Solana Surges: 2 Compelling Reasons Why This Is the Prime Buying Window

Solana's network isn't just humming—it's screaming. While traditional finance grapples with legacy systems, this blockchain powerhouse is carving its path, and the charts are starting to reflect a fundamental shift. Forget the noise; the signal points to a unique convergence of technical strength and market positioning.

The Throughput Advantage Becomes Unignorable

Speed has always been the thesis, but now it's the reality. As other networks congest and fees spike, Solana's architecture keeps transactions fast and costs microscopic. This isn't a lab experiment; it's live utility attracting serious developers and users who need performance, not promises. The network handles volume that would cripple others, proving its scalability isn't just theoretical—it's a working business model.

Ecosystem Momentum Hits Critical Mass

Builders are voting with their code. The surge in active addresses and protocol deployment isn't a speculative blip—it's organic growth. From DeFi to NFTs and beyond, major projects are choosing Solana not as a backup, but as a primary home. This developer momentum creates a powerful flywheel: more apps attract more users, which in turn attracts more capital and innovation. The ecosystem is moving past 'potential' and into tangible, revenue-generating activity.

The window for entry at these levels may be narrowing. While Wall Street debates quarterly earnings, Solana's network quietly processes more transactions than some credit card networks—a fact that still seems to escape the average portfolio manager. The fundamentals are aligning, suggesting this isn't just a trade; it's a position in the infrastructure of the next web.

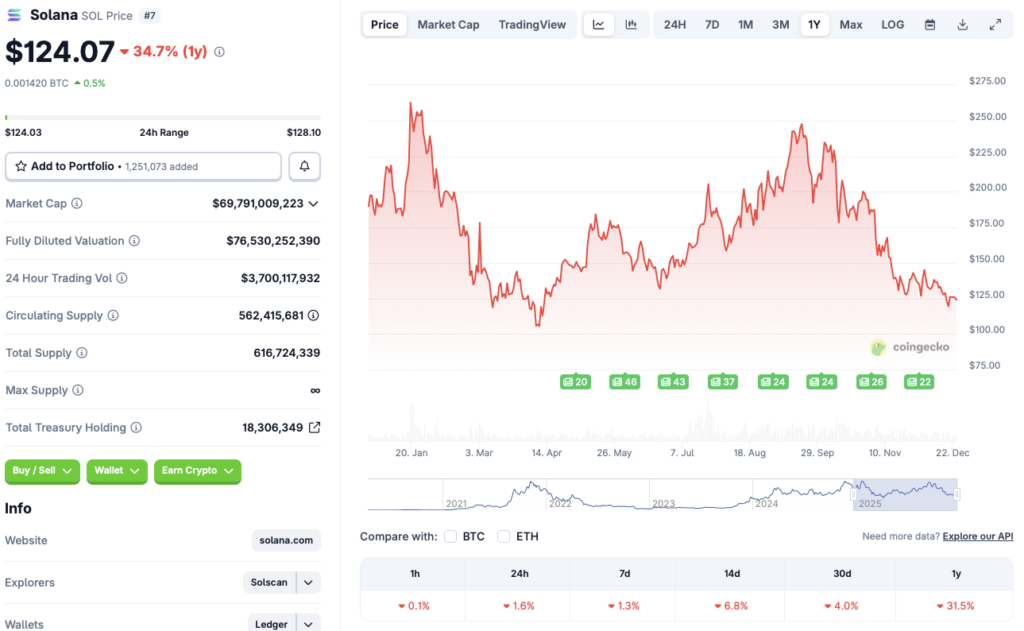

Source: CoinGecko

Source: CoinGecko

Now May Be a Good Time To Buy Solana

Solana’s (SOL) price fell to below $9 after the collapse of FTX in 2022. Since its 2022 lows, SOL’s price has hit multiple all-time highs. SOL’s rebound over the last few years is a testament to its resilience. While the current price dip is worrisome for many, there is a high chance that SOL will recover its price over the coming months, if not years.

Solana (SOL) tends to follow Bitcoin’s (BTC) trajectory. Many financial institutions anticipate BTC to rally in the coming months. VanEck has released a report claiming that BTC could be nearing its bottom. The financial institution cites BTC’s miner capitulation to support its argument. Grayscale is also of the opinion that BTC will climb to a new peak in 2026. Along with Grayscale, Bernstein has also predicted BTC to hit a new high next year, anticipating a price of $150,000 in 2026 and $200,000 in 2027. BTC hitting a new peak will likely lead to Solana (SOL) making a similar move.

Solana (SOL) also saw the launch of several spot ETFs over the last few months. While ETF inflows have been low, considering the risk-off approach from investors, the trend may change over the coming months. ETF inflows could lead to SOL hitting a new peak in 2026.