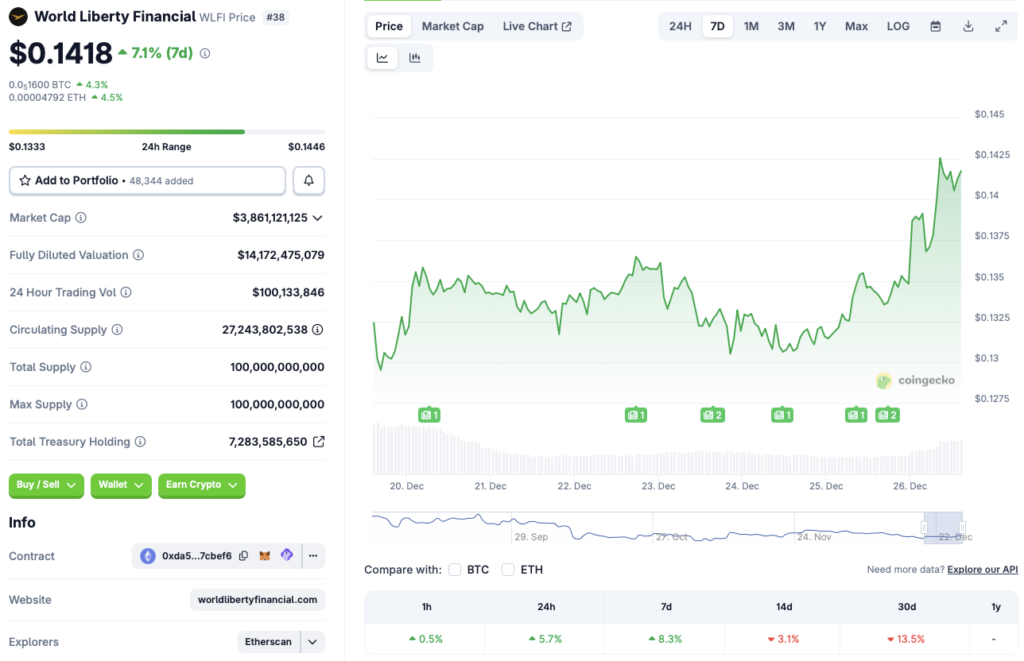

Trump-Linked World Liberty Financial Soars 8% Today: What’s Driving the Rally?

World Liberty Financial just ripped higher—an 8% surge in a single session. The stock's sudden jump has traders scrambling for answers, and all eyes are on its high-profile political connection.

The Trump Factor: Market Catalyst or Noise?

When a company's name gets tangled with a figure like Donald Trump, volatility follows. Today's move isn't about earnings or a new product launch; it's pure sentiment trading. The market is pricing in speculation, betting that the association itself translates to value—a classic case of narrative over numbers.

Following the Political Money Trail

Institutions and retail investors alike are chasing the momentum, creating a self-fulfilling rally. It’s the old Wall Street playbook: buy the rumor, sell the news. Just don't ask for the financials to justify the pop. Sometimes, in the grand theater of finance, the spotlight matters more than the script.

An 8% gain on political whispers? In any other sector, that would raise eyebrows. In this one, it's just another Tuesday.

Source: CoinGecko

Source: CoinGecko

What’s Behind World Liberty Financial’s Rally? Will It Sustain?

WLFI’s latest price surge could be due to the the project’s USD1 stablecoin hitting the $3 billion market cap milestone. The stablecoin market has seen incredible growth over the last few years. Several projects have begun stablecoin initiatives, including Ripple. USD1’s market cap hitting $3 billion may have led to a boost in investor sentiment. USD1’s massive growth may have been further amplified by Binance’s USD1 Boost Program. According to an announcement, the program is “designed to help USD1 holders to maximise their rewards.”

While World Liberty Financial’s (WLFI) rally is commendable, it is unclear if the rally can sustain itself. Given that the larger crypto market faced a massive correction and is undergoing a consolidation phase right now, WLFI’s rally may fizzle out over the coming days. Bitcoin (BTC) is struggling to hold the $89,000 price level, and other assets may follow its trajectory. WLFI could see a price dip if investors begin to book profits.

Additionally, market participants are currently taking a risk-averse approach. This argument is complimented by the fact that gold and silver are hitting new peaks ever so often. Investors could exit their WLFI positions, book profits, and relocate their funds to SAFE havens.