Hyperliquid, Ethena Brace for $657M Token Unlock Pressure This Week

Two major crypto projects are about to flood the market with fresh supply—and traders are watching the charts for signs of a dip.

The Unlock Clock Is Ticking

Hyperliquid and Ethena are set to release a combined $657 million worth of tokens from their vesting schedules. That’s not a typo. For context, that’s more than the market cap of some mid-tier altcoins—poised to hit circulating supply in a matter of days.

Why This Time Could Hurt

Token unlocks aren’t new, but their timing often stings. When large tranches hit the market, early investors, team members, or advisors can finally cash out. Even the hint of a sell-off can spook sentiment, turning paper gains into very real selling pressure.

Will the Market Absorb It?

Liquidity depth gets tested during these events. If buy-side order books are thin, even a moderate sell flow can push prices down—fast. Some projects navigate this smoothly; others see double-digit drops. It’s a classic case of supply meeting demand, crypto-style.

A Dose of Cynicism

Nothing says “long-term alignment” like a scheduled multi-million dollar exit for insiders—just another day in decentralized finance, where the roadmap often leads straight to the sell button.

Keep an eye on volume and order flow this week. How the market digests this unlock could signal whether bullish momentum is strong enough to swallow half a billion dollars in new supply—or if gravity still works in crypto.

Hyperliquid leads token unlock schedule with $333.99 million release

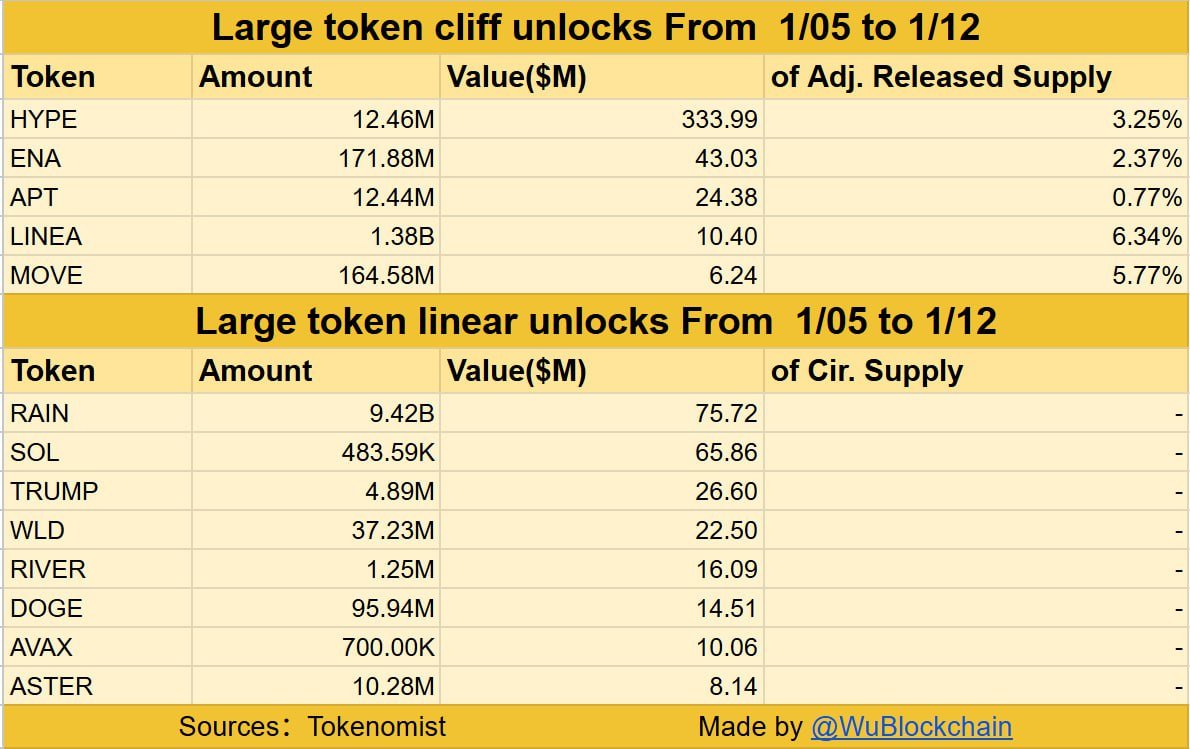

Hyperliquid (HYPE) tops the week’s cliff token unlock schedule with 12.46 million tokens valued at $333.99 million. The release accounts for 3.25% of the project’s adjusted released supply.

Ethena (ENA) follows with 171.88 million tokens worth $43.03 million set for release. The unlock comprises 2.37% of ENA’s adjusted released supply. The two projects combined account for $377.02 million in token unlocks, representing 57.4% of the total value scheduled for the week.

Ethena and Aptos round out major cliff unlocks

Aptos (APT) has 12.44 million tokens scheduled for release, valued at $24.38 million. The unlock represents 0.77% of APT’s adjusted released supply. This makes it the smallest percentage among major projects on the list.

Linea (LINEA) faces an unlock of 1.38 billion tokens worth $10.40 million. The release represents 6.34% of LINEA’s adjusted released supply, making it the largest unlock by percentage among the five major cliff releases.

MOVE rounds out the major cliff unlocks with 164.58 million tokens valued at $6.24 million. The release accounts for 5.77% of MOVE’s adjusted released supply. The percentage ranks second highest among cliff unlocks, following LINEA at 6.34%. Combined cliff token unlock value reaches almost $418 million across five major projects.

Linear token unlocks add $239M in weekly releases

RAIN leads all linear unlocks with 9.42 billion tokens valued at $75.72 million set for daily release throughout the week. The unlock represents the largest linear release by dollar value. RAIN’s scheduled releases account for 31.7% of total linear unlock value during the period.

Solana (SOL) follows with 483,590 tokens worth $65.86 million scheduled for gradual release. SOL’s linear unlock represents the second-largest by value. The two projects combined account for $141.58 million, comprising 59.3% of the total linear unlock value.

TRUMP has 4.89 million tokens valued at $26.60 million scheduled for linear release. Worldcoin (WLD) will release 37.23 million tokens worth $22.50 million through daily vesting. River (RIVER) has 1.25 million tokens worth $16.09 million set for gradual release.

Dogecoin will unlock 95.94 million tokens worth $14.51 million. Avalanche will release 700,000 tokens through linear vesting, each valued at $10.06 million. Aster completes the linear schedule of 10.28 million tokens worth $8.14 million. In total, linear token unlocks amount to approximately $239 million across eight projects.

Smaller projects face major percentage unlocks

There are more token unlock events scheduled for smaller projects, according to CoinMarketCap data. CUDIS will see the unlocking of 12.19 million tokens, equal to $365,249, representing 1.22% of its total locked tokens. Infinity Ground (AIN) will release 18.13 million tokens worth $954,166, representing a 1.81% share of its locked coins.

ROA Core has scheduled for release 16.96 million tokens, equating to $111,059, representing 1.70% of the total locked tokens. Then there is Animalia (ANIM), which will unlock 2.37 million tokens worth $2,298, or 2.18% of total locked supply. Lastly, among the smaller unlocks is Ultiverse, with 166.67 million tokens worth $61,541, making up 1.67% of the locked tokens.

Sign up to Bybit and start trading with $30,050 in welcome gifts