DOJ Sells 57 Bitcoin in Defiance of Trump’s Executive Order Mandating Strategic Crypto Reserve

Justice Department liquidates seized assets while White House pushes national Bitcoin stockpile—regulatory wires cross in plain sight.

The Contradiction Unpacked

Federal prosecutors offloaded 57 Bitcoin from a criminal forfeiture case, netting roughly $3.2 million at current prices. The sale happened quietly through a General Services Administration auction—standard procedure for seized assets. No fanfare, no press release. Just another day moving digital evidence into cash.

Meanwhile, an executive order signed last quarter directs the Treasury to 'establish and maintain a strategic reserve of Bitcoin and other select digital assets.' The language cites monetary sovereignty and hedging against 'currency manipulation by foreign adversaries.' One branch sells, another branch buys—the left hand apparently didn't check the right hand's blockchain wallet.

Market Mechanics & The Political Layer

These 57 coins represent a rounding error in Bitcoin's $950 billion market cap. The real story isn't the volume—it's the symbolism. Selling confiscated crypto while building a national reserve sends mixed signals to institutional investors. Are we treating Bitcoin as contraband or a strategic asset? The answer seems to be: both, depending which department's budget needs balancing this quarter.

Observers note the DOJ's sale reinforces Bitcoin's liquidity narrative—even seized coins can be monetized efficiently. But it also highlights the government's awkward dance with an asset class it can't fully control. Building a reserve suggests long-term belief; auctioning forfeitures treats it like seized art or vintage cars.

The Bottom Line

Washington's crypto schizophrenia continues. One agency's compliance headache becomes another agency's monetary policy tool—all while traders watch the circus and adjust their positions accordingly. The takeaway? When it comes to government crypto moves, never expect consistency—just another entry in the ledger of bureaucratic irony. After all, what's a few million between departments when you're printing trillions? The real strategic reserve might just be the government's ability to hold two contradictory positions without blinking.

Source: Bitcoin Magazine

Source: Bitcoin Magazine

The Bitcoin was sent directly to Coinbase Prime address, which currently shows a zero balance, indicating the assets may have already been liquidated.

Defying Federal Guidance on Multiple Fronts

This marks the second instance in which the Southern District of New York has acted against federal directives in the Samourai case.

On April 7, 2025, Deputy Attorney General Todd Blanche issued a memo titled “,” stating “the Department [of Justice] will no longer target VIRTUAL currency exchanges, mixing and tumbling services, and offline wallets for the acts of their end users.“

Despite this clear guidance, SDNY prosecutors proceeded with cases against Rodriguez, Hill, and Tornado Cash developer Roman Storm.

The prosecution also moved forward after learning, through a Brady request, that two high-ranking FinCEN officials “” that Samourai Wallet wasn’t operating as a money transmitter because of its non-custodial nature.

The SDNY has earned its colloquial nickname “Sovereign District of New York” for operating independently within the federal system, boasting conviction rates exceeding 90% and a reputation for harsh sentencing.

Amongst many others, Senator Cynthia Lummis has particularly criticized this move, saying the United States “can’t afford to squander these strategic assets while other nations are accumulating bitcoin.”

“I’m deeply concerned about this report,” she added.

Why is the U.S. gov still liquidating bitcoin when @POTUS explicitly directed these assets be preserved for our Strategic Bitcoin Reserve? We can’t afford to squander these strategic assets while other nations are accumulating bitcoin. I’m deeply concerned about this report. https://t.co/XW5WxsfliA

— Senator Cynthia Lummis (@SenLummis) January 6, 2026Legal Framework and Presidential Intent

Trump’s executive order established two distinct entities:

- The Strategic Bitcoin Reserve for forfeited Bitcoin.

- The United States Digital Asset Stockpile for other cryptocurrencies.

The order explicitly states that “Government BTC deposited into the Strategic Bitcoin Reserve shall not be sold and shall be maintained as reserve assets of the United States utilized to meet governmental objectives in accordance with applicable law.“

According to legal analysis, the forfeited Bitcoin falls under 18 U.S. Code § 982(a)(1), which governs property involved in unlicensed money transmitting offenses.

Neither this statute nor the incorporated § 853 requires liquidation of forfeited property.

The executive order only permits disposal of digital assets in specific scenarios, such as returning funds to crime victims, law enforcement operations, sharing with state partners, or satisfying specific statutory requirements, none of which apply to the Rodriguez and Hill cases.

Back in April 2025, White House crypto adviser Bo Hines emphasized that any Bitcoin accumulation strategy must be “budget neutral,” and the administration wasexploring creative approaches, including tariff revenue and revaluing gold reserves.

Treasury Secretary Scott Bessent also clarified in August that the country is “not going to be buying that, but we are going to use confiscated assets and continue to build that up.“

Questions About Ending the War on Crypto

Rodriguez received a five-year sentence on November 6, while Hill was sentenced to four years on November 19 for operating Samourai Wallet, which prosecutors claimed processed over $237 million in criminal proceeds.

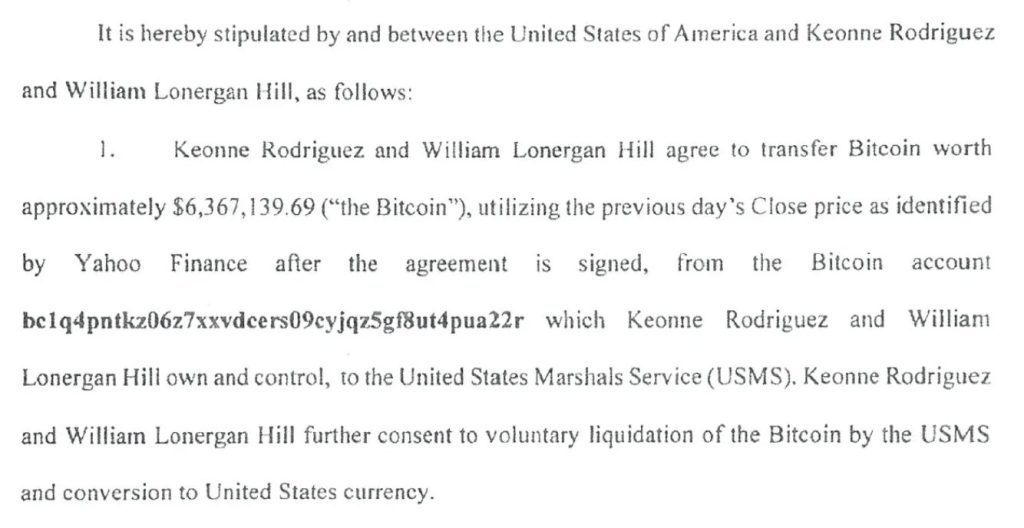

Both developers forfeited the $6.3 million in fees earned from their platform’s operations.

On December 16, President TRUMP indicated he would consider pardoning Rodriguez after being asked about the case during an Oval Office event.

“I’ve heard about it, I’ll look at it,” Trump told reporters, directing Attorney General Pam Bondi to examine the matter.

Rodriguez responded on social media, stating, “this President knows all about lawfare. He knows all about a weaponized Biden DOJ hunting down their political rivals.“

I have always said that the most challenging aspect of getting a pardon for me and Bill WOULD be getting the attention of @realDonaldTrump. He is very busy with many people competing for his attention. Today, thanks to the journalist at Decrypt, the President is aware of our… https://t.co/lmYljfFax9

— Keonne Rodriguez (@keonne) December 15, 2025Trump has previously pardoned Ross Ulbricht and Changpeng Zhao in related crypto cases, and has raised Optimism of a similar pardon for Rodriguez.

The liquidation contradicts the administration’s stated goal of treating Bitcoin as a strategic asset on par with Gold reserves.

As a result, Patrick Witt, Executive Director of the WHITE House President’s Council of Advisors for Digital Assets, said on X that the council is looking into the matter.

We are looking into this. https://t.co/qDcvC3bTML

— Patrick Witt (@patrickjwitt) January 6, 2026