Missed Gold’s Rally? Platinum and Palladium Could Be the Next Winners in 2026

Gold's parabolic run left many on the sidelines. Now, the spotlight shifts to its industrial cousins.

The Underdog Metals Awaken

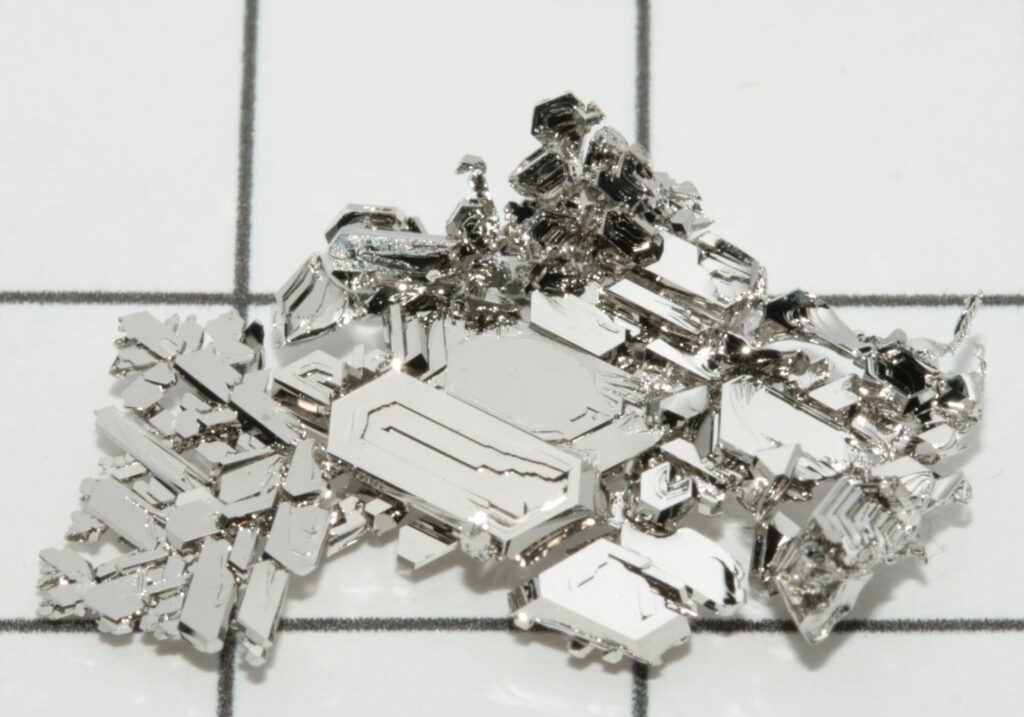

While gold captured headlines and investor frenzy, platinum and palladium traded in relative obscurity. Their price action told a story of neglect—until now. Market mechanics are aligning for a potential catch-up play that has portfolio managers whispering.

Industrial Demand Meets Constrained Supply

These aren't just shiny rocks. Platinum and palladium are critical components in everything from automotive catalysts to hydrogen fuel cells. Supply chains remain tight, geopolitical tensions simmer, and the green energy transition isn't slowing down. The fundamentals are screaming for attention.

The Contrarian's Playbook

Chasing last year's winner is a classic rookie move—like buying the top of a meme coin rally. Smart money looks for the next narrative. With gold's massive move resetting valuation benchmarks across the precious metals complex, the relative discount in platinum and palladium becomes impossible to ignore. It's the ultimate mean reversion trade, dressed in a hard asset suit.

The herd is still fixated on yellow metal. But the real alpha might just be hiding in plain sight, waiting for its turn in the cycle. After all, in finance, the biggest profits often come from buying what everyone else forgot to look at.

Platinum and Palladium Are Expected to Rise

According to a new Kitco article, the prices of platinum and palladium are also expected to rise steadily. Both the metals have faced constraints primarily due to the accelerated EV adoption as demand for primary catalysts pushed these metals to explore new lows. However, a new shift is now taking place where the demand for EVs may drop, building a new case for palladium and platinum to rise again.

Moreover, with the war economy scenarios rising hard and fast, experts are stating how stockpiling critical minerals will be a priority in the NEAR future.

. W.Sa

Possible Price Targets For The Future

According to Nicky Sheils, platinum and palladium may have a prosperous 2026 when it comes to their pricing and valuation. Platinum is expected to trade around $2000 per shield, with BMO expecting the asset to hit $1500 by 2026.