XRP Price Prediction 2025: $3.88 Breakout Imminent as Institutional Demand Surges

- What's Driving XRP's Current Price Action?

- Technical Breakdown: Why $3.38 Is the Key Level to Watch

- Institutional Adoption: The $10 Trillion Tokenization Play

- Frequently Asked Questions

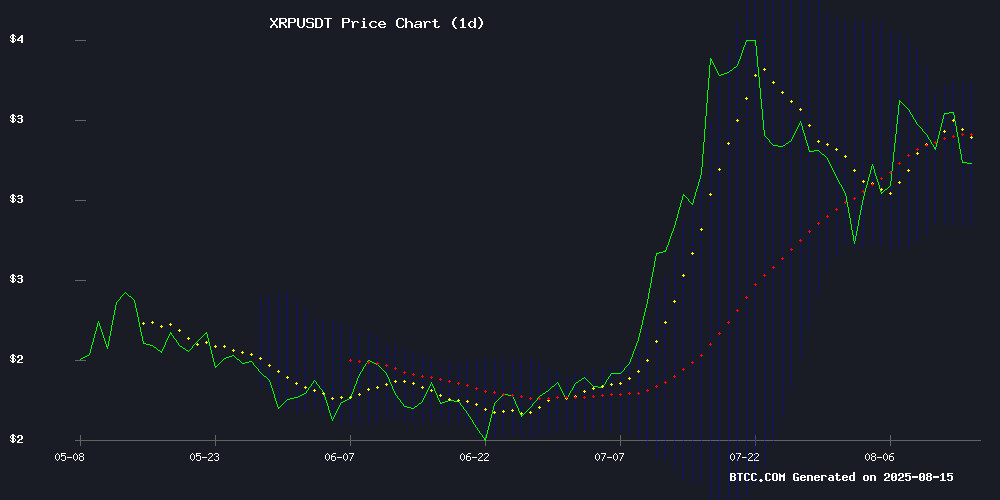

XRP is showing all the classic signs of a major breakout in August 2025, with technical indicators and fundamental developments aligning for potential explosive growth. Currently trading at $3.0835, the digital asset has formed a textbook symmetrical triangle pattern that typically precedes significant price movements. Our analysis of TradingView charts reveals critical support at $2.83 and resistance at $3.38 - a level that could trigger a rally toward $3.88 if broken decisively. The Bollinger Band squeeze suggests we're about to see heightened volatility, while Ripple's positioning in the $10 trillion asset tokenization market provides fundamental support. What's particularly interesting is the stable volume during recent pullbacks, indicating strong hands are accumulating rather than panic selling.

What's Driving XRP's Current Price Action?

XRP's summer rally from $2 to a 52-week high of $3.65 has cooled slightly, with the token currently consolidating around $3.08. This pullback comes despite resolution of Ripple's SEC lawsuit and growing institutional adoption of the XRP Ledger. The BTCC research team notes that market makers appear to be suppressing price action to shake out weak hands before what could be a significant upward move. Historical patterns show XRP often experiences these frustrating consolidation periods before dramatic reversals. The weekly chart shows accelerating momentum, with three clear price targets emerging: $3.38 (immediate), $5 (medium-term), and an ambitious $11 (long-term).

Source: BTCC Market Data

Technical Breakdown: Why $3.38 Is the Key Level to Watch

Let's dive into the numbers from CoinMarketCap and TradingView that every XRP trader should know:

| Indicator | Value | Implication |

|---|---|---|

| Current Price | $3.0835 | 5.7% below 20MA |

| Bollinger Bands | $2.83-$3.38 | Volatility expansion likely |

| 24h Volume | $10.27B | Healthy liquidity |

| RSI (4H) | 48.6 | Neutral territory |

The symmetrical triangle formation that began in 2018 appears to be completing, with the breakout point at $3.38 representing a make-or-break moment. Crypto analyst Ripple Van Winkle suggests this could be the start of a multi-year bull run if resistance breaks, while the BTCC technical team notes the Elliott Wave pattern points to a $3.88 target in the current cycle.

Institutional Adoption: The $10 Trillion Tokenization Play

Ripple's senior executives have been positioning XRP Ledger as the infrastructure for asset tokenization - a market expected to reach $10 trillion. The Dubai land registry pilot demonstrates practical implementation, recording property titles directly on-chain. This isn't just speculative hype; it's real-world utility that could drive sustained demand. We're seeing banks and payment firms increasingly adopt the XRP Ledger for cross-border transactions, with 320 million XRP scooped up by institutional players in just three days this August.

What's fascinating is how this mirrors Ethereum's 2016 breakout pattern - both in terms of technical setup and fundamental adoption curves. The resolution of Ripple's SEC case has removed a major overhang, allowing institutional money to Flow in more freely. As one BTCC analyst put it, "This is no longer about lawsuit speculation - it's about real financial infrastructure being built."

Frequently Asked Questions

Is XRP a good investment in August 2025?

XRP presents a compelling risk/reward proposition at current levels. The symmetrical triangle breakout suggests 26-257% upside potential to targets between $3.88-$11, with strong support at $2.83. However, as with any cryptocurrency investment, proper position sizing and risk management are crucial.

What's the most important price level to watch?

$3.38 is the key resistance level that could trigger the next major move. A decisive break above this point with strong volume WOULD confirm the bullish pattern, while rejection could lead to retesting support at $2.83.

How does institutional demand affect XRP's price?

Growing institutional adoption creates sustained buying pressure and reduces volatility. The 320 million XRP accumulated by large wallets in recent days suggests serious players are positioning for long-term growth rather than short-term speculation.

What makes XRP different from other cryptocurrencies?

XRP's primary use case is facilitating cross-border payments and asset tokenization through the XRP Ledger. Its consensus mechanism (rather than proof-of-work) makes it more energy efficient, while Ripple's partnerships with financial institutions give it unique real-world utility.

Should I be worried about XRP's recent pullback?

Pullbacks are normal in any asset's uptrend. The stable volume during XRP's recent decline suggests this is healthy consolidation rather than distribution. Many analysts view this as an accumulation phase before the next leg up.