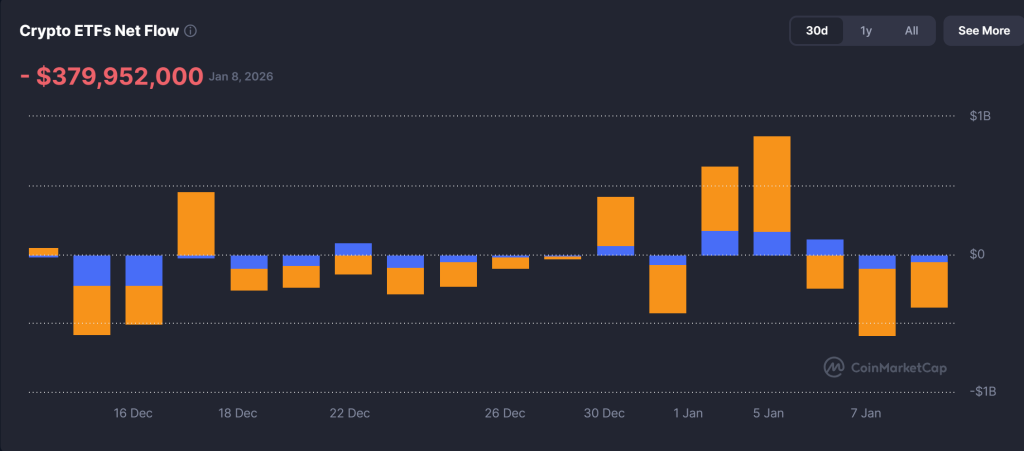

Bitcoin Defies $380M ETF Exodus: $90K Support Holds Firm as $108K Breakout Looms

Bitcoin's proving its resilience isn't just a meme. Despite a massive $380 million bleeding from ETF coffers, the king crypto isn't just holding the $90,000 line—it's eyeing a historic surge toward $108,000.

The Great Wall of $90K

Forget the institutional cold feet. While traditional finance plays hot potato with ETF shares, Bitcoin's on-chain metrics and spot market demand are telling a different story. The $90,000 level has transformed from resistance into a formidable support floor, absorbing sell-pressure that would crater lesser assets.

Setup for the Next Leg Up

The technical landscape is painting a bullish picture. The consolidation above $90,000 isn't stagnation; it's a coiled spring. Analysts point to a textbook breakout setup forming, with key moving averages aligning and momentum building just beneath the surface. All it needs is a catalyst.

When Outflows Signal Strength

Paradoxically, the ETF exodus might be clearing the path. Short-term paper hands exiting via regulated vehicles reduces overhead supply. It's the market's way of shaking out weak holders—a classic cleanse before a major ascent. The real buying, as always, happens on the decentralized exchanges and in cold wallets Wall Street can't touch.

The $108K Target in Sight

The breakout trajectory is clear. A sustained move above recent local highs could trigger a swift revaluation, sending BTC on a direct path to test the $108,000 barrier. This isn't hopium; it's a measured technical projection based on the current range structure and volume profile. The pieces are on the board.

So, while suit-and-tie funds fret over daily flows—a quaint, myopic metric in crypto time—the underlying network grows stronger. Sometimes, the smartest money is the patient money that doesn't need a prospectus to understand value. The breakout isn't just looming; it's being built, block by block, right under their noses.

That stability comes amid visible stress in institutional flows. crypto ETF products recorded net outflows of roughly $380 mn, a reminder that short-term positioning remains fragile. Still, price action suggests the market is absorbing supply rather than capitulating, a subtle but important distinction for trend followers.

Bitcoin Technical Analysis: Triangle Compression Signals a Volatility Expansion Ahead

On the daily chart, Bitcoin is coiling into a broad symmetrical triangle, defined by a descending trendline from the $107K high and a rising support base that began near $80.5K. This structure reflects compression rather than trend exhaustion, with volatility steadily contracting.

Technically, the market remains constructive. bitcoin continues to form higher lows, signaling that buyers are stepping in earlier on pullbacks.

The 50-day EMA has flattened and is attempting to curl higher, while RSI has reset into a neutral-bullish range without flashing bearish divergence. Recent candles, including Doji and spinning tops, point to indecision, not distribution.

Why $97K Is the Level That Matters Most

The critical resistance zone sits between $94K and $97.3K, where prior supply, the triangle’s upper boundary, and the 0.618 Fibonacci retracement converge. A daily close above this band WOULD likely trigger a volatility expansion.

A confirmed breakout opens the door to an initial move toward $100.7K, followed by a measured advance into the $105K–$108K region if volume confirms. On the downside, failure to hold $90K risks a pullback toward $86.9K, with stronger structural support NEAR $80.5K.

Bitcoin Outlook: A Pause Before the Next Leg

From a trading perspective, Bitcoin’s price outlook remains cautious, signaling not an ending but a transition. A clean break above $97.3K would favor continuation setups targeting low six-figure prices, while downside risk stays clearly defined below rising trend support.

As liquidity rotates and sentiment stabilizes, this period of compression may be remembered as the base for Bitcoin’s next directional move.

For long-term investors and new entrants alike, the current structure offers a reminder that markets often move most decisively just when patience runs thin, setting the stage for renewed Optimism across the digital asset space.

Maxi Doge: A Meme Coin Built Around Community and Competition

Maxi Doge is gaining traction as one of the more active meme coin presales this year, combining bold branding with community-driven incentives. The project has already raised more than $4.43 million, placing it among the stronger early performers in the meme token category.

Unlike typical dog-themed tokens that rely purely on social buzz, Maxi DOGE leans into engagement. The project runs regular ROI competitions, community challenges, and events designed to keep participation high throughout the presale phase. Its leverage-inspired mascot and fitness-themed branding have helped it stand out in a crowded meme market.

The $MAXI token also includes a staking mechanism that allows holders to earn daily smart-contract rewards. Stakers gain access to exclusive competitions and partner events, adding a passive earning component while encouraging long-term participation rather than short-term speculation.

Currently priced at $0.0002775, $MAXI is approaching its next scheduled presale increase. With momentum building and community activity remaining strong, Maxi Doge is positioning itself as a meme coin focused on sustained engagement rather than one-off hype.

Click Here to Participate in the Presale