin itself remains elevated, trading about 28% below its all-time high but up sharply in recent sessions on rising volume.

That divergence between Bitcoin’s resilience and Strategy’s equity weakness has fueled debate over whether the company now resembles an investment vehicle rather than an operating business.

Critics, including economist Peter Schiff, have pointed to the stock’s drawdown as evidence that aggressive Bitcoin accumulation has weighed on shareholders.