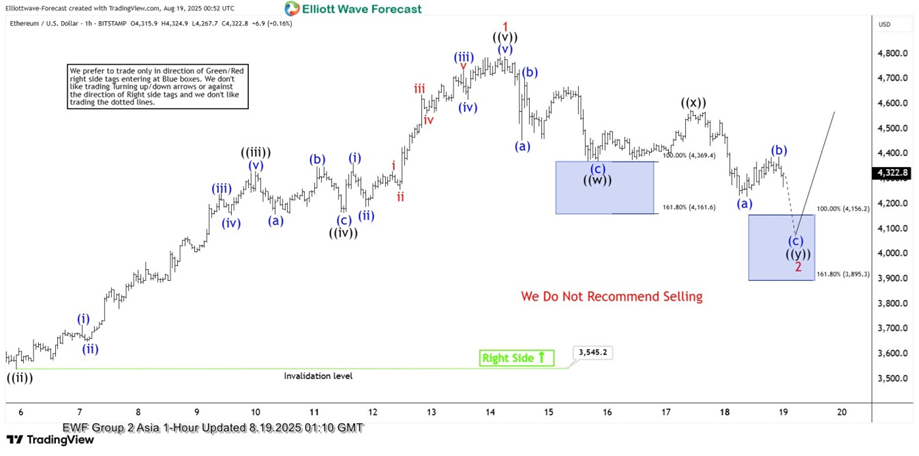

Ethereum’s Elliott Wave Pattern Signals Double Three Correction - What Traders Need to Watch

Ethereum's price action is painting a classic corrective pattern—and smart money is taking notes.

The Double Three Formation Unfolds

ETH's recent pullback isn't some random sell-off. It's textbook Elliott Wave theory in motion—a complex correction that typically precedes another leg higher. The pattern suggests institutional accumulation disguised as retail panic.

Why This Matters Now

Timing these waves separates pros from gamblers. Get the entry wrong and you're catching falling knives. Nail the rhythm and you ride the next wave up. Current structure implies we're in the final stages of this corrective phase.

The Bigger Picture

Never forget—crypto markets eat retail sentiment for breakfast. While newcomers panic about 'downward trends,' seasoned traders see these setups as gift-wrapped opportunities. Just another reminder that in finance, the easiest money transfers from the impatient to the disciplined.

Ethereum (ETH/USD) – 60 Minute Elliott Wave technical chart