Ray Dalio’s Dollar Warning: Long-Term Decline Against Gold & Yuan – Crypto’s Ultimate Bull Signal?

Another heavyweight enters the currency doom loop. Ray Dalio—hedge fund legend and macro oracle—just fired a warning shot across the dollar's bow. His prognosis? A sustained, structural decline that'll see it lag behind both gold and the Chinese yuan. The old guard's pillars are cracking.

The Flight to Hard Assets

When institutional giants start talking down the world's reserve currency, capital doesn't just sit still. It hunts for exits. Gold's historic role as a store of value gets a fresh coat of paint, while the yuan's rise is a direct geopolitical play. But there's a new, digital contender in the hard-asset arena.

Crypto's Asymmetric Bet

This isn't just about a weak dollar—it's about a failing paradigm. Fiat systems rely on trust and central management, two commodities in increasingly short supply. Decentralized networks, by contrast, offer a verifiable, borderless, and politically neutral alternative. They don't just store value; they program it.

Every percentage drop in long-term dollar confidence isn't a loss—it's potential energy flowing into alternative systems. Bitcoin becomes digital gold 2.0. Stablecoins become the transactional grease for global trade. Smart contracts bypass not just banks, but entire legal jurisdictions. The infrastructure for a parallel financial system is already built, just waiting for the flood.

The Cynical Take

Let's be real—the same finance titans warning about systemic risk have built fortunes within the very system they now question. Their 'hedges' often look suspiciously like positions they already own. But even a broken clock is right twice a day, and self-interest can still illuminate a truth.

The real signal isn't in any single forecast. It's in the chorus. When mainstream narrative shifts from 'if' the dollar weakens to 'how fast,' the game changes. Crypto's value proposition shifts from speculative tech toy to essential portfolio plumbing. It's the hedge against the hedge, the bet on a system that doesn't need their permission to work.

So, is a declining dollar good for crypto? That's like asking if rising sea levels are good for boats. It creates the environment where alternatives aren't just attractive—they're necessary. The old world is talking about managing decline. The new one is building what comes next.

Dollar Weakness Reflects Structural Fiscal Pressures

The currency’s decline stems from structural fiscal imbalances and shifting expectations for monetary policy.

“A large amount of debt (nearly $10tn) will need to be rolled going forward,” Dalio wrote, warning that simultaneous Fed easing to push real interest rates down makes “debt assets look unappealing, especially at the long end of the curve.“

He expects “a further steepening of the yield curve seems probable.“

Trump administration policies compound these pressures through what Dalio calls “an all-out aggressive bet on capitalism” involving stimulative fiscal policy and reduced regulations to boost manufacturing.

While aimed at revitalizing manufacturing, these measures widen wealth gaps as capitalists capture most gains.

“The value of money issue, otherwise known as the affordability issue, will probably be the number one political issue next year,” he predicted, expecting it to contribute to Republican losses in the House.

Geopolitical shifts accelerated dollar weakness. “In 2025 there was a clear shift from multilateralism to unilateralism,” Dalio observed, noting this raised conflict threats and “contributed to the increased use of economic threats and sanctions, protectionism, deglobalization” while strengthening demand for gold.

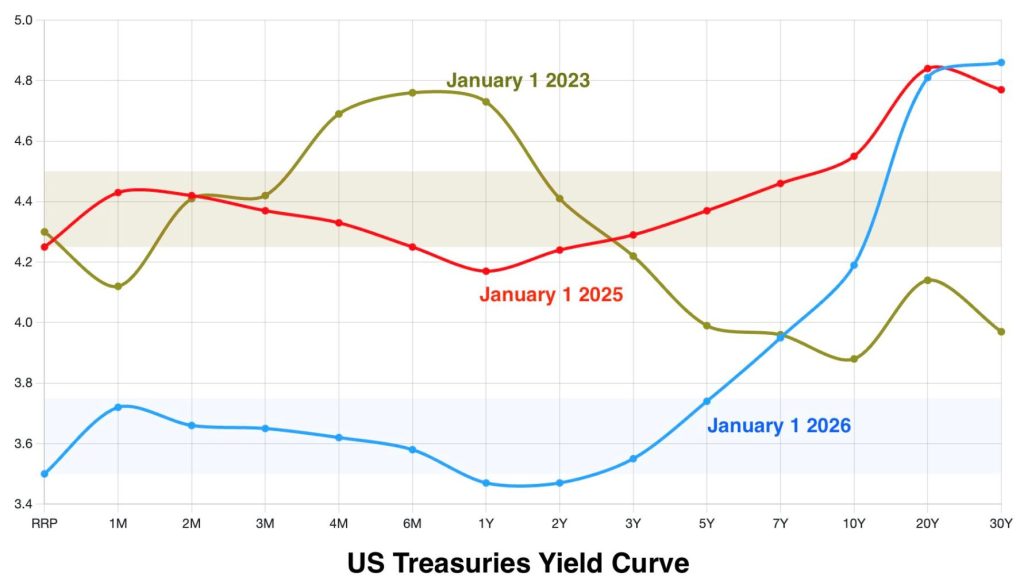

Yield Curve Steepening Signals Shifting Financial Conditions

The US bond market entered 2026 with its steepest yield curve since 2021, with the spread between two-year and 30-year Treasuries reaching 140 basis points, Bitfinex analysts noted in their latest report.

They added that this reflects markets expecting policy rate cuts while demanding higher compensation for holding long-term government debt amid inflation uncertainty and heavy Treasury issuance.

The curve steepens when long-term rates rise faster than short-term rates, creating what the report describes as “higher term premia, persistent inflation uncertainty, heavy Treasury issuance, and growing fiscal concerns.”

While lower policy rates suggest accommodation, elevated long-term yields continue raising borrowing costs across the economy, partially offsetting relief from front-end easing.

For equities, higher long-term discount rates limit valuation expansion, particularly for growth stocks whose earnings lie far in the future.

The report notes that companies with near-term cash flows, pricing power, and tangible assets tend to fare better in this environment.

In times like this, Coinbase CEO Brian Armstrong has framed Bitcoin as applying constructive pressure on US policymakers to maintain fiscal responsibility.

“Bitcoin provides a check and balance on the dollar,” he said on a recent Tetragrammaton podcast.

Armstrong also warns that inflation without matching growth could cost the dollar its reserve status.

Precious Metals Rally Delays Crypto Upside

Bitcoin and Ethereum’s consolidation connect to capital flowing into precious metals amid geopolitical stress.

Speaking with Cryptonews, Farzam Ehsani, co-founder and CEO of VALR, notes gold ROSE 69% and silver surged 161% over the past year.

Long-term Bitcoin holders stopped selling for the first time since July, while ethereum showed improving fundamentals, including a cleared staking exit queue and record transaction activity at historically low fees.

“Bitcoin’s current sideways movement against the backdrop of record-breaking gains in gold and silver resembles a ‘calm before the storm,’ typically followed by a broader crypto market rally,” Ehsani said.

He projects that Bitcoin could reach $130,000 and Ethereum $4,500 in Q1 2026, once precious metals momentum fades, with significantly higher upside if gold and silver experience sharper corrections.

At publication time,is trading slightly above $91,000, down nearly 1.5% in the last 24 hours.