Ethereum (ETH) Price Prediction For January 2026: The Bull Case Unfolds

Ethereum's next major price target comes into focus as the network approaches a critical inflection point.

The Scaling Catalyst

Layer-2 adoption isn't just growing—it's exploding. Arbitrum, Optimism, and a dozen other contenders are siphoning transaction volume off the mainnet, slashing fees and making DeFi accessible again. This isn't just a technical upgrade; it's a fundamental demand driver. More utility means more users, and more users mean a stronger bid for ETH.

The Institutional On-Ramp Widens

Forget the speculative retail frenzy of cycles past. The real story is in the cold wallets of asset managers and corporate treasuries. Spot ETH ETFs, now a reality, have opened a firehose of traditional capital. It's a classic Wall Street move: first they ignore it, then they lobby against it, then they package it into a fee-generating product and sell it back to you.

Staking's Vicious Circle

The Merge locked in a new economic reality. With over a quarter of all ETH now securing the network, liquid supply is tightening. Every new validator not only strengthens network security but actively removes coins from circulation. This creates a self-reinforcing loop of scarcity—a feature no other major asset can claim.

January 2026: A Convergence Point

By early 2026, these threads pull taut. Protocol upgrades will be live, institutional flows will have matured, and the staking economy will be deeply entrenched. The price prediction isn't about chart lines; it's about the collision of proven utility with unprecedented capital access. The only thing more volatile than ETH's price might be a traditional portfolio manager's blood pressure watching it.

Ethereum January 2026 Price Prediction: What’s Happening

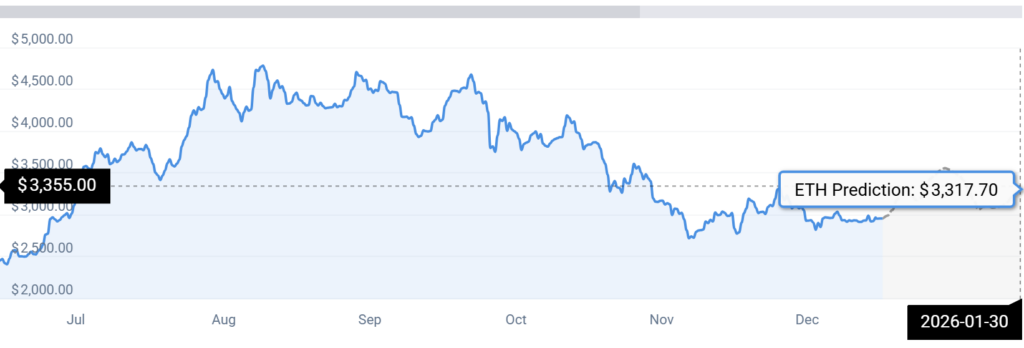

Ethereum has had a rough 2025. The past year has been a mix of many things, with Ethereum spending the majority of its time exploring lower price valuations. The token is down 10% in the last year, showing how it can slowly redeem its pace, especially as the tokenization agenda continues to gain steam, keeping ETH in the center of it.

LATEST:![]() Bitmine chairman Tom Lee told CNBC that Ethereum could reach $7,000-$9,000 by early 2026 as Wall Street accelerates tokenization efforts, with a longer-term case for $20,000. pic.twitter.com/bxdPzmRj7s

Bitmine chairman Tom Lee told CNBC that Ethereum could reach $7,000-$9,000 by early 2026 as Wall Street accelerates tokenization efforts, with a longer-term case for $20,000. pic.twitter.com/bxdPzmRj7s

Per Javon Marks, a leading cryptocurrency expert, Ethereum is currently showing two price targets that it wants to hit eventually. Marks claims how Ethereum’s price chart is showing a bullish divergence, bringing a new high of $4900 into play. Moreover, the Ethereum price is targeting an ambitious price spot of $8500 after claiming $4900, showcasing how the asset is planning for the long haul.

$ETH currently holding the formation of another Hidden Bullish Divergence and the response suggested from this type of pattern can consist of an over 54% increase to the All Time Highs above $4,900!

This WOULD bring $8,500+ into play…

(Ethereum) pic.twitter.com/G5qCMpEKQQ

![]()

The January ETH Targets

According to CoinCodex ETH stats, Ethereum is currently showing signs of a possible ascent, climbing up to hit $3317 by the end of month 2026.