Ethereum (ETH) Price Prediction: BlackRock and Fidelity ETF Buying Frenzy Fuels Unstoppable Momentum

Wall Street giants are placing their biggest bets yet on Ethereum's future—and the smart money is following.

The Institutional Floodgates Open

BlackRock and Fidelity aren't just dipping toes—they're diving headfirst into ETH ETFs, creating a buying pressure that's reshaping the entire crypto landscape. Traditional finance finally admits what we've known for years: Ethereum isn't just digital gold, it's the foundation of the new financial system.

Momentum Builds Beyond Speculation

This isn't retail FOMO driving prices. We're watching institutions scramble to secure positions before the real explosion hits. The ETF approvals triggered a domino effect that even the most skeptical bankers can't ignore—though they'll still call it a 'speculative asset' while quietly rebalancing their portfolios.

The New Financial Architecture

Ethereum's proving it's more than just a cryptocurrency—it's becoming the backbone of decentralized finance. While traditional banks debate interest rates in wood-paneled rooms, ETH's smart contracts are quietly rebuilding global finance from the ground up.

Wall Street's late to the party as usual, but at least they finally brought their checkbooks. The real question isn't if ETH will hit new highs—it's how many zeros get added before traditional finance admits they should've bought sooner.

Ethereum (ETH) Price

Ethereum (ETH) Price

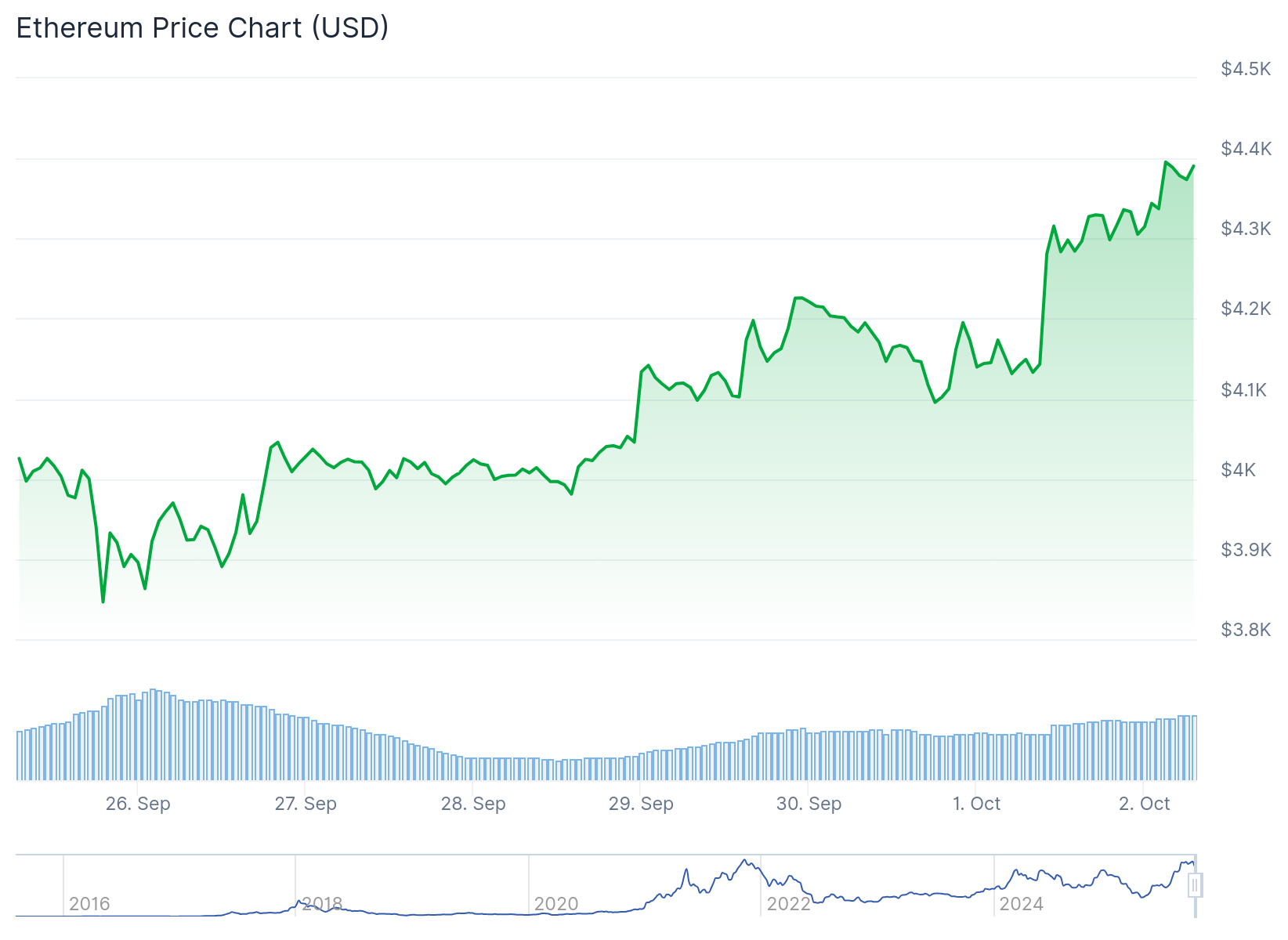

The cryptocurrency has gained 2.7% over the past seven days. Trading volume has climbed 6.51% to reach $43.48 billion.

Ethereum spot ETFs recorded major inflows on September 29, 2025. The products attracted approximately $547 million in new capital. Fidelity led the buying with around $202 million in purchases.

$ETH ETF inflow of $127,500,000 🟢 yesterday.

BlackRock bought $127,500,000 in Ethereum. pic.twitter.com/sXfDHhfHUs

— Ted (@TedPillows) October 1, 2025

BlackRock added close to $154 million to its holdings. These inflows ended several consecutive days of outflows from ethereum ETFs.

Research indicates that $100 million in ETF inflows can lift spot prices between 0.3% and 0.7%. The renewed institutional demand has provided stability to the market.

Crypto analyst Marzell Crypto noted that Ethereum recently pushed past the $4,300 mark. The analyst stated that maintaining closes above $4,261 is critical for continued upward movement. This level now serves as a key support point.

UPDATE!!! 🚨

ETHEREUM is PUMPING!!! 🚀

📊 #ETH has tapped the $4,300 level and is showing strength.

✅ On the 4H timeframe, we need to see price hold and close above $4,261 today for longs to remain valid.

As long as $ETH stays above this key zone, momentum favors further… https://t.co/cdIiBHK4P5 pic.twitter.com/fqUG7IFSJq

— Marzell (@MarzellCrypto) October 1, 2025

Price Targets and Technical Analysis

Another analyst, BitBull, pointed out that Ethereum successfully converted the $4,000 level from resistance into support. This flip is viewed as a positive development by market observers.

Based on current market conditions, some analysts project potential price targets between $8,000 and $10,000. These forecasts depend on sustained momentum and market participation.

The Relative Strength Index for Ethereum currently sits at 50.82. This reading shows neutral market conditions with slight bullish momentum. The indicator has improved from an earlier reading of 44.57.

The MACD indicator stands at -12.1 with a signal line at -51.9. The histogram remains slightly positive but still in negative territory. This suggests some continuing resistance in the market.

Chart analysis identifies resistance NEAR $4,275. Beyond this point, upside targets are seen at $4,450 and $4,800. Medium-term projections extend toward $5,766 if current momentum continues.

Support levels remain strong between $4,100 and $4,175. Ethereum is currently trading above this range. Analysts view this zone as a potential demand area if any pullback occurs.

Trading volume has increased by 13.86% to $84.44 billion according to CoinGlass data. Open interest ROSE 2.88% to reach $57.02 billion. These figures show continued trader and investor interest in the cryptocurrency.

The ETH OI-Weighted Funding Rate stands at 0.0062%. This rate indicates moderate market Optimism among traders.

Derivatives market data shows bullish positioning among traders. Binance reports a long-to-short ratio of 1.8. Top traders display higher conviction with a ratio of 2.7.

Daily futures volumes jumped 38% to $72 billion. Options activity increased by 50%. These rises in volume indicate that traders expect larger price movements.

Ethereum remains below a descending resistance trendline from September highs. A confirmed close above $4,300 WOULD represent a structural shift. This move could open a path toward higher price targets of $4,450, $4,800, and eventually $5,766.