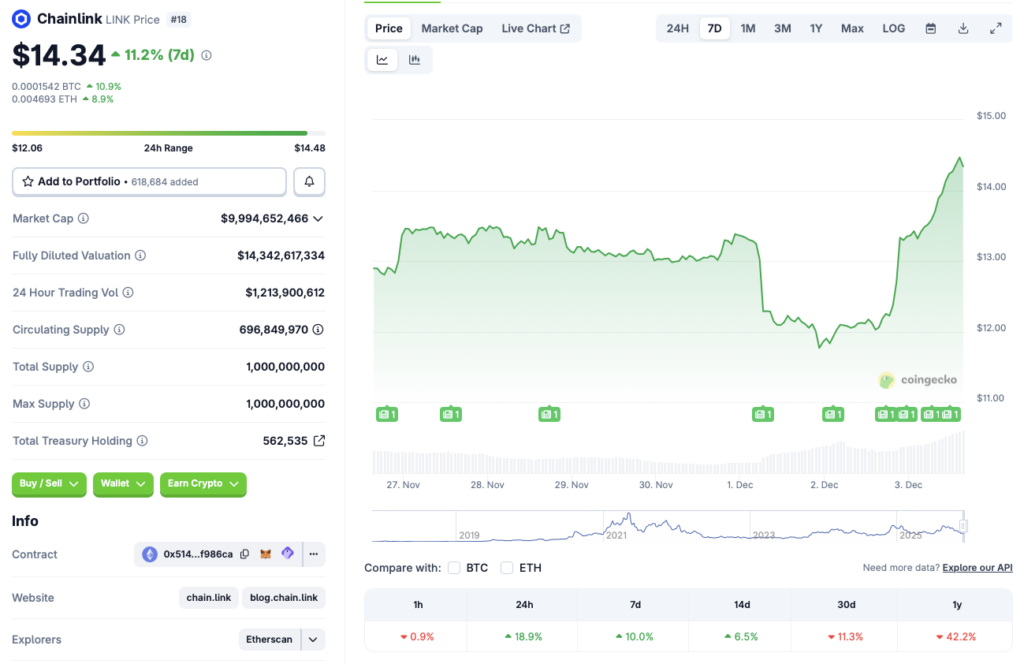

Chainlink Surges 19% in 24 Hours: Can It Hit $25 Before December Ends?

Chainlink just ripped through the market with a 19% surge in a single day—traders are scrambling, charts are flashing green, and everyone's asking the same question: is $25 the next stop?

Oracle Networks Get Real

Forget abstract promises. Chainlink's oracle network feeds real-world data directly into smart contracts—price feeds, weather data, sports scores. It's the plumbing that makes decentralized finance actually work. When DeFi heats up, LINK tends to follow.

The Technical Take

A move this sharp doesn't happen in a vacuum. It smashes through resistance levels, triggers algorithmic buy orders, and fuels the classic crypto feedback loop: price up, FOMO in, price up further. The path to $25 isn't just hopeful thinking; it's a chart pattern waiting to be validated.

Broader Market Tailwinds

Chainlink isn't flying solo. When Bitcoin flexes and Ethereum rallies, the entire altcoin universe gets a gravity assist. Institutional whispers about real-world asset tokenization—bonds, real estate, carbon credits—play right into Chainlink's core utility. More assets on-chain means more demand for reliable data feeds.

The Skeptic's Corner

Let's be real—a 19% pop is thrilling, but crypto moves in two directions. Some will call this a classic 'dead cat bounce' or profit-taking waiting to happen. After all, what's a crypto rally without a few finance bros on social media predicting both a moonshot and an imminent crash in the same breath?

The bottom line? Chainlink's infrastructure is more critical than ever. A run to $25 this month would signal more than just speculative fever—it would mark a vote of confidence in the very skeleton of Web3. Whether it's a sprint or a marathon, one thing's clear: the oracles are awake.

Source: CoinGecko

Source: CoinGecko

Will Chainlink Rally to $25 in December 2025?

The latest market upswing follows improvements in futures data. The development is a likely signal that investors are bullish on the crypto market. Grayscale’s recent report predicting Bitcoin (BTC) hitting a new all-time high in 2026 may have also lifted investor sentiment. chainlink (LINK) is likely following the sentiment surge.

Another reason for the rally could be the increased chances of another interest rate cut in December 2025. Rate cuts often lead to more risky investments as borrowing becomes easier. Chainlink (LINK) and other crypto assets could benefit from another rate cut.

If the market bullishness continues, Chainlink (LINK) could hit the $25 mark this month. However, LINK’s price could face resistance at the $18 and $20 price levels before hitting $25. LINK last traded at the $25 price point in September of this year.

CoinCodex analysts predict Chainlink (LINK) to rally over the next few weeks, but do not expect the asset to hit $25 anytime soon. The platform anticipates LINK to trade at a potential maximum price of $15.40 on Dec. 31. Hitting $15.40 from current price levels will entail a rally of about 7.39%.