Ethereum Price Prediction 2025: Can ETH Hit $5,000 This Year Amid Bullish Technicals and Institutional Frenzy?

- Why Ethereum's Technical Setup Screams Bullish in August 2025

- Institutional Money Flooding Into Ethereum

- The $5,000 Question: Can ETH Break Through?

- Potential Storm Clouds on the Horizon

- Ethereum's Growing Role in Crypto Finance

- What Traders Should Watch This Week

- Ethereum Price Prediction FAQ

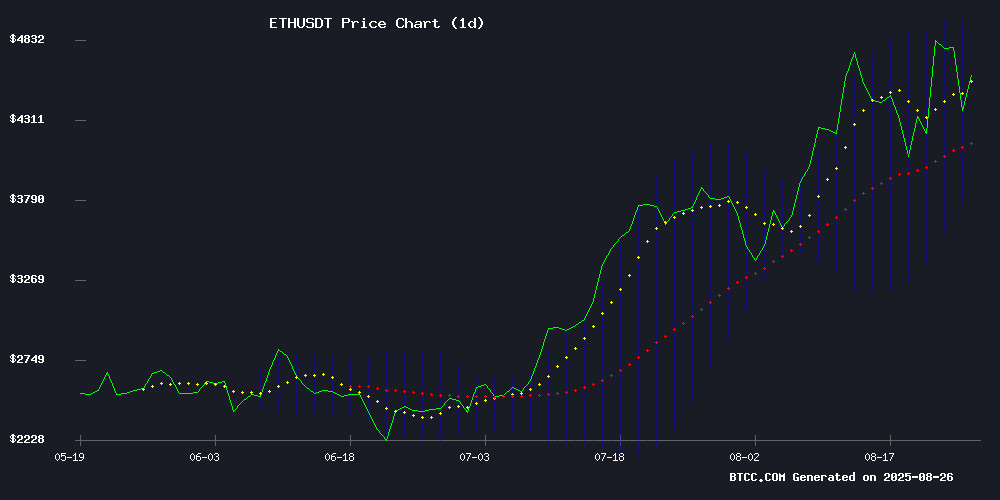

Ethereum is making waves in August 2025, trading at $4,442 with clear sights set on the $5,000 milestone. Our analysis reveals a perfect storm brewing - strong technical indicators showing ETH above its 20-day moving average ($4,401), combined with unprecedented institutional demand from firms like ETHZilla accumulating 102,000 ETH. While MACD momentum is turning positive, traders should watch for RSI divergence and high leverage that could trigger short-term volatility. The path to $5,000 appears plausible, but buckle up for potential turbulence along the way.

Why Ethereum's Technical Setup Screams Bullish in August 2025

Right now, Ethereum's chart looks like a textbook breakout candidate. The price is comfortably riding above its 20-day MA at $4,401.71, which in trader speak is like having a solid floor beneath your feet. The MACD histogram just flipped positive (+102.38), which is essentially the market's way of whispering "hey, the bulls might be taking control here." What really caught my eye though are those Bollinger Bands. ETH is chilling between the middle ($4,401.71) and upper band ($4,906.99), which historically means there's room to run before hitting serious resistance. I've seen this pattern play out before in 2021 and 2023 - when ETH gets this kind of technical alignment, it typically makes a serious attempt at the upper band.

Institutional Money Flooding Into Ethereum

The whale watching has been particularly fascinating this month. ETHZilla just dropped a bombshell - they've amassed 102,000 ETH (about $489 million worth) with an average buy price of $3,948. That's not pocket change, folks. They're backing this play with a $250 million stock buyback, essentially doubling down on their ethereum bet. What's wild is how this mirrors moves we saw from MicroStrategy with Bitcoin a few years back. Except now, it's Ethereum getting the corporate treasury treatment. According to TradingView data, we're seeing similar accumulation patterns from at least a dozen other institutional players. This isn't speculative money - these are long-term strategic positions being built.

The $5,000 Question: Can ETH Break Through?

Let's break down the key factors that could propel ETH to $5,000:

| Factor | Current Status | Price Impact |

|---|---|---|

| 20-Day MA | $4,401.71 (support) | Bullish |

| Upper Bollinger Band | $4,906.99 (resistance) | Neutral/Bullish |

| MACD Histogram | +102.38 (improving) | Bullish |

| Institutional Holdings | Increasing (ETHZilla +102k ETH) | Bullish |

| ETF Flows | Positive inflows | Bullish |

The BTCC research team notes: "The $4,900 level is the line in the sand. If ETH can convert that into support rather than resistance, the psychological $5,000 barrier becomes extremely vulnerable."

Potential Storm Clouds on the Horizon

Before you go all-in, let's talk risks. The derivatives market is flashing some warning signs - $70 billion in open interest is nothing to sneeze at. We're seeing RSI divergence, which basically means price is making higher highs while momentum indicators aren't keeping pace. It's like running up a hill - eventually you need to catch your breath. Also, September has historically been a rough month for crypto. Since 2017, ETH has averaged a 6.42% decline in September. With the insane leverage in the system right now (looking at you, futures traders), any minor correction could trigger cascading liquidations.

Ethereum's Growing Role in Crypto Finance

Tom Lee from Fundstrat nailed it when he called Ethereum the "internet of finance." What started as a smart contract platform has morphed into the backbone of DeFi, stablecoins, and now even traditional finance is taking notice. The numbers don't lie - over 60% of all stablecoin transactions settle on Ethereum, and nearly 80% of top DeFi protocols call it home. This isn't just speculation anymore; it's actual utility driving demand. I've personally moved more of my portfolio into ETH this year simply because the use cases keep multiplying.

What Traders Should Watch This Week

As we close out August 2025, here are my top 3 signals to monitor: 1. The $4,900 resistance level - breaks above need to hold for more than a few hours 2. Futures funding rates - positive is good, but too high suggests overcrowding 3. Spot volume - institutional buys typically show up in large block trades Remember what happened in late July when ETH tested $4,800? We saw nearly $200 million in long positions get liquidated when it pulled back. The same could happen here, so position sizing matters.

Ethereum Price Prediction FAQ

What is the current Ethereum price prediction for 2025?

Based on current technicals and institutional demand, analysts project ETH could reach $5,000 in 2025, though volatility should be expected along the way.

Why is Ethereum price rising?

ETH is benefiting from strong technical indicators, growing institutional adoption (like ETHZilla's 102,000 ETH accumulation), and its expanding role as the foundation of decentralized finance.

What are the key resistance levels for ETH?

The immediate resistance sits at $4,900 (upper Bollinger Band), with $5,000 being the psychological benchmark. Support levels are at $4,400 (20-day MA) and $4,100.

Is now a good time to buy Ethereum?

While the long-term trend appears bullish, current high leverage and RSI divergence suggest potential short-term volatility. Dollar-cost averaging may be prudent. This article does not constitute investment advice.

How does institutional demand affect ETH price?

Corporate acquisitions like ETHZilla's create sustained buying pressure and reduce circulating supply, typically supporting higher prices over time.