Trump Flags Supreme Court Tariff Case as Major Risk for Markets

Markets brace for impact as former President Trump singles out a looming Supreme Court decision on tariffs—calling it the single biggest threat to financial stability.

The Legal Countdown

No dates, no dollar figures—just pure political risk. The case centers on executive authority to impose sweeping tariffs without congressional approval. A ruling could reshape trade policy overnight, sending shockwaves through equities, bonds, and yes, even crypto.

Why Crypto Watchers Should Care

Traditional market tremors don’t stay contained. When institutional capital gets spooked, it either flees to safety or hunts for uncorrelated returns. Digital assets often become the pressure valve—volatility spikes, liquidity shifts, and narratives flip on a dime. Remember: regulatory uncertainty is crypto’s native habitat.

The Ripple Effect

Trade wars distort currency flows, disrupt supply chains, and fuel inflation fears. That cocktail tends to boost hard-asset narratives—from gold to Bitcoin. But a messy legal battle? That injects pure chaos, the kind that makes even degenerate traders check their leverage.

Wall Street’s Blind Spot

Analysts can model earnings and Fed policy—but they can’t model a 5-4 decision. The Street’s obsession with quarterly guidance looks almost quaint when constitutional law hits the docket. Another reminder that the biggest market risks often wear robes, not suits.

Bottom line: This isn’t just another headline. It’s a structural threat with binary outcomes. Markets hate ambiguity, and the Supreme Court just deals in it. Buckle up—or hedge with something that doesn’t care about judicial review.

Trump’s Tariffs and Supreme Court Ordeals: What Is Happening?

Donald Trump, the US president, has recently issued a statement regarding his upcoming tariff ruling by the Supreme Court. This hearing is essential for the future of the United States, as it may rule out the legitimacy of tariffs imposed by the US on other countries. However, a negative ruling reprimanding these tariffs can be intense for markets, as the US may be compelled to shell out billions as tariff refunds, sending shockwaves within the market anatomy.

![]() TRUMP: IF SUPREME COURT RULES AGAINST TARIFFS, WE'RE SCREWED

TRUMP: IF SUPREME COURT RULES AGAINST TARIFFS, WE'RE SCREWED

President Trump warned that a Supreme Court ruling against his tariffs WOULD force the US to refund hundreds of billions of dollars and could unwind trillions in related investments, calling the outcome “a complete… pic.twitter.com/goNRLahI5O

Trump made new comments about this ruling recently, adding how the entire payback process could be extremely messy for the nation to deal with if this ruling goes awry in any way.

BREAKING: President Trump says the US would have to pay back "trillions of dollars" if the Supreme Court rules that his tariffs are illegal.

"It would be a complete mess," Trump says.

A ruling is expected by as soon as Wednesday this week. pic.twitter.com/yLrrIJufP5

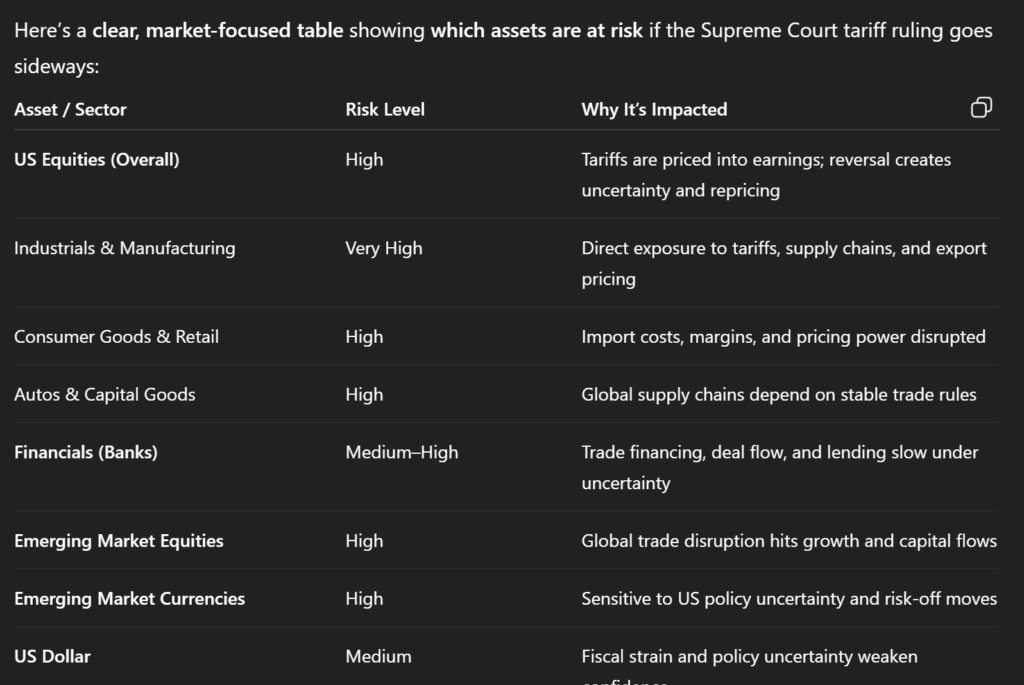

Assets at Risk

Trump later shared how this development could push the US off track, compelling it to pay an exorbitant amount of money.

Trump later shared

If this ruling goes sideways, the assets that are most at risk are US equities and emerging market assets, per ChatGPT. Moreover, the US dollar and commodities linked to global growth are also at risk, given their volatile nature and stance.