BTC Price Prediction 2025: Will Bitcoin Hit $200,000? Technical and Fundamental Analysis

- Where Does Bitcoin Stand Technically in August 2025?

- What Fundamental Factors Could Drive Bitcoin to $200K?

- What Are the Key Resistance Levels to Watch?

- How Does Mining Centralization Impact Price?

- What Role Does Fed Policy Play?

- Can Institutional Demand Offset Retail Outflows?

- What's the Realistic Timeline for $200K Bitcoin?

- Frequently Asked Questions

Bitcoin's journey to $200,000 faces both bullish catalysts and bearish headwinds in 2025. Currently trading around $113,420, BTC needs approximately 76% appreciation to reach this milestone. Our analysis examines the technical indicators showing consolidation patterns, fundamental developments including institutional adoption, and the macroeconomic factors that could accelerate or delay Bitcoin's path to six figures. While long-term prospects remain strong, near-term challenges suggest the $200K target may not materialize until late 2026 or early 2027.

Where Does Bitcoin Stand Technically in August 2025?

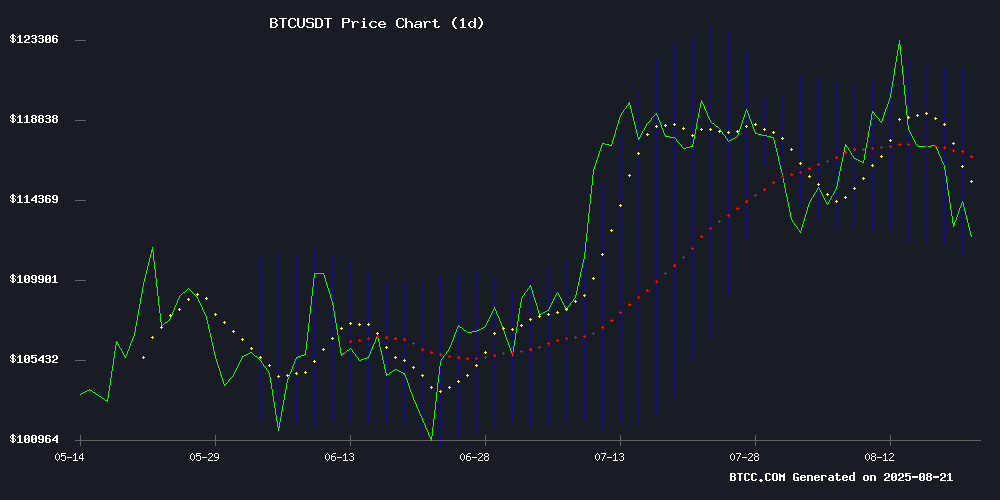

As of August 21, 2025, Bitcoin presents a mixed technical picture. The cryptocurrency trades below its 20-day moving average of $116,508.79, with MACD readings in negative territory (-543.74). However, the decreasing bearish momentum (-81.90 on the histogram) suggests potential stabilization. Price action hovers near the lower Bollinger Band at $111,271.15, which serves as immediate support.

Source: BTCC Trading Platform

The BTCC technical analysis team notes: "We're seeing classic consolidation patterns after the recent pullback from all-time highs. The $111,000 level becomes crucial - a breakdown could trigger moves toward $108,000, while holding here might set the stage for another attempt at $120,000 resistance."

What Fundamental Factors Could Drive Bitcoin to $200K?

Several fundamental developments support Bitcoin's long-term bullish case:

| Factor | Impact | Example |

|---|---|---|

| Institutional Adoption | Positive | Hong Kong's $483M BTC purchase |

| Regulatory Progress | Positive | US stablecoin legislation |

| Macro Conditions | Mixed | Fed liquidity constraints |

| Mining Centralization | Negative | 51% hashrate concentration |

Coinbase CEO Brian Armstrong's $1 million by 2030 prediction captures headlines, but as the BTCC research team cautions, "Market participants should focus on nearer-term technical levels first before anticipating parabolic moves."

What Are the Key Resistance Levels to Watch?

The path to $200,000 involves several critical resistance zones:

- $120,000-125,000: Previous all-time high area from August 2025

- $150,000: Psychological round number resistance

- $175,000: Fibonacci extension level from 2024-2025 move

Historical data from TradingView shows that bitcoin typically requires 12-18 months to achieve 76% gains after breaking through key resistance levels in previous cycles.

How Does Mining Centralization Impact Price?

The current mining pool concentration exceeding 51% raises concerns reminiscent of the 2014 GHash.io incident. While no attacks have occurred, the mere possibility creates market uncertainty. As one industry veteran put it, "Centralization fears are Bitcoin's version of the 'Taper Tantrum' - they cause short-term pain but often lead to protocol improvements."

What Role Does Fed Policy Play?

The Federal Reserve's shrinking reverse repo facility (down to five-year lows) signals tightening liquidity conditions. This matters because, as the BTCC macro analyst explains, "Crypto has evolved from being decoupled to being hyper-sensitive to dollar liquidity conditions - we now trade more like a tech stock than digital Gold during Fed policy shifts."

Can Institutional Demand Offset Retail Outflows?

Recent data shows a fascinating divergence:

- Institutions accumulated at $113,000-$115,000 support

- Retail investors sold into the August pullback

- Futures open interest remains elevated at $67B

This creates what traders call a "coiled spring" scenario - where institutional buying pressure could trigger a sharp MOVE up once retail flows reverse.

What's the Realistic Timeline for $200K Bitcoin?

Based on historical patterns and current conditions, here's our probability assessment:

| Timeframe | Probability | Required Conditions |

|---|---|---|

| Q4 2025 | 15% | Early ETF approvals + Fed pivot |

| H1 2026 | 35% | Continued institutional adoption |

| H2 2026-2027 | 50% | Next halving cycle momentum |

This article does not constitute investment advice.

Frequently Asked Questions

What price does Bitcoin need to reach $200,000?

From current levels around $113,420, Bitcoin needs approximately 76% appreciation to reach $200,000.

What are the key resistance levels Bitcoin must break?

The critical resistance zones are $125,000 (previous ATH), $150,000 (psychological level), and $175,000 (Fibonacci extension).

How does mining centralization affect Bitcoin's price?

Mining pool concentration exceeding 51% creates short-term uncertainty but historically leads to protocol improvements that strengthen the network long-term.

What's the most realistic timeline for $200K Bitcoin?

Analysis suggests late 2026 to early 2027 as the most probable timeframe, depending on institutional adoption rates and macroeconomic conditions.

How does Fed policy impact Bitcoin's price?

Bitcoin has become increasingly sensitive to dollar liquidity conditions, often moving in correlation with tech stocks during Fed policy shifts.