Bitcoin Core Development Jumps 60% After Years of Decline - The Comeback is Real

Bitcoin's engine room just roared back to life. After a prolonged slowdown in developer activity, the project's core development has surged a staggering 60%—a clear signal that the foundational work on the world's leading cryptocurrency is accelerating once more.

The Quiet Years Are Over

For years, the narrative focused on a slowdown. Developer commits dipped, chatter on forums turned speculative, and critics pointed to a potential innovation stall. That chapter is closed. The recent data shows a decisive reversal, with a wave of fresh code and renewed collaboration hitting the Bitcoin Core repository.

What's Fueling the Revival?

The surge isn't happening in a vacuum. It's a response to a maturing ecosystem demanding scalability, security, and sophisticated new features. Developers are tackling complex protocol upgrades, optimizing network performance, and fortifying the codebase against emerging threats. This isn't tinkering—it's foundational engineering for the next era.

Why This Matters More Than Price

While traders obsess over daily candles, long-term value is built in the commit history. A vibrant, active developer base is the ultimate bullish indicator—far more reliable than any influencer's tweet. It means the network is being maintained, improved, and future-proofed by the brightest minds in cryptography, often while Wall Street analysts are still trying to figure out what a hash function is.

This 60% leap forward cuts through the noise. It bypasses the short-term market mania and gets back to building. The code is the truth, and right now, it's speaking volumes.

Source: X/@lopp

Source: X/@lopp

According to core contributor Jameson Lopp, the surge came as 135 different developers contributed code changes totaling 285,000 lines, while Bitcoin transferred $4.5 trillion in value throughout the year, averaging $144,000 per second according to CoinMetrics estimates.

The development renaissance unfolded against a backdrop of philosophical warfare over Bitcoin’s Core purpose, with multiple competing proposals emerging to address concerns about blockchain spam.

Meanwhile, Bitcoin’s price recovered above $92,000 on Monday following a weekend geopolitical shock in Venezuela, as institutional money returned to crypto markets with $646 million flowing into ETFs on the first trading day of 2026.

Network Metrics Reveal Maturation Despite Price Stability

Bitcoin recorded the flattest year on record, with an average daily price change of just -0.02% in 2025, while the blockchain expanded from 626.5 GB to 710.1 GB, with an annual growth rate of 13.3%.

The network’s UTXO set actually shrank from 186.3 million to 165.8 million entries, removing one net UTXO every 1.5 seconds as efficiency improvements took hold.

Network hashrate also increased by 32% from 802 to 1,060 exahash per second, while the reachable node count ROSE by 18% to 24,298, according to Bitnodes data.

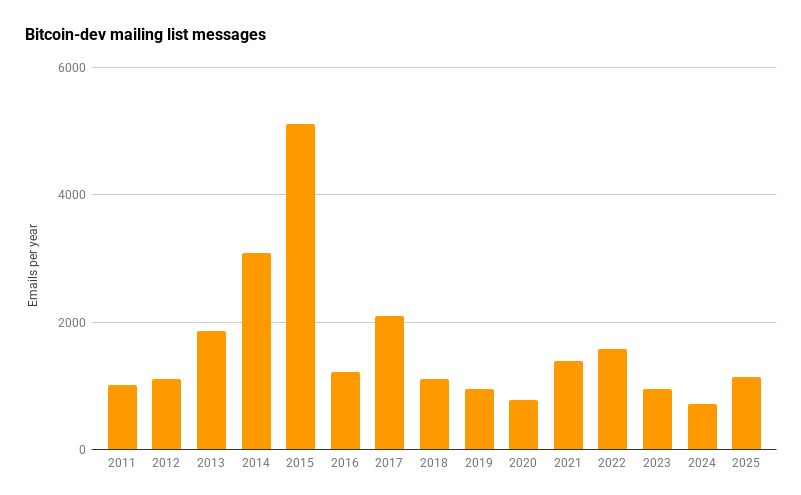

The median upstream bandwidth for reachable nodes also dropped 39% to 6.6 megabits per second, while bitcoin Core code commits increased just 1% year over year to 2,541, suggesting more substantial changes per commit.

Jameson Lopp, who compiled the annual metrics, noted a concerning trend in physical security.

“At the beginning of 2025 I predicted we’d see an all-time high for wrench attacks, averaging one per week. Unfortunately, that prediction came true,” he wrote, referring to violent theft attempts targeting Bitcoin holders.

At the beginning of 2025 I predicted we'd see an all-time high for wrench attacks, averaging one per week. Unfortunately, that prediction came true. pic.twitter.com/5ptcwxIjzk

— Jameson Lopp (@lopp) December 31, 2025Adoption Surges As Data Storage Debates Intensify

Merchant adoption surged 53% in 2025, according to BTCmap cataloging, likely driven by Square enabling Bitcoin payments in point-of-sale terminals.

Corporate balance sheets also continued to hit all-time highs, with companies now holding nearly 7% of the Bitcoin supply as institutional accumulation accelerated.

Bitcoin OP_RETURN outputs dropped 47% year over year due to decreased interest in the Runes protocol that launched in 2024.

Despite this decline, 33 million inscriptions were stored on the blockchain in 2025, a 58% year-over-year increase. However, fee rates remained incredibly low, with inscriptions paying just $12 million in total fees.

33M inscriptions were stored on the Bitcoin blockchain in 2025, an increase of 58% year over year.

However, fee rates were incredibly low and they only ended up paying a total of $12M in fees this year. pic.twitter.com/SxM5hUPNmY

The BSV fork lost another 64% against Bitcoin in 2025, now worth a mere 0.02% of the original protocol.

Lightning Network capacity also quietly surged to an all-time high of 5,805 BTC after dropping for most of the year, indicating renewed interest in the LAYER 2 payment solution.

2025: Year of Security Audit and Controversial Upgrades

Bitcoin CORE completed its first public third-party security audit in November after 16 years of operation, with Quarkslab’s 100-man-day assessment finding no critical vulnerabilities.

The audit, commissioned by the Open Source Technology Improvement Fund and funded by Brink, identified only two low-severity issues across the peer-to-peer layer, mempool, and consensus logic.

A month earlier, Bitcoin Core released version 30.0, removing the 80-byte OP_RETURN limit, increasing the default data carrier size to 100,000 bytes, and allowing multiple OP_RETURN outputs per transaction.

Adam Back, Blockstream CEO, defended the update as containing essential security patches from “,” while critics warned of spam risks and potential legal liabilities.

![]() Bitcoin proposal to permanently delete Ordinals and NFT-related UTXOs faces developer backlash over fund confiscation and governance precedent concerns.#Bitcoin #Ordinalshttps://t.co/pBiH0t2fGG

Bitcoin proposal to permanently delete Ordinals and NFT-related UTXOs faces developer backlash over fund confiscation and governance precedent concerns.#Bitcoin #Ordinalshttps://t.co/pBiH0t2fGG

The upgrade triggered an exodus to Bitcoin Knots, an alternative implementation that grew to represent 28% of network nodes.

Back in December, a proposal called “The Cat” by developer Claire Ostrom also proposed to permanently ban Ordinals inscriptions and NFTs by marking their dust-sized outputs as unspendable, prompting a fellow contributor, Greg Maxwell, to call it “” of millions in funds.

Bitcoin Recovery Follows Geopolitical Shock

As the Bitcoin community cheers growth, Akshat Siddhant, lead Quant analyst at Mudrex, said institutional interest returned strongly following developments in Venezuela.

“If BTC closes above $93,700, momentum could carry it toward $100,000, with support forming NEAR $88,500,” he said, noting the Fear-Greed Index turned neutral for the first time since October as crypto ETFs attracted fresh capital.

At the time of writing,is trading at $92,861, up 1.64% in the past 24 hours.