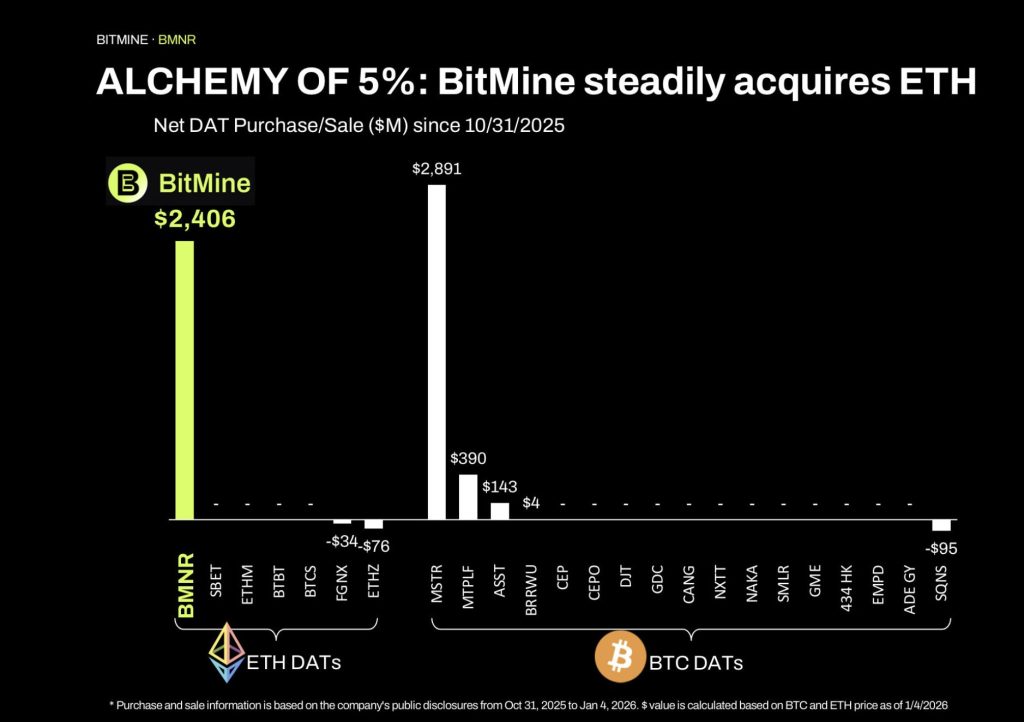

Tom Lee’s Bitmine Immersion Acquires 32,977 ETH, Boosting Crypto and Cash Reserves to $14.2 Billion

Major institutional player makes another massive Ethereum play.

Bitmine Immersion, the crypto-focused investment vehicle led by prominent analyst Tom Lee, just executed another whale-sized move. The firm added a staggering 32,977 ETH to its treasury, signaling continued aggressive accumulation in the digital asset space. This strategic acquisition isn't happening in a vacuum—it's part of a broader portfolio expansion that's pushing the firm's total holdings to a jaw-dropping $14.2 billion.

Building the Digital Fort Knox

The latest Ethereum purchase represents a classic accumulation strategy from a fund with deep conviction. While retail traders chase memecoins, established players are methodically building positions in core blockchain infrastructure assets. This move follows a pattern of strategic deployment into what Lee's firm views as foundational crypto assets, betting on long-term utility over short-term hype.

The Cash Conundrum

What's particularly telling is the composition of that $14.2 billion figure. The firm isn't all-in on crypto volatility—it maintains significant cash reserves alongside its digital asset positions. This hybrid approach provides dry powder for opportunistic buys during market dips while hedging against the sector's infamous volatility. It's a balanced stance that suggests preparedness for any market environment, bullish or bearish.

Institutional moves like this continue to validate crypto's place in modern portfolios—even if some traditional finance veterans still think blockchain is just a fancy spreadsheet. The real story isn't just the size of the bet, but the strategic patience behind it.

Staking Strategy and MAVAN Rollout

Bitmine has also expanded its Ethereum staking operations. Total staked ETH reached 659,219 ETH, valued at roughly $2.1 billion, following a weekly increase of more than 250,000 ETH.

At current composite Ethereum staking rates of around 2.8%, the company estimates potential annual staking income of $374 million once its ETH is fully deployed.

Central to this plan is Bitmine’s upcoming Made in America Validator Network (MAVAN), a commercial staking solution expected to launch in the first quarter of 2026.

![]() BitMine @BitMNR plans an early-2026 launch of its MAVAN validator network, aiming to turn a $12B Ether treasury into staking yield at scale.#BitMine #Staking https://t.co/YOlkeNouQu

BitMine @BitMNR plans an early-2026 launch of its MAVAN validator network, aiming to turn a $12B Ether treasury into staking yield at scale.#BitMine #Staking https://t.co/YOlkeNouQu

The company is also currently working with three staking providers while finalizing MAVAN, which Lee described as a “best-in-class” secure staking infrastructure designed to optimize yield and long-term returns.

Macro Tailwinds and Ethereum Conviction

Lee highlighted several macro and structural tailwinds supporting Bitmine’s Ethereum-focused strategy including growing US government support for crypto, increased adoption of stablecoins and tokenization on Wall Street and rising demand for authentication and proof-of-provenance solutions in an AI-driven economy.

He also pointed to parallels between today’s crypto market and the post–Bretton Woods financial system shift of the early 1970s, arguing that regulatory developments such as the GENIUS Act and the SEC’s Project Crypto could prove similarly transformative for digital assets.

Market Position and Shareholder Focus

Bitmine now ranks as the largest Ethereum treasury in the world and the second-largest global crypto treasury overall, behind Strategy’s Bitcoin holdings.

The company has also emerged as one of the most actively traded US stocks, with average daily trading volume approaching $1 billion, placing it among the top 50 most traded equities nationwide.

Bitmine will hold its annual stockholder meeting on January 15, 2026, in Las Vegas, where shareholders will vote on proposals including an increase in authorized shares.

Management says the flexibility would support future capital markets activity, selective acquisitions, and continued ETH accumulation—all aimed at increasing crypto net asset value per share over the long term.