XRP at a Crossroads: Time to Hold, Buy, or Sell Now? The Bullish Case Unpacked

XRP's price action has traders asking one question: hold, buy, or bail?

Forget the noise from traditional finance talking heads—the ones who still think a blockchain is a type of bicycle lock. The real analysis starts with on-chain momentum and regulatory clarity, two areas where XRP is quietly building a formidable position.

The Liquidity Lens

Look beyond the daily charts. Major exchange inflows and outflows paint a clearer picture of institutional sentiment. When large wallets move tokens off exchanges, it's not a sell-off—it's a preparation for something bigger. That's accumulation, not distribution.

Network Utility Isn't Just Buzz

While other assets chase speculative narratives, XRP's value proposition remains rooted in settlement. It bypasses the correspondent banking maze, cutting transaction times from days to seconds and slashing costs. That's not a future promise; it's a current, working utility that scales with adoption.

The Regulatory Shield

Clarity matters. In a sector haunted by regulatory ghosts, XRP's defined legal standing provides a stark advantage. It operates with a rulebook, while others are still writing one. This isn't just about compliance; it's about operational certainty for the institutions that will drive the next wave of capital.

Timing the Tide

Market cycles are brutal, but they're also predictable. Positioning during periods of consolidation—when weak hands capitulate and headlines turn negative—has historically separated portfolio performance from mere participation. The current landscape offers that precise setup for the patient.

Final Tally: A calculated hold, with strategic buying on weakness, targets the infrastructure of tomorrow's financial system. Selling now? That's a gift to the next wave of smart money. Remember, in crypto, the biggest profits often transfer from the impatient to the strategic.

Source: Coingecko

Source: Coingecko

XRP Investment: Buy, Hold, or Sell?

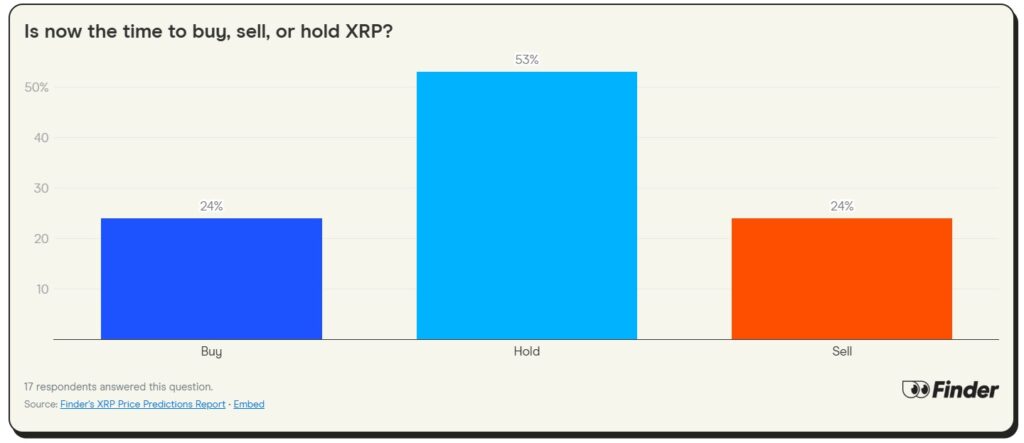

The majority of cryptocurrency experts from the Finder’s panel have come to a consensus suggesting that traders hold XRP. 53% of experts advise investors to hold on to the token, indicating it could surge further. An equal number of analysts have called to buy and sell the token. 24% of analysts urged traders to buy XRP, while another 24% of them have asked to sell the token. In addition, around 35% of the experts believe that the token is fairly priced in the charts.

Ruslan Lienkha, Chief of Markets at YouHodler, is among the analysts who provided a hold call to investors. The analyst stressed that Ripple’s success in fintech, which was deeply rooted in traditional finance, and the company’s ability to reshape the landscape, will reflect positively in the charts in the long term. He asked traders to hold on to the tokens as XRP WOULD go much higher in the coming years.

he said.