Bitcoin Price Prediction: Coinbase Analyst Reveals 2 Unusual Quantum Computing Threats That Could Break Bitcoin – Is BTC Headed to Zero?

Quantum computing just became Bitcoin's boogeyman. A Coinbase analyst outlines two unconventional attack vectors that could, theoretically, unravel the world's largest cryptocurrency. Forget simple decryption—this is about exploiting the blockchain's foundational logic.

The Shor's Algorithm Shortcut

Everyone talks about quantum machines cracking Bitcoin's elliptic curve cryptography. That's threat number one. It's the digital equivalent of a master key for every wallet. The analyst notes this remains a distant, but mathematically plausible, future scenario where private keys become public knowledge.

The Double-Spend Quantum Gambit

Here's the curveball. The second method involves quantum speed to execute a perfect double-spend attack. A sufficiently powerful quantum computer could theoretically mine blocks so fast it rewrites transaction history before the network notices—undermining the very 'immutability' that gives Bitcoin its value. It turns the blockchain's greatest strength into a potential weakness.

So, can Bitcoin go to zero? The analyst's framework suggests it's a catastrophic tail risk, not a forecast. The crypto community has a long history of treating existential threats like distant sci-fi—right up until they're not. It's the ultimate stress test for an asset class that loves to 'have the conversation' after the hack. The real price prediction? Innovation in quantum-resistant cryptography just got a whole lot more valuable. Because in finance, the best hedge is often sold by the people warning you about the apocalypse.

Coinbase Flags Two Quantum Attack Vectors on Bitcoin

Duong’s analysis, published by Coinbase, centers on a hypothetical “Q-day” when cryptographically relevant quantum computers (CRQCs) could run Shor’s and Grover’s algorithms efficiently enough to weaken existing encryption standards.

Bitcoin relies on two Core systems:

- ECDSA for transaction signatures

- SHA-256 for proof-of-work mining

According to Coinbase, signature compromise is the primary concern, not quantum mining. While quantum-accelerated mining faces scaling limits, breaking ECDSA could allow attackers to derive private keys from exposed public keys, enabling unauthorized transfers.

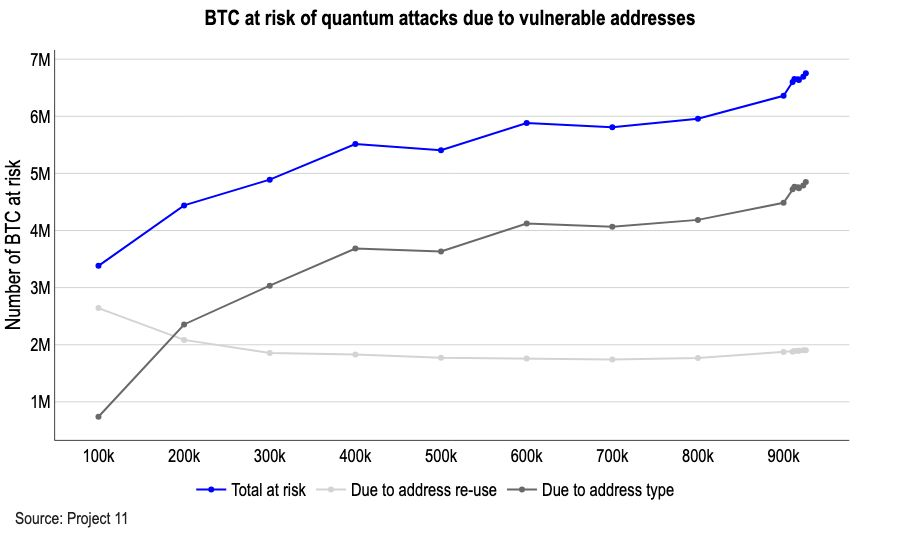

6.51 Million BTC Already Exposed On-Chain

Coinbase estimates that 6.51 million BTC, or 32.7% of total supply, is currently vulnerable to long-range quantum attacks due to address reuse and legacy script types.

These include:

- Pay-to-Public-Key (P2PK)

- Bare multisig (P2MS)

- Certain Taproot (P2TR) outputs

Satoshi-era coins represent a known subset of this exposure. In addition, every bitcoin transaction faces short-range risk at the moment of spending, when public keys briefly appear in the mempool. While exploitation probability remains low today, Coinbase argues this risk profile makes post-quantum migration unavoidable.

Governments Target 2035 as Crypto Migration Deadline

US and EU agencies have already instructed critical infrastructure providers to transition to post-quantum cryptography (PQC) by 2035, according to public policy guidance. Bitcoin developers and research groups such as Chaincode Labs are evaluating similar timelines.

Chaincode outlines two possible scenarios:

- A rapid quantum breakthrough, forcing migration within two years

- A gradual transition, allowing upgrades over five to seven years

Potential solutions include quantum-resistant signature schemes such as CRYSTALS-Dilithium and SPHINCS+, likely introduced via soft forks to preserve network continuity.

Bitcoin Price Prediction: Triple Top Meets Fibonacci Support as BTC Nears Breakout Point

On the daily chart, Bitcoin price prediction has turned bearish as BTC is consolidating below $94,100, where a triple top pattern has formed. This level aligns with the 50% Fibonacci retracement of the decline from $107,700, reinforcing supply pressure.

Price remains supported by a rising trendline from November, with the 38.2% retracement NEAR $90,900 acting as a key pivot.

Candlestick structure shows small bodies and frequent wicks, signaling indecision rather than distribution. RSI has cooled toward neutral, suggesting momentum reset rather than trend failure.

As long as Bitcoin holds higher lows above $86,900, the broader structure remains constructive.

A sustained break above $92,000–$94,100 WOULD reopen upside toward $100,000, with the prior high near $107,000 back in focus.

For markets, the message is clear: quantum risk is not a zero-day threat, but it is now a priced-in, long-dated variable shaping Bitcoin’s evolution, custody models, and valuation frameworks as the asset matures.

Maxi Doge: A Meme Coin Built Around Community and Competition

Maxi Doge is gaining traction as one of the more active meme coin presales this year, combining bold branding with community-driven incentives. The project has already raised more than $4.4 million, placing it among the stronger early performers in the meme token category.

Unlike typical dog-themed tokens that rely purely on social buzz, Maxi DOGE leans into engagement. The project runs regular ROI competitions, community challenges, and events designed to keep participation high throughout the presale phase. Its leverage-inspired mascot and fitness-themed branding have helped it stand out in a crowded meme market.

The $MAXI token also includes a staking mechanism that allows holders to earn daily smart-contract rewards. Stakers gain access to exclusive competitions and partner events, adding a passive earning component while encouraging long-term participation rather than short-term speculation.

Currently priced at $0.000277, $MAXI is approaching its next scheduled presale increase. With momentum building and community activity remaining strong, Maxi Doge is positioning itself as a meme coin focused on sustained engagement rather than one-off hype.

Click Here to Participate in the Presale