Bitcoin HODLers Unleash 97,000 BTC—Largest Movement This Year Signals Major Shift

Bitcoin's bedrock believers just moved a mountain of digital gold—97,000 BTC to be exact. That's the biggest stash shifted by long-term holders in 2025.

What's driving the exodus?

Some see profit-taking after recent gains, while others speculate about institutional rebalancing or even early signs of cycle maturity. Either way, when HODLers break pattern, markets pay attention.

This isn't panic selling—it's strategic repositioning. These coins didn't move during 80% drawdowns, so their movement now speaks volumes about confidence and timing.

Traditional finance pundits will call it reckless; crypto natives call it liquidity events. Meanwhile, Wall Street still can't decide if Bitcoin is digital gold or a speculative meme—classic finance folks missing the point as usual.

Watch the on-chain metrics—this kind of movement either precedes major rallies or signals local tops. Either way, volatility's coming.

1 To 2 Years Old Bitcoin Investors Made Up For The Biggest Part Of The Spike

In a new post on X, on-chain analytics firm Glassnode has discussed how the activity of the Bitcoin long-term holders (LTHs) has been looking recently. The LTHs refer to the BTC investors who have been holding onto their coins for more than 155 days.

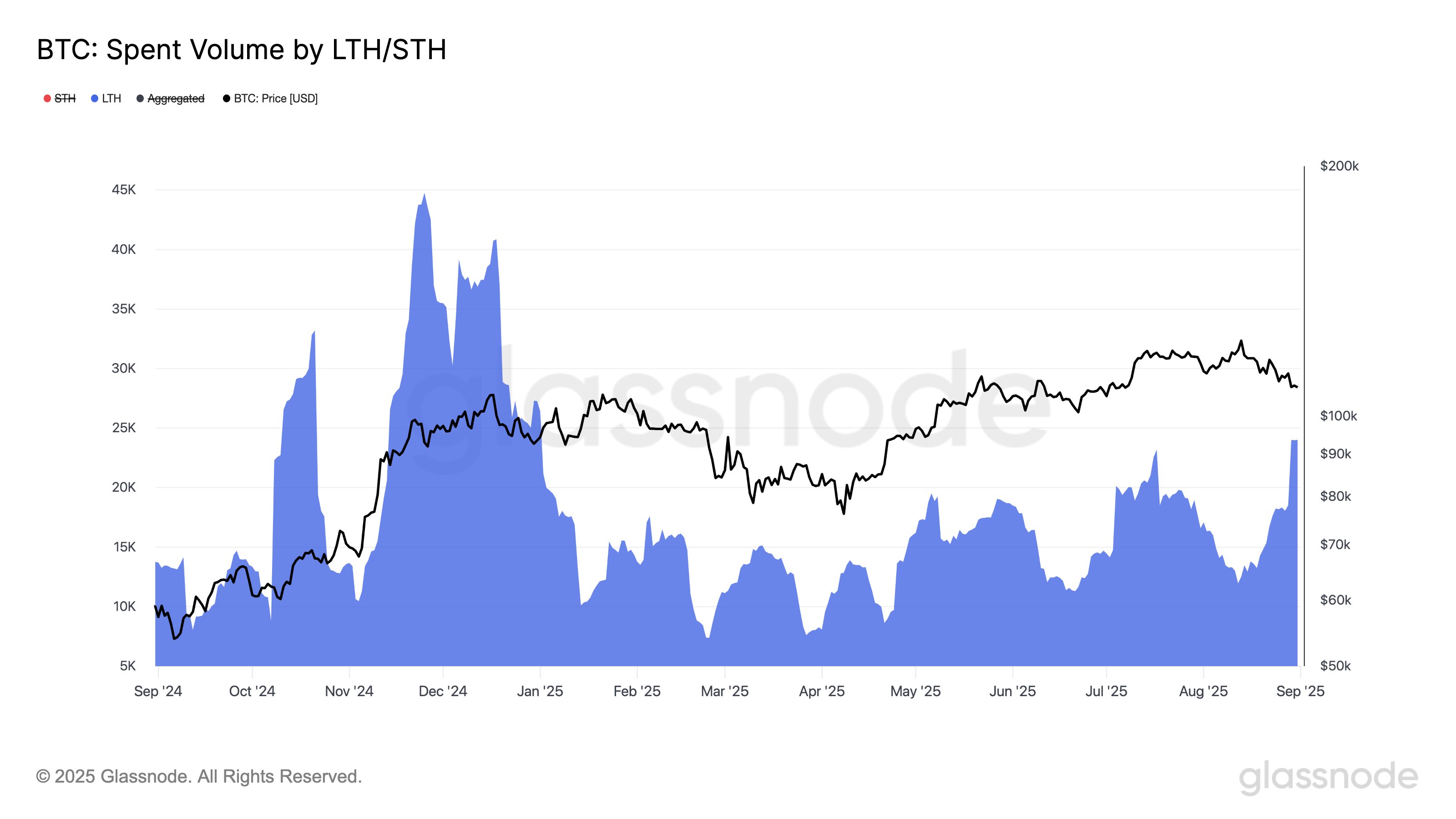

Statistically, the longer an investor holds onto their coins, the less likely they are to sell them in the future. As such, the LTHs with their relatively long holding time are considered to be resolute entities. Despite their conviction, however, there are times when even members of this cohort decide to part with their coins. Below is a chart shared by Glassnode that shows how spending from this cohort has fluctuated over the past year.

As is visible in the graph, the 14-day simple moving average (SMA) of the Bitcoin volume spent by the LTHs has shot up recently, indicating the HODLers are ramping up their transaction activity.

The spike in LTH spending has come after a decline in the BTC price. The timing could be a possible sign that some of the diamond hands are starting to think the bull run is winding down, so they have decided to exit with their profits while they still can.

Though while bitcoin LTH transactions are elevated right now, they are still significantly below the levels observed in the last quarter of 2024. Also, the smoothed data of the 14-day SMA may suggest the development corresponds to an increase in spending over a period, but it turns out that it’s largely due to a single large daily spike.

From the chart, it’s apparent that this large spike that occurred on Friday involved around 97,000 BTC, worth a whopping $10.6 billion. This is the largest spending day for the LTHs in 2025 so far.

The LTH group’s 155-day cutoff means that the cohort covers a rather large range, so here’s another chart, this one breaking down how the different segments of the group have contributed to this event:

It WOULD appear that the 1 to 2-year-old Bitcoin LTHs provided the largest part of the spending spike at 34,500 BTC. The 6 to 12 months and 3 to 5 years segments are other standouts, each contributing around 16,000 BTC.

BTC Price

Bitcoin slipped toward $107,000 during the weekend, but it appears the coin has jumped back to start Monday as its price is now trading around $109,500.