BlackRock’s Bitcoin ETF Just Gobbled Up Its Biggest Single-Day Haul in 3 Months

The institutional floodgates are creaking open again.

Wall Street's quiet giant just made a statement that echoed across crypto trading desks. In a single, decisive move, BlackRock's spot Bitcoin ETF recorded its largest daily inflow since the post-launch frenzy cooled—a clear signal that the 'smart money' isn't just dipping a toe, but diving back in.

What the Flow Really Means

Forget the retail hype. This isn't about social media sentiment or meme coin mania. This is capital allocation on a scale that moves markets. When an asset manager of this magnitude directs fresh billions toward a Bitcoin vehicle, it's a structural bet. They're not trading the news; they're building a position.

The move bypasses the old arguments about custody and technical hurdles. It cuts straight to portfolio strategy. For major funds, this ETF is now just another box to check—digital gold, sitting neatly beside Treasuries and tech stocks.

The Institutional Green Light

Three months of relative calm had some wondering if the institutional story was over. This surge answers that question with a resounding 'no.' It suggests a renewed, perhaps more calculated, phase of accumulation. The early adopters got in; now the mainstream allocators are following their playbook.

It's a powerful counter-narrative to any lingering bearishness. While pundits debate cycles, these flows show money voting with its feet—or more accurately, its servers.

A New Phase for Crypto Assets

This isn't just about Bitcoin's price. It's about validation. Every billion that flows into these regulated products further embeds crypto into the global financial system. It turns volatility from a bug into a feature—another asset class with its own risk-return profile for quants to model.

Sure, the traditional finance crowd might still scoff at the 'magic internet money' aspect over their third espresso. But their compliance departments just got a lot more comfortable with the ticker symbol.

The takeaway? The infrastructure is built. The pipes are primed. And when the world's largest asset manager decides it's time to drink, it doesn't use a straw—it uses a firehose. Just another day where the future of finance looks less like a Wall Street trading floor and more like a global, digital ledger. The cynics will call it a speculative bubble; the allocators call it Tuesday.

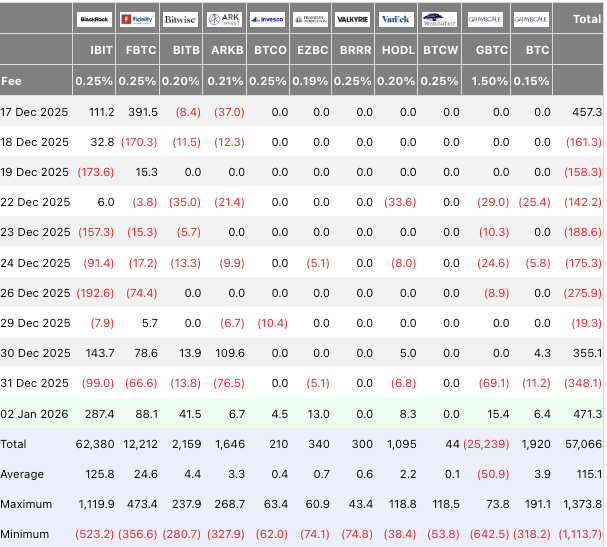

Source: Farside Investors

Source: Farside Investors

Will Bitcoin Continue Its Rally Following BlackRock’s Big ETF Inflow?

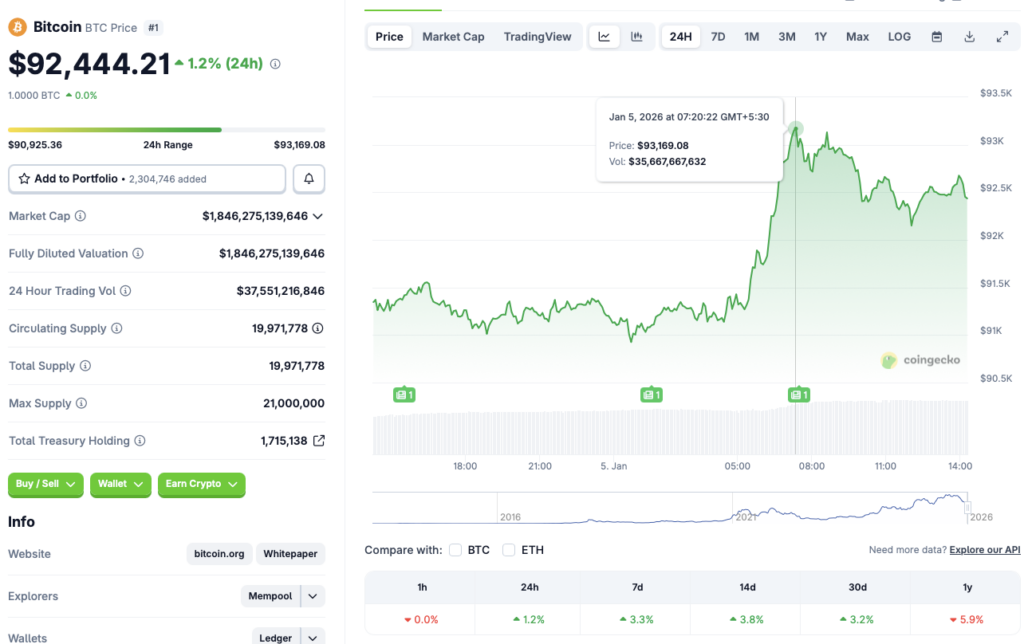

Bitcoin (BTC) briefly breached the $93,000 mark earlier today, Jan. 5, 2025. However, the asset faced substantial resistance, falling back the $92,000 price level. According to CoinGecko data, BTC has rallied 1.2% in the last 24 hours, 3.3% in the last week, 3.8% in the 14-day charts, and 3.2% over the previous month. Despite the turnaround, the original crypto is still down by nearly 6% since January 2025.

BTC’s rally may have been triggered by BlackRock’s big purchase. Moreover, bitcoin (BTC) celebrated its 17th birthday on Jan. 3. A birthday rally may have further pushed the asset price. The market rally may have also been propelled by the expectations of economic stability following the US seizing Venezuelan oil reserves following a military strike.

We may be entering the early stages of another bullish market phase. Grayscale and Bernstein claim that Bitcoin (BTC) is following a 5-year cycle, and not a 4-year path. This means that the original crypto may climb to a new peak in 2026, five years after the 2021 all-time high. Bernstein anticipates BTC to hit a new all-time high of $150,000 in 2026.

However, there is also a chance that the crypto market will face new challenges from fresh volatility over the coming weeks. Macroeconomic uncertainties continue to worry investors. Market participants have taken a risk-averse approach, evident from gold and silver prices hitting new multiple new peaks over the last few months.