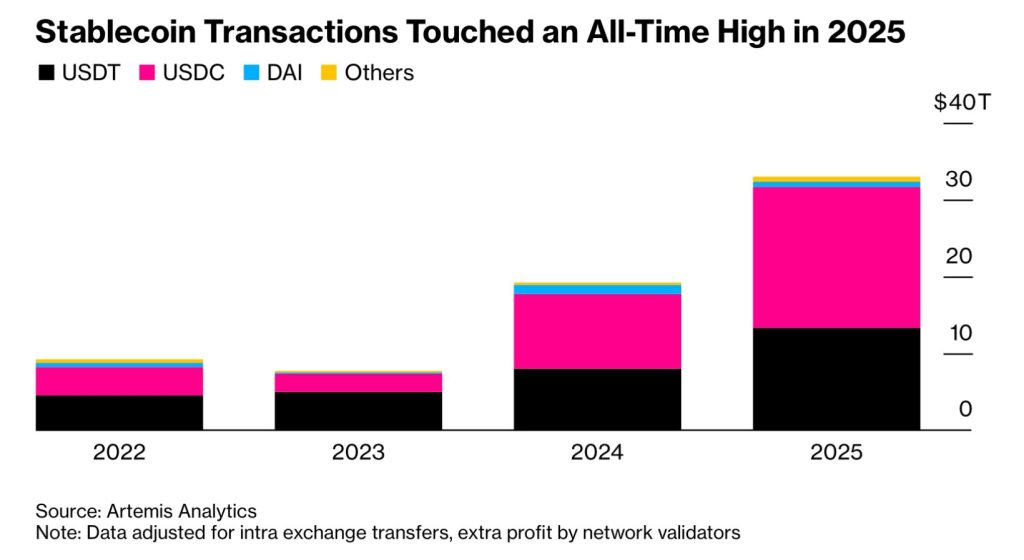

Stablecoin Transactions Skyrocket 72% in 2025, Smash $33 Trillion Barrier as USDC Takes the Crown

Forget the old rails—stablecoins just rewired global finance.

The Numbers Don't Lie

A blistering 72% surge in transaction volume tells the real story. The total? A mind-bending $33 trillion moved across chains. That figure isn't just big—it's a direct challenge to the legacy settlement systems still sipping their morning coffee.

USDC Seizes the Throne

The race for dominance has a clear winner. USDC didn't just participate; it led the charge, capturing the lion's share of this explosive growth. Its rise signals a market maturing, choosing infrastructure and transparency over hype.

What's Fueling the Fire?

It's not just speculation. This is utility in motion—cross-border payments, DeFi liquidity, and corporate treasuries finally getting off the sidelines. The network effect is kicking in, and velocity is everything. Traditional finance is watching its moat evaporate in real-time.

The New Plumbing Is Live

This isn't a test. $33 trillion in annual throughput proves the stablecoin layer is now critical infrastructure. It's faster, cheaper, and operates 24/7. The old guard's quarterly earnings calls are about to feature some very awkward questions.

A cynical jab? The only thing growing faster than stablecoin volume might be the number of bank analysts scrambling to rebrand 'crypto' as 'digital asset innovation' in their PowerPoints.

The takeaway? The future of money moved last year—and it didn't ask for permission.

Source: Artemis Analytics

Source: Artemis Analytics

The unprecedented rise in stablecoin transactions comes after the passing of the TRUMP administration’s GENIUS Act in July 2025. Known as the Guiding and Establishing National Innovation for U.S. Stablecoins, the legislation is the first comprehensive regulatory framework for payment stablecoins in the country.

In a previous conversation with Cryptonews, Tether creator Reeve Collins said that the passing of laws like GENIUS paves the way for global acceptance of stablecoins.

“The reason why that’s so powerful… and all the large financial institutions get involved, is because, it’s lucrative,” he noted.

DeFi Users Prefer USDC – Here’s Why

According to Anthony Yim, co-founder of Artemis, decentralized finance or “DeFi” traders prefer the USDC stablecoin to frequently MOVE in and out of positions.

Further, the “unstable geopolitical landscape” signalled mass adoption of digital US dollars, Yim added. Citizens of countries suffering inflation also prefer to hold USD-pegged stablecoins due to ease of access.

That said, Tether is a more widely used stablecoin for day-to-day payments and business transactions. Users prefer to simply hold its value in wallets rather than using it for moving around.

Stablecoin Transaction Flows to Hit $56T by 2030

Bloomberg Intelligence analysis predicted that the total stablecoin payment flows could reach $56 trillion by 2030. However, regulators such as the IMF have warned that stablecoins could disrupt traditional finance and growth.

Even though the growth isn’t slowing down. Artemis data noted that transaction volumes in the last quarter of 2025 alone recorded $11 trillion, compared to $8.8 trillion in Q3.

Elsewhere, the East is also building a distinct, sustainable path for digital assets, challenging Western dominance with pragmatic regulation.

Chengyi Ong, Head of Public Policy, APAC at Chainalysis, told Cryptonews, “unquestionably, stablecoins are a game-changer.”

Besides, the stablecoin dominance and the GENIUS Act have led to a broader adoption of digital assets among banking and tech giants such as Standard Chartered and Amazon, exploring launching their own stablecoin.