Michael Saylor’s Billion-Dollar Bitcoin Bet: 13,627 BTC Scooped for $1.25B

Another massive buy order just hit the Bitcoin ledger—and it's got one name all over it.

The Accumulation Playbook

While traditional finance hedges and dithers, one strategy keeps printing: buy the dip, hold forever. This latest move isn't a speculative punt; it's a systematic deployment of capital into what proponents call the hardest money ever created. The math is simple—divide the total spend by the coins acquired. The result? A clear vote of confidence measured in billions.

Strategy Over Sentiment

Forget the daily price chatter. This isn't about timing the market. It's about capturing a finite asset with a long-term horizon that makes quarterly earnings reports look myopic. The playbook bypasses Wall Street's fee structures and goes straight to the source, treating volatility as a feature, not a bug.

The New Treasury Reserve

What do you call a corporate asset that operates 24/7, can't be inflated by central banks, and verifies its own scarcity on a public ledger? For a growing cohort, the answer is 'digital property.' It's a bet that the future of a company's balance sheet might just be written in code, not just currency—a quiet revolution happening one block at a time.

Meanwhile, the old guard is still trying to figure out how to short it. Some things never change.

Total Holdings Reach 687,410 BTC

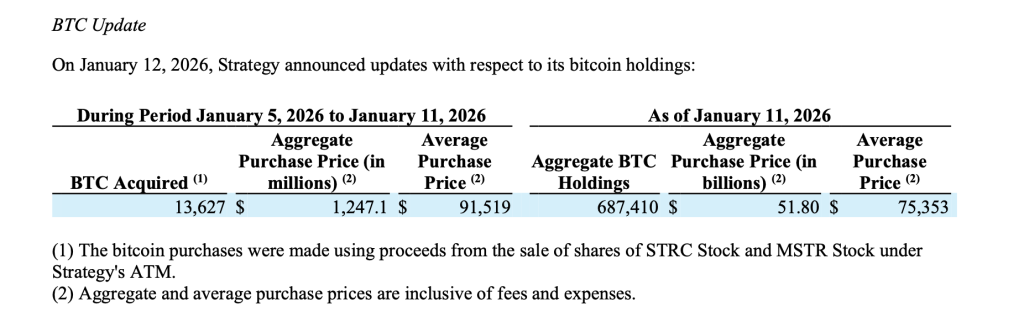

As of January 11, Strategy reported aggregate bitcoin holdings of 687,410 BTC, acquired for a total cost of approximately $51.80 billion. The company’s average purchase price across all holdings stands at $75,353 per bitcoin, according to the filing.

The latest acquisition comes despite recent volatility in bitcoin prices and a broader pullback in digital asset investment products, signalling Strategy’s continued conviction in bitcoin as a long-term treasury reserve asset.

Purchases Funded Through Equity and Preferred Stock Issuance

The filing shows that the bitcoin purchases were funded using proceeds from the sale of shares under the company’s at-the-market (ATM) programmes, including both common and preferred equity.

During the same period, Strategy sold 1,192,262 shares of STRC, its Variable Rate Series A Perpetual Stretch Preferred Stock, generating $119.1 million in net proceeds. In addition, the company sold 6,827,695 shares of MSTR Class A common stock, raising $1.13 billion in net proceeds.

No shares were sold during the period from its other preferred stock offerings, including STRF, STRK, and STRD, though significant issuance capacity remains available across these instruments.

Capital Structure Supports Ongoing Bitcoin Accumulation

As of January 11, Strategy reported substantial remaining capacity for future issuance, including more than $20.3 billion under STRK, $4.0 billion under STRD, $3.9 billion under STRC, and $1.6 billion under STRF. The company also retains over $10.2 billion of availability under its MSTR common stock programme.

The structure allows Strategy to continue accessing capital opportunistically while spreading financing across common equity and multiple layers of preferred stock with varying dividend features.

A Long-Term Bitcoin Treasury Strategy

Strategy’s disclosure reinforces its position that bitcoin remains the Core asset on its balance sheet. While the company’s average acquisition price is well below recent market highs, the pace and scale of accumulation underline its willingness to deploy significant capital regardless of short-term price movements.

With nearly 700,000 BTC now held, Strategy’s balance sheet has become one of the most concentrated institutional expressions of long-term bitcoin exposure in global markets.