Gold Tumbles 1.5% as Bitcoin Surges 2%: The Great Asset Shift is Here

Forget the old playbook. While traditional safe havens stumble, digital gold is writing its own rules.

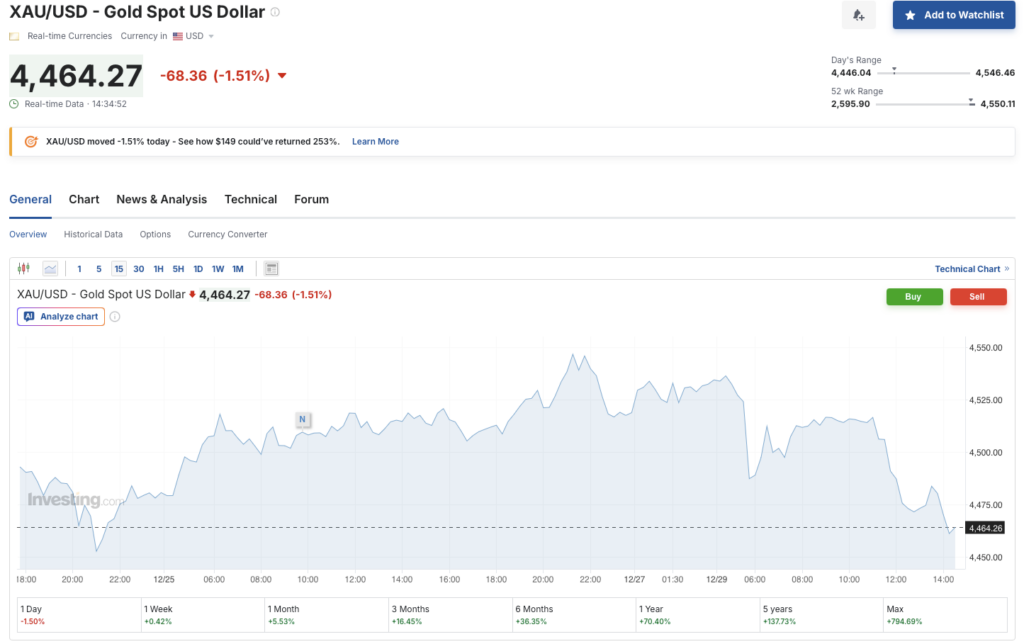

Gold's Glitter Fades

The precious metal just took a sharp 1.5% dive. That's not a typo—it's a signal. Inflation fears, interest rate jitters, the usual suspects are lined up. Yet, the classic hedge isn't holding its line. Makes you wonder what the vaults are really protecting these days.

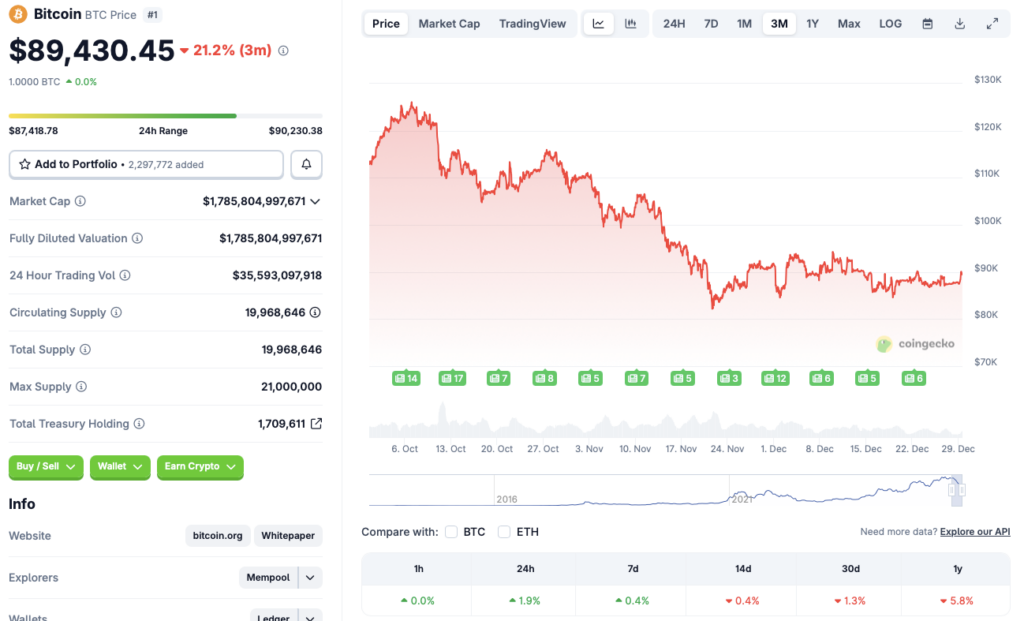

Bitcoin's Breakout March

Meanwhile, Bitcoin charges ahead with a solid 2% gain. No central bank whispered in its ear. No geopolitical summit gave it a nod. This momentum is organic, driven by adoption pipelines filling up and a network effect that's becoming too loud to ignore. It's not reacting to the old world's news cycle; it's creating its own.

The Narrative Rewrite

This isn't a coincidence—it's a correlation breaking down. The 1.5% drop versus the 2% climb paints a clear picture: capital is getting restless. It's sniffing out efficiency, sovereignty, and a system that operates 24/7/365. Why park wealth in a static asset when you can deploy it on a global, programmable ledger? Some bankers are still charging fees for that kind of question.

So, what's going on? A generational reassessment of what 'value' and 'safety' truly mean. Gold had its millennia. Bitcoin is building its foundation for the next one. The charts are just starting to tell that story.

Source: Investing.com

Source: Investing.com

Gold Dips While Bitcoin Rises: Is The Market Turning Around?

According to CoinGecko data, Bitcoin (BTC) has rallied 1.9% in the last 24 hours and 0.4% over the previous week. However, the original crypto is still down by 0.4% in the 14-day charts, 1.3% over the last month, and 5.8% since December 2024. Bitcoin (BTC) is currently facing resistance at the $90,000 price level. Breaching beyond $90,000 could take BTC back to $100,000, a price level last traded at in mid-November 2025.

Bitcoin (BTC) faced a steep price correction over the last few months after investors began to take a risk-averse approach. The development steps from macroeconomic uncertainties, leading to diminishing chances of another interest rate cut in early 2026. Investors have likely moved their funds from risky assets, such as bitcoin (BTC) and other cryptocurrencies, to safe havens such as gold and silver. The trend may continue over the coming months, until macroeconomic conditions improve.

The recent dip in gold and rise in Bitcoin (BTC) could be a signal that the trend may be in for a change. However, it is also possible that investors are testing the waters before 2026 kicks off. BTC could see a price dip, or a price consolidation over the coming days. However, if gold continues to dip, we may see a surge in crypto investments.