Jupiter & Helium Expose Token Buyback ’Meta’ — Why It Never Works in Crypto

Token buybacks are the latest crypto trend that's already showing its age. Projects like Jupiter and Helium are jumping on the bandwagon, deploying treasury funds to purchase their own tokens off the open market. The pitch? It's a bullish signal, a show of confidence, a way to 'return value' to holders.

The Illusion of Scarcity

On paper, it sounds like corporate share repurchases—a classic move to boost earnings per share and signal strength. In crypto, the mechanics are similar: reduce circulating supply, theoretically increase demand, and watch the price chart climb. It's financial alchemy, turning treasury cash into perceived token value.

Why the Math Never Adds Up

But crypto isn't a traditional balance sheet. Token buybacks often ignore a fundamental truth: perpetual inflation. Many projects have ongoing emissions, vesting schedules, and staking rewards that constantly drip new tokens into circulation. A buyback might temporarily sop up some supply, but it's often a finger in the dam against a tidal wave of new issuance. It's a performance—financial theater for the retail crowd.

A Short-Term Boost, A Long-Term Question

The pop is usually temporary. Markets quickly price in the buyback, then look past it to fundamentals: actual utility, user growth, sustainable revenue. Without these, the price gain evaporates, leaving a chart that looks like a sugar rush and crash. It's a tactic, not a strategy—the corporate equivalent of using earnings to manipulate stock price rather than invest in R&D.

One cynical finance jab? It's the perfect crypto strategy: use other people's money to create a temporary price illusion, letting early insiders and team members cash out while the 'meta' narrative is still hot. Genuine value creation is harder, slower, and doesn't make for a catchy tweet. In the end, sustainable protocols are built by users, not by treasury accountants playing market maker.

Buybacks vs. Supply: Why Helium and Jupiter Are Changing Course

Helium confirmed in early January that it has halted HNT buybacks funded by Helium Mobile revenue, despite generating $3.4 million in October 2025 alone.

Founder and CEO Amir Haleem said the market showed little response to open-market purchases, prompting the team to redirect capital toward subscriber growth, hardware expansion, and increased carrier offload usage.

an update on HNT buybacks: the market doesn’t seem to care about projects buying their tokens back off the market, so we are going to stop wasting our money under the current conditions

Helium + Mobile generated $3.4M in October alone and I’d rather we use that money to grow the…

![]()

Helium had shifted to daily automated buybacks in late 2025, burning tokens purchased with revenue from mobile subscriptions and network data usage.

That program followed earlier treasury-funded burns and was designed to tie real business activity to token supply reduction. While data credit burns from network usage remain in place, buybacks tied to mobile revenue have now been paused.

Buybacks $70 Million

Unlocks $1.2 Billion

Someone who is good at the economy please help me budget this, my token is dying pic.twitter.com/LnInIM0985

Jupiter is facing a similar reckoning, as the Solana-based DEX aggregator spent more than $70 million on JUP buybacks in 2025, funded by roughly half of its protocol fee revenue.

With JUP trading near $0.21, down almost 90% from its early-2024 high, Jupiter founder Siong publicly asked the community whether buybacks should be halted.

what do you all think if we stop the JUP buyback?

we spent more than 70m on buyback last year and the price obviously didn’t MOVE much.

we can use the 70m to give out for growth incentives for existing and new users.

should we do it?

![]()

The common thread is supply, as Jupiter’s circulating supply has expanded sharply, driven by airdrops, staking rewards, and scheduled unlocks.

Roughly 700 million JUP entered circulation through January 2025 alone, while ongoing ASR rewards added persistent inflation, with buybacks absorbing only a fraction of that issuance.

As critics across solana DeFi have pointed out, buying tokens in the open market does little when new supply consistently exceeds what is being removed. In that environment, buybacks become exit liquidity rather than long-term value capture.

This dynamic has fueled a broader critique of what some describe as “chart painting.” Buybacks can create short-term support or narrative momentum, but without structural demand, they struggle to hold.

We have now gone from “buybacks are great” to “buybacks don’t work”

Have we you considered the following:

– your token is just overvalued

– buybacks don’t offset issuance (unlocks)

– Expected buybacks are on future revenue, revenue is reflexive

– discount assigned for “off…

Why Buybacks Alone Struggle to Support Crypto Tokens

Several market participants argue that buybacks only work when they are paired with reasons to hold the token, such as mandatory utility, reduced emissions, or direct participation in cash flows. Otherwise, traders simply sell into predictable buying pressure.

buybacks are an inherently pessimistic mechanism

they imply: we don't have a better use for the cash than to paint the chart in the short term (in the hopes that the chart works out long term)

it's an implicit binary option where you are in a sense trying to bootstrap the…

At the same time, defenders of buybacks note they are not inherently flawed. In traditional finance, buybacks are meant to return excess capital when equity is undervalued, not to offset aggressive dilution.

In crypto, however, tokens rarely represent ownership, and future buybacks are discretionary rather than guaranteed.

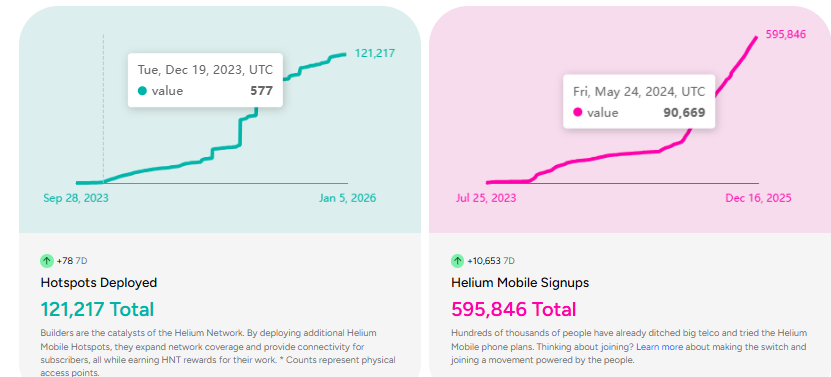

For Helium, the challenge is aligning its growing off-chain business with on-chain value. The network now supports nearly 600,000 mobile subscribers and generates steady data credit burns through carrier offload.

The team’s current strategy prioritizes expanding real usage, with the expectation that higher network activity will eventually strengthen token economics. Buybacks remain an option, but only once growth and cash flows materially outpace issuance.

Jupiter’s situation is more complex, as it operates one of the most profitable DeFi platforms, with DEEP liquidity, large TVL, and a growing suite of products, including perps, lending, and a mobile wallet. Yet JUP remains largely optional.

Analysts argue that without tighter integration into the protocol’s Core functions, buybacks alone cannot absorb inflation or anchor value.

Proposals circulating within the ecosystem focus on reducing emissions, tying rewards to revenue, and making JUP an asset for serious users rather than a passive governance token.