Michael Saylor’s Billion-Dollar Bitcoin Bet: MicroStrategy Adds 1,287 BTC, Amasses $2.25B War Chest

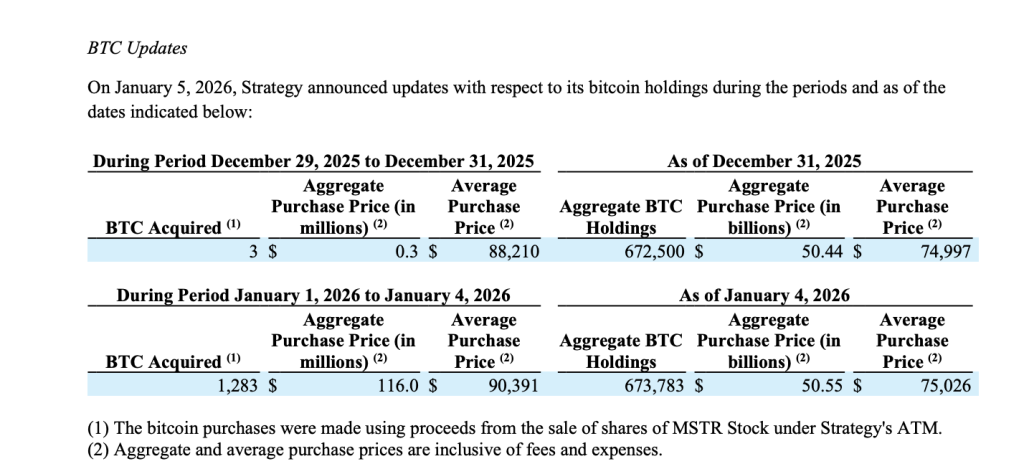

MicroStrategy just loaded up on another 1,287 bitcoins. The corporate treasury's digital gold strategy is accelerating, pushing its total USD-denominated reserves to a staggering $2.25 billion.

The Saylor Playbook: Aggressive Accumulation

Forget dipping a toe—this is a full-scale cannonball into the deep end. The latest purchase isn't a cautious hedge; it's a conviction-driven allocation that sidelines traditional cash reserves. The move signals a fundamental belief that corporate balance sheets are undergoing a permanent shift.

Building a Digital Fort Knox

That $2.25 billion reserve figure isn't just a number—it's a statement. It represents a massive, liquid position designed to weather volatility and fund future acquisitions. It’s a war chest built for a new financial era, bypassing the slow-drip of bond yields for the asymmetric potential of a scarce digital asset. A stark contrast to the quarterly earnings theater that dominates traditional finance.

The strategy continues to defy Wall Street's old guard, proving that for some, the greatest risk isn't being in crypto—it's being left out entirely.

USD Reserves Rise to $2.25 Billion

Alongside the bitcoin purchases, Strategy reports it has also also increased its USD reserves by roughly $62 million, bringing total dollar reserves to approximately $2.25 billion.

The filing shows that the capital was raised primarily through the sale of Class A common stock under the company’s at-the-market (ATM) equity program.

Between January 1 and January 4, Strategy reports it sold 735,000 shares of MSTR stock, generating net proceeds of $116.3 million.

This follows an additional $195.9 million raised from equity sales at the end of December. The proceeds were largely allocated toward bitcoin acquisitions reinforcing the company’s long-standing capital allocation strategy.

Equity Issuance Remains Key Funding Tool

The filing also details significant remaining issuance capacity across Strategy’s capital stack. As of January 4 the company had more than $11.3 billion in MSTR common stock available for issuance, alongside several classes of preferred stock with multi-billion-dollar issuance capacity.

Strategy did not sell any preferred shares during the latest reporting period, relying instead on common equity issuance to fund its bitcoin purchases. Net proceeds from all sales were reported after commissions and fees.

Strategy’s continued accumulation shows its unwavering commitment to bitcoin as a primary treasury reserve asset. Since first adopting the strategy in 2020, the company has consistently used equity and capital markets to increase its BTC exposure, regardless of market cycles.

Bitcoin Holds Near $93,000 as Early-January Momentum Builds

Earlier Bitcoin traded around $92,966, up roughly 1.8% over the past 24 hours, extending its early-January recovery after a volatile December. The move places BTC NEAR the upper end of its recent range with buyers stepping in following a pullback from October’s all-time high near $126,000.

Bitcoin fluctuated between roughly $91,277 and $92,966, reflecting improving short-term momentum. Trading volume over the past 24 hours stood near $28.9 billion, suggesting renewed participation as the market digests macro signals and early-year capital deployment.

From a broader perspective, Bitcoin’s market capitalization sits around $1.86 trillion with the circulating supply nearing 19.97 million BTC, leaving less than 1.03 million coins to be mined.

Despite the recent rebound, BTC remains about 26% below its October 2025 peak showing that the market is still in a consolidation phase rather than a full breakout.