Bitcoin’s Hash Rate Plunge Creates Millionaire Solo Miners Overnight

When the network's computational power tanked, the little guys finally got their shot—and some hit the jackpot.

The Underdog's Moment

Forget the mining pools. A sudden, sharp drop in Bitcoin's overall hash rate reshuffled the deck. The massive, industrial-scale operations saw their statistical advantages momentarily vanish. That opened a window—a rare, fleeting crack in the protocol's armor—where an individual with a modest rig could solve a block.

Probability Defied

It's the crypto equivalent of a lottery ticket suddenly having decent odds. The math shifted. The network difficulty, still calibrated for higher power, didn't adjust instantly. Solo miners, often mining for ideological purity or just as a hobby, found themselves in a statistical sweet spot. Their chance to validate a block and claim the full 6.25 BTC reward—plus fees—wasn't a pipe dream anymore. It was a real, if temporary, possibility.

The Aftermath and the Grind

The euphoria is real but temporary. The network's self-correcting difficulty mechanism ensures these windows slam shut. Hash rate recovers, the big pools re-establish their dominance, and the grind returns. For the lucky few, it's a life-changing validation event. For everyone else, it's a tantalizing reminder of Bitcoin's core promise—decentralized opportunity—even if it's mostly a promise kept for the financial institutions and mining syndicates that can afford the energy bills, the kind that make your average VC's carbon offset purchase look like a rounding error.

So, was it luck, or was it the system working as designed? A bit of both. It proves the protocol's neutrality, but don't kid yourself—it's a brutal, efficiency-obsessed casino where the house always wins... until, for one block, it doesn't.

Bitcoin Continues Descent Amid Solo Mining Streak

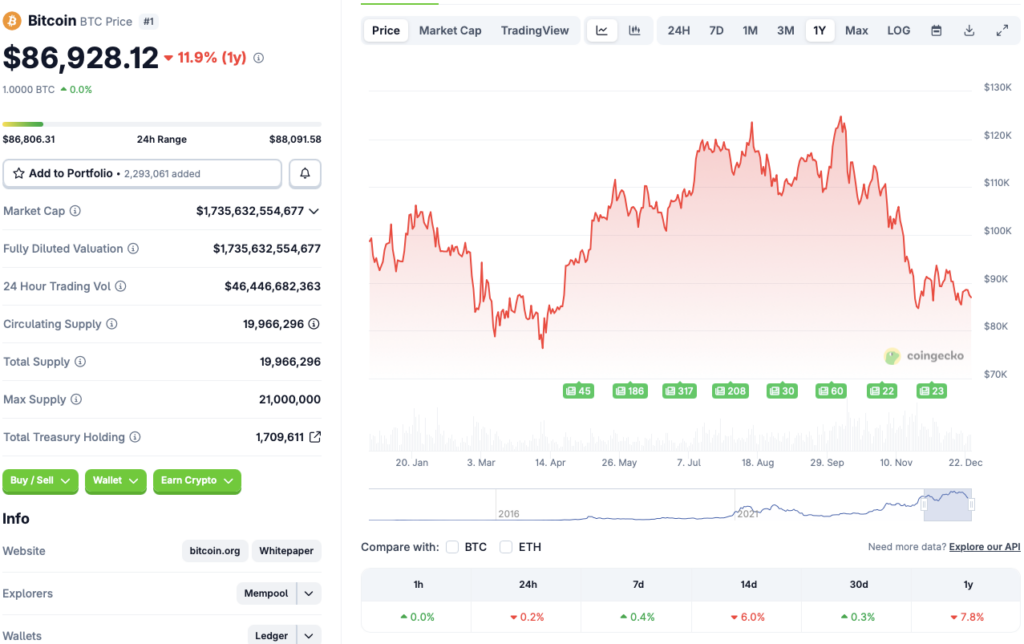

Bitcoin’s ongoing struggles seem to have no end in sight, with prices falling below the $87,000 mark. According to CoinGecko’s bitcoin data, BTC’s price has dipped 0.2% in the last 24 hours, 6% in the 14-day charts, and 7.8% since December 2024. The original crypto has registered small gains in weekly and monthly charts, rallying by 0.4% and 0.3%, respectively.

Bitcoin (BTC) has seen a downtrend right after hitting an all-time high of $126,080 in October of this year. Since its October peak, BTC’s price has struggled to gain momentum. BTC’s downtrend is especially surprising, given that the Federal Reserve has rolled out two interest rate cuts in the last three months. The lackluster performance is attributed to macroeconomic conditions.

Bitcoin (BTC) may see some relief in 2026. Several financial institutions, such as Grayscale, Bernstein, and VanEck, anticipate the asset to rebound soon. Grayscale and Bernstein expect BTC to hit a new all-time high in 2026. VanEck has predicted that BTC may be NEAR its bottom.

On the other hand, Barclays has presented a bearish outlook for next year. The financial institution anticipates the crypto market to face additional challenges in 2026, arising from decreased spot trading volumes and low demand. Bitcoin (BTC) could face further price corrections under such circumstances.