BNB’s $1000 Rebound: Binance’s Flagship Token Eyes Historic Comeback - Here’s the Timeline

Forget the bear market whispers—BNB is staging a comeback tour, and its next stop looks like four digits.

The exchange token that powers the world's largest crypto ecosystem isn't just recovering; it's retracing a path burned into the charts during previous bull cycles. Market structure suggests a consolidation phase is giving way to accumulation, with key moving averages flipping from resistance to support.

When Liquidity Talks

Order books reveal thinning sell-side liquidity above current levels. Each minor pullback gets bought aggressively—a classic sign of institutional hands building positions away from the retail spotlight. The $1000 level isn't just psychological; it's a major technical confluence zone where previous breakdowns occurred.

Catalysts Over Hype

This isn't blind momentum. Binance's ongoing burn mechanism permanently removes BNB from circulation—a deflationary tailwind most traditional finance products can only dream of. New chain adoption, from gaming to real-world assets, increases fundamental utility beyond simple fee discounts. Meanwhile, regulatory settlements, while costly, removed a monumental overhang—allowing the market to price the actual ecosystem, not just legal risk.

The Final Hurdle

Breaking through the $1000 barrier requires more than technicals. It needs a surge in total value locked across BNB Chain, a spike in new project deployments, and sustained positive net flow into Binance's spot markets. Watch for a decisive weekly close above the 200-week moving average—that's the signal the algorithms are waiting for.

The path is clearing. The mechanisms are in place. The only thing left is for the market to do what it does best—price in the future before most realize it's arrived. After all, in crypto, the 'smart money' is usually just the money that got there first and had the stomach to hold.

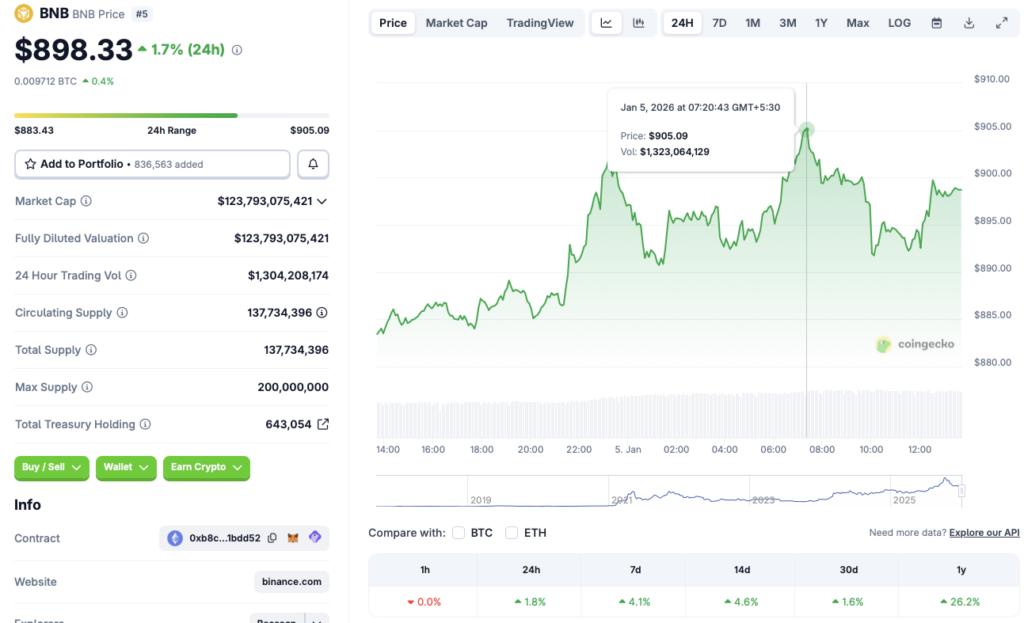

Source: CoinGecko

Source: CoinGecko

When Will Binance’s BNB Coin Hit $1000 Again?

According to CoinCodex analysts, BNB will continue to rally over the coming weeks. The platform anticipates the asset to reclaim the $1000 mark on Feb. 18, 2026. CoinCodex further expects BNB to breach the $1,191 by April 4, 2026

BNB’s latest price rally comes amid a larger crypto market resurgence. Bitcoin (BTC) briefly hit the $93,000 price level, and other assets seem to be following its path. The market rally could be due to hopes of economic stability after the US seized Venezuelan oil reserves following a military strike.

While BNB’s rally is commendable, it is unclear if the rally can sustain itself. The crypto market has struggled to gain momentum since October, despite two interest rate cuts in three months. Macroeconomic uncertainties have pushed investors into SAFE havens such as gold and silver. Both precious metals have hit multiple new all-time highs over the last few months. BNB could face another price correction if market participants continue their risk-averse strategy.

However, we could be in the early stages of another bull run. If the larger economy shows signs of cooling down, and jobs data also supports the larger picture, BNB could continue its upward trajectory. Nonetheless, fresh volatility could present unforeseen challenges to the crypto market.