Bitcoin’s Wild Ride: Historical Data Confirms Volatility Is Core Feature, Not Design Flaw

Forget what the traditional finance skeptics say—Bitcoin's rollercoaster price movements aren't a bug, they're the main attraction.

The Nature of Digital Gold

Historical charts reveal what crypto natives have known for years: those heart-stopping 30% drops and parabolic rallies aren't accidents. They're baked into Bitcoin's DNA—the very characteristic that separates it from stagnant fiat currencies and creates generational wealth opportunities.

Volatility as Value Driver

While Wall Street analysts clutch their pearls over price swings, smart money recognizes these fluctuations as the engine of unprecedented returns. The same volatility that terrifies traditional investors has consistently rewarded those with diamond hands and long-term vision.

Traditional finance types might prefer their 2% annual bonds—meanwhile, Bitcoin's creating millionaires during lunch breaks. Some features are just too powerful for conventional portfolios.

Bitcoin’s Volatility: An Innate Part of Its Anatomy

According to the Kobeissi Letter, frequent falls and plunges in the prices of leading assets are a natural part of their nature. These massive plunges often act as catalysts for a better ascent, shaping the asset’s future for the better. Per KL, Bitcoin and Ether averaged 2 declines in more than a year, with the S&P 500 recording 4 declines worth 5% in a year.

The portal later outlined how the Nasdaq 100 documents 4 declines worth 5% in a year, followed by Gold recording 1 sharp decline of 10% each year.

In short, the portal emphasized the importance of volatility in the market, adding how such plunges play a crucial role in shaping the assets’ future for the better.

“

Some perspective:

1. bitcoin averages 2 declines of -20% or more per year

2. Ether averages 3 declines of -20% or more per year

3. The S&P 500 averages 4 declines of -5% or more per year

4. The Nasdaq 100 averages 4 declines of -5% or more per year

5. Gold averages 1 decline…

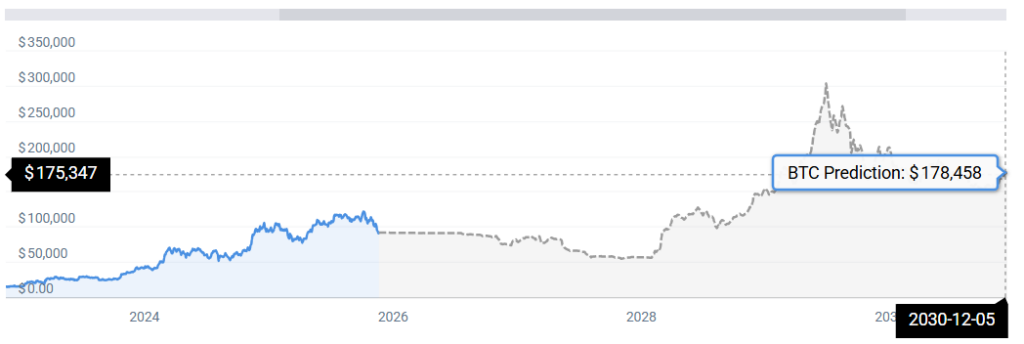

Zooming Out For Real: The Projected BTC Future

According to CoinCodex BTC stats, Bitcoin has already started to carve out its own path. CC adds how Bitcoin may hit $177k by 2030.