Bitcoin & Ethereum Price Forecast: Crypto Market Outlook – European Analysis August 19

Crypto markets defy traditional finance yet again—while bankers debate rate cuts, digital assets write their own rules.

Bitcoin's Resilience

The original cryptocurrency continues to shrug off regulatory noise, maintaining its dominance despite endless predictions of its demise. No government approval needed—just pure market momentum driving adoption forward.

Ethereum's Evolution

Smart contract platforms aren't just keeping pace—they're redefining what financial infrastructure can achieve while legacy systems play catch-up. The merge? Just another Tuesday in crypto-land.

Altcoin Dynamics

While the majors hold steady, the real action happens where traditional finance fears to tread—decentralized applications actually generating utility while hedge funds still debate entry points.

Market Realities

Volatility remains the price of admission for disrupting a system that still settles transactions slower than medieval merchants. Meanwhile, crypto markets settle billions in minutes—but sure, focus on the energy debate.

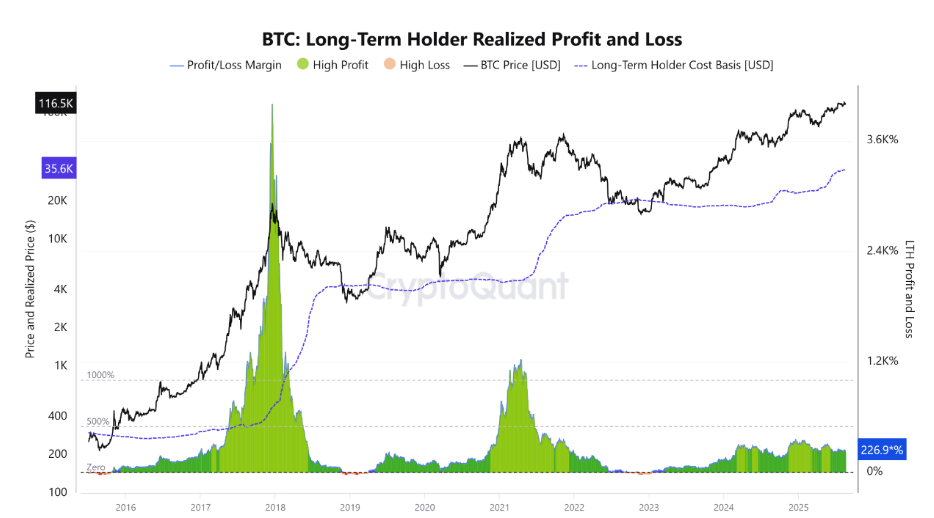

Bitcoin Price Forecast: BTC momentum fades, edging below $115,000 despite Putin-Zelenskyy meeting on the cards

Bitcoin (BTC) continues to lose steam, slipping below $115,000 at the time of writing on Tuesday, after retreating nearly 5% from last week’s record high of $124,474. The decline comes as markets turn cautious ahead of geopolitical developments, with US President Donald TRUMP confirming to arrange trilateral talks with Russian President Vladimir Putin and Ukrainian President Volodymyr Zelenskyy. Despite the price weakness, treasury firms like Metaplanet and Strategy continue to accumulate BTC at current price dips.

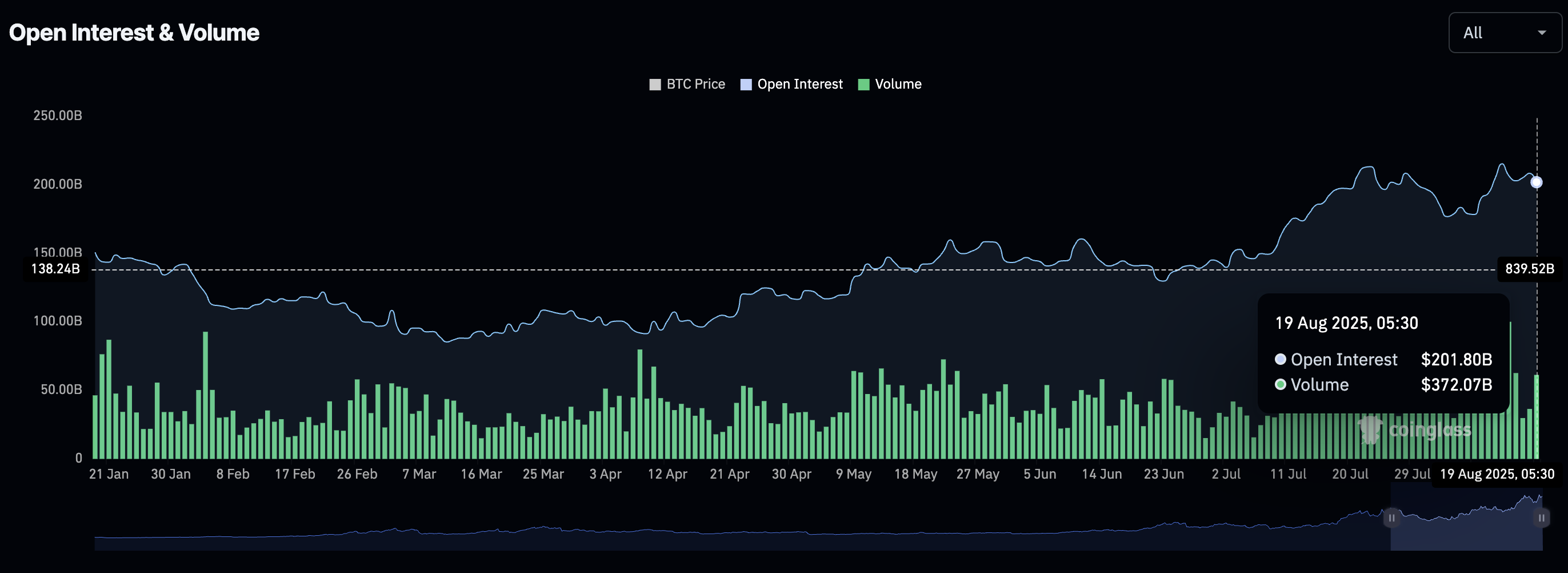

Crypto Today: Bitcoin, Ethereum, XRP under pressure as derivatives data signals risk-off

A risk-off sentiment prevails in the cryptocurrency market, as Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) continue their downward trend. The worsening market mood is supported by the surprise increase in the US Producer Price Index (PPI) last week, which surged by 0.9% in July, exceeding the 0.2% forecast.

Lumber crash signals cooling economy – What it could mean for crypto

Lumber prices dropping below $600 may not sound like a crypto story, but it’s flashing warning signs about the economy that could Ripple into digital assets.

Lumber is often seen as a leading indicator for housing and credit demand. Its sharp fall suggests builders are cutting back, financing is tightening, and consumers are hesitating on big purchases. Historically, when lumber collapses, broader markets follow with a lag.