Altcoin Season Index Flashes: SOL and XRP Primed to Outrun Bitcoin in 2026

Forget the king—the princes are ready to sprint. A key market indicator is flashing signals that could see major altcoins like Solana and Ripple finally break Bitcoin's dominance.

The Setup

The Altcoin Season Index isn't just a fancy metric—it's the crypto market's mood ring. When it heats up, it historically signals capital rotating out of Bitcoin and into riskier, high-potential alternatives. Right now, the needle is moving.

SOL and XRP in the Spotlight

All eyes are on Solana and Ripple. SOL's ecosystem—brimming with DeFi and NFT projects—has proven its resilience and speed. Meanwhile, XRP's fate remains tethered to its endless legal saga with the SEC, a drama that somehow still fuels speculative fervor. The index suggests these aren't just bouncing; they're building momentum for a sustained run.

Why This Time Could Be Different

Past 'alt seasons' were often pure speculation. The 2026 landscape is different. Institutional frameworks are forming, and real-world utility is no longer a punchline—it's a checklist. Projects that deliver actual use cases are separating themselves from the meme-coin chaos. It’s a shift from gambling to calculated bets on blockchain infrastructure.

The Bitcoin Question

Does this mean Bitcoin is finished? Hardly. It remains the bedrock. But a healthy altcoin market doesn't dethrone the king—it builds out the kingdom. Think of Bitcoin as the reserve currency; altcoins are the high-growth tech stocks. Money flows where the action is.

The Cynical Take

Let's be real—half of this 'rotation' is just traders chasing the next dopamine hit after getting bored with Bitcoin's relative stability. The other half is the eternal hope that *this* cycle, the 'fundamentals' will finally matter more than hype and Twitter threads from anonymous accounts. Place your bets accordingly.

The Bottom Line

The signals are aligning. If the index holds true, we're looking at a period where agility and specific utility could outperform sheer store-of-value dominance. SOL and XRP aren't just participating; they're positioned to lead the charge. Buckle up.

Source: Joao Wedson

Source: Joao Wedson

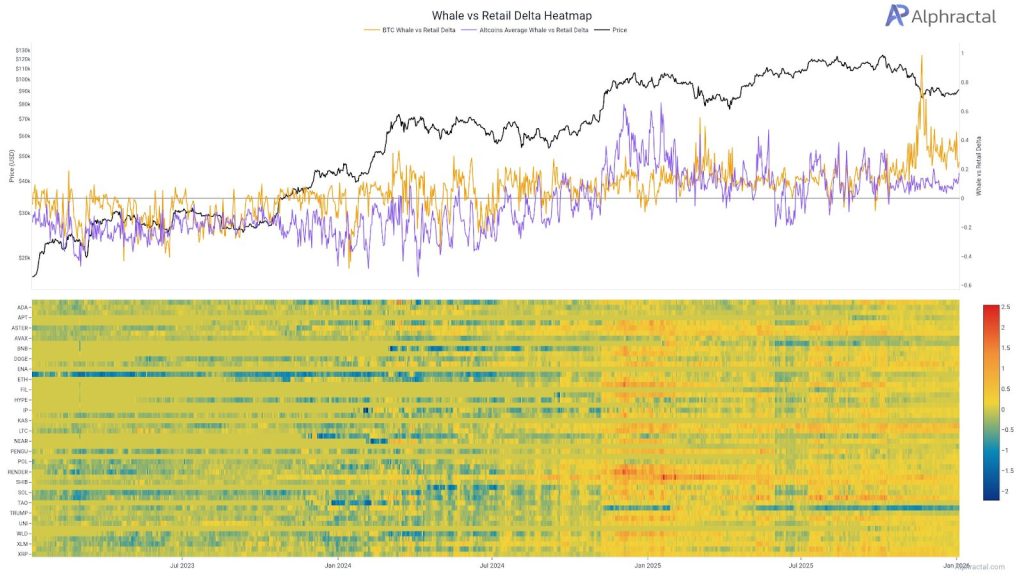

“That’s why some altcoins are pumping while most people have no clue what’s really going on,” he explained.

XRP and SOL Lead Recent Altcoin Recovery

Over the last 7 days, Solana has surged overto break out of its downtrend while XRP pumped nearlyto reclaim the $2.00 price level and surpass BNB as the 4th largest cryptocurrency by market capitalization.

Analysts observed that XRP is now stabilizing following a prolonged downtrend, displaying early signs of base formation.

From a structural standpoint, XRP has already completed two major historical impulse cycles.

The first cycle into 2014-2015 and the second into 2017-2018 both topped after roughly 49-50 monthly candles, each accompanied by clear volume expansion.

Price action since the 2018 peak has been compressed within a multi-year descending triangle/contracting range, defined by falling resistance from the 2018 high and a rising structural base.

This compression phase appears to have resolved upward in 2024-2025, with XRP maintaining above the long-term mean and consolidating rather than collapsing after the breakout. That behavior typifies a wave (III) to wave (IV) transition, not a macro top.

On a log scale, the projected trajectory targets a wave V expansion into the $5-$10+ zone, which WOULD align with prior cycle extensions once XRP exits long-term compression.

Provided XRP holds above its long-term structural support and doesn’t re-enter the pre-2024 range, the dominant bias remains upward, with the next major MOVE likely explosive rather than gradual.

Solana Dominates Transaction Volume

According to Nansen AI, solana dominated 2025 transactions with approximately 6× more than BNB Chain.

This is reflected in SOL digital asset investment products, which finished 2025 with $3.56 billion in inflows, more than a 1,000% increase from 2024, when Solana recorded $310 million in inflows.

Global digital asset inflows reached US$47.2bn in 2025, just shy of the 2024 record. Bitcoin saw a 35% decline in flows, with inflows of US$26.9bn in 2025. ethereum saw the most substantive gains, with inflows of US$12.7bn, up 138% YoY. XRP and Solana saw a rise of 500%…

— Wu Blockchain (@WuBlockchain) January 5, 2026Analysts have now observed that SOL is breaking out of the October downtrend, and attention should focus on the asset as $200+ becomes increasingly probable.

The daily SOL/USDT chart displays a clear shift from a strong bullish structure into a corrective and distributional phase. Earlier in the year, Solana respected multiple bullish breaks as the price advanced from the lower demand region NEAR $100-$120 into the $240-$260 area.

However, failure to sustain price within the upper rejection block around $260-$290 marked a major inflection point, confirming strong sell-side pressure at elevated levels and initiating a broader downtrend.

Since that rejection, market structure has flipped bearish, with repeated bearish breaks and lower highs forming beneath successive supply zones around $200, $180, and $160.

The most important detail currently is that price is reacting to demand, but without a confirmed bullish break of the structure yet.

Provided SOL remains below the nearby supply zone around $145-$160, any bounce will likely be corrective rather than trend-reversing.

A clean break and acceptance above that supply area would represent the first signal that downside momentum is weakening and could unlock pathways for recovery toward $180 and $200.