Monero (XMR) Skyrockets as Privacy Competitor Zcash Loses Entire Development Team

Privacy coins just got a seismic shake-up—and the market's voting with its wallet.

Monero's price surge isn't happening in a vacuum. It's a direct reaction to chaos across the aisle. Zcash, once heralded as the privacy-forward alternative with its selective transparency, just watched its entire core development team walk out the door. Poof. Gone. No roadmap, no maintenance, just a gaping void where a tech team used to be.

The Privacy Play Gets Simple

For investors and users, complexity is the enemy. Zcash offered optional privacy—a feature that, ironically, regulators and exchanges found all too easy to 'option' out. Monero? It's privacy by default, no questions asked. With Zcash's dev exodus, the narrative crystallizes overnight: if you want a privacy coin that actually works like one, the choice just got a lot simpler.

Network Effect Meets Flight to Safety

This isn't just about one team quitting. It's about network security and long-term viability. Developers are the lifeblood of any crypto project. When they leave, the code stagnates, vulnerabilities go unpatched, and confidence evaporates. Capital isn't sentimental; it flees from risk and flocks to the strongest alternative. Monero, with its battle-tested protocol and active, dedicated community, is soaking up that flight to safety—and the speculative premium that comes with it.

The Ironic Twist for 'Institutional' Privacy

Here's the cynical finance jab: Zcash's design, often pitched as more 'palatable' to institutions due to its auditability, became its Achilles' heel. It tried to please both masters—privacy purists and compliance officers—and in the end, may have satisfied neither enough to sustain its core builders. Meanwhile, Monero, the 'rebel' asset, demonstrates that in crypto, unwavering commitment to a core utility can be the ultimate institutional-grade feature: survivability.

The market's verdict is clear. In the high-stakes world of digital privacy, reliability trumps optionality. When the developers of a rival project vanish, the remaining titan doesn't just win by default—it gets a massive, multi-million dollar vote of confidence.

TLDR

- Monero has regained its position as the largest privacy cryptocurrency by market capitalization, trading around $460 on Thursday.

- The entire Electric Coin Company team resigned after a dispute with Zcash’s parent nonprofit board, causing ZEC to drop approximately 15%.

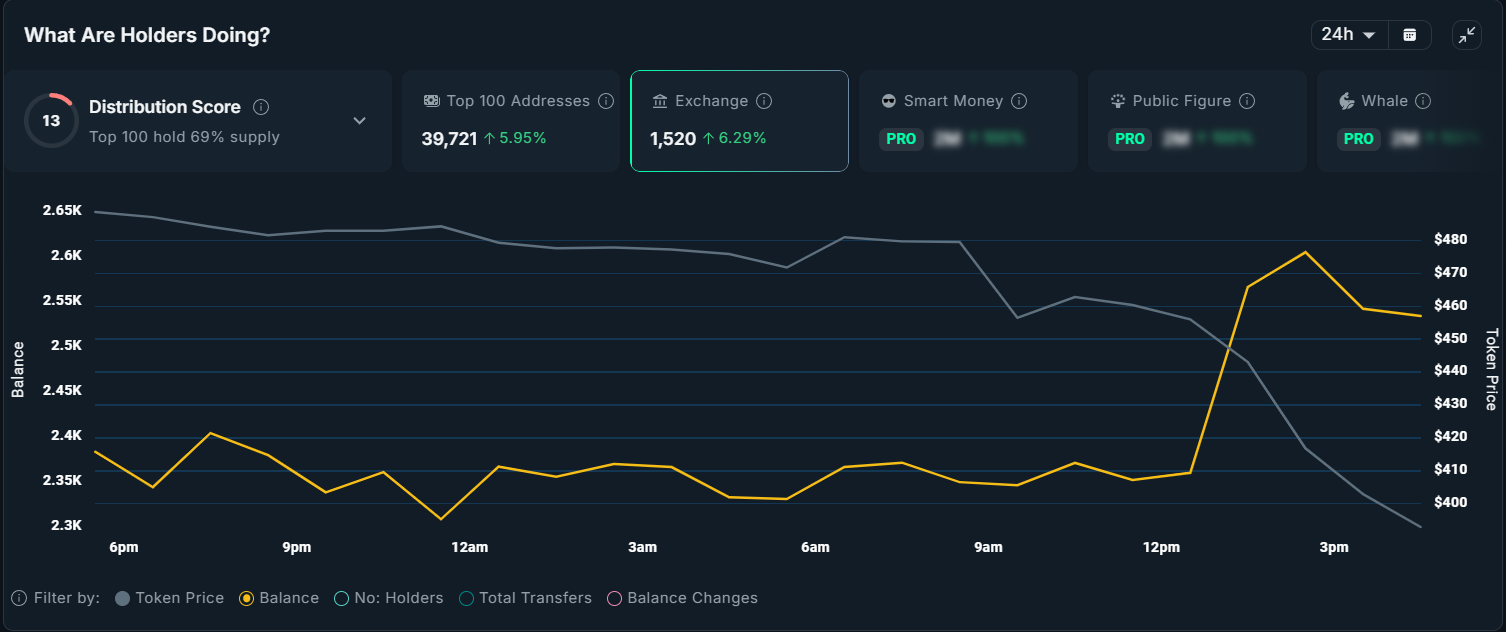

- Exchange data shows Zcash balances rose 7% in 24 hours, indicating increased selling pressure following the governance crisis.

- Capital appears to be rotating from Zcash to Monero, with XMR gaining roughly 5% while ZEC fell 16.7% during the same period.

- Monero currently trades about 13.5% below its all-time high of $518.99, with momentum indicators showing strong buying pressure.

Monero has returned to its position as the largest privacy cryptocurrency by market capitalization. The shift comes as Zcash faces internal challenges that triggered price declines and investor uncertainty.

Trading around $460 on Thursday, Monero sits close to the $490 level it briefly reached in late December. The token has extended a multi-week rally that outperformed most privacy-focused digital assets.

This marks a reversal from mid- to late-2025 when traders favored ZEC as their preferred privacy play. Zcash had attracted attention through wallet integrations that support shielded transactions.

The current shift accelerated Thursday after the entire Electric Coin Company team resigned. ECC CEO Josh Swihart described the departure as constructive discharge by the Bootstrap board, with developers forming a new company.

Swihart stated that decisions taken by the board altered employment terms in ways that undermined the team’s ability to operate independently. He emphasized that the Zcash protocol remains unaffected by the governance changes.

ZEC dropped by approximately 15% on the day before recovering slightly. The decline extended a pullback from November highs and reversed part of the surge that pushed the token into the top 20 cryptocurrencies late last year.

Zcash Holders React to Development Team Exit

On-chain data shows a surge in selling activity within hours of the announcement. Nansen reported a sharp increase in exchange inflows, with ZEC balances on exchanges rising by roughly 7% in 24 hours.

Rising exchange balances typically indicate preparation to sell. This behavior highlights a sudden shift in sentiment among Zcash investors.

Zcash’s Chaikin Money FLOW turned negative, signaling net outflows. During the same period, Monero’s CMF spiked upward, reflecting growing inflows.

The timing suggests investors may be reallocating within the privacy sector rather than exiting it entirely. When uncertainty hits one project, capital often migrates toward perceived stability within the same narrative category.

Monero Gains Ground in Privacy Sector

XMR price climbed roughly 5% during the same window that saw ZEC fall 16.7%. Zcash currently trades NEAR $398 following the decline.

#XMR buy and hold for smart gains. #XMR Monero once again becomes a leader in the field of privacy, while #ZCASH is experiencing instability that undermines the growth of its price! $XMR #Monero pic.twitter.com/63zCRIYuUN

— CryptoBull_360 (@CryptoBull_360) January 8, 2026

Momentum indicators support Monero’s improving outlook. XMR’s Money Flow Index surged sharply in the early hours following the Zcash announcement.

A rising MFI indicates strong demand entering the market. In Monero’s case, the uptick suggests buyers are stepping in with conviction.

XMR currently trades near $456, placing it about 13.5% below its all-time high of $518.99. The market capitalization gap between the two tokens has widened as Monero maintains momentum while Zcash navigates near-term uncertainty.

Andreessen Horowitz’s crypto division stated this week that privacy will serve as the key competitive advantage in 2026. The a16z crypto team made the comments as the privacy sector experiences renewed attention from investors and developers.

Traders are monitoring how the ECC team’s departure affects development timelines for protocol upgrades and ecosystem growth initiatives at Zcash.