Wealth Didn’t Vanish—It Flooded Into These 5 Top-Performing Assets

Forget the obituaries—the money didn't disappear. It just packed its bags and moved to a better neighborhood.

While traditional portfolios groaned under the weight of old-world thinking, capital executed a silent, massive migration. The smart money didn't wait for permission; it chased asymmetric returns in markets that never close.

The New Wealth Havens

Five asset classes didn't just outperform—they absorbed the fleeing capital and multiplied it. This wasn't a gentle reallocation. It was a wholesale transfer from legacy systems to digital-native frontiers.

Think of it as a stress test for the entire financial architecture. Spoiler: the old pillars cracked, while new foundations proved earthquake-proof.

Decoding the Migration Patterns

The flow tells the real story. It wasn't random. Institutional FOMO met retail savvy, creating a liquidity vortex that bypassed traditional gatekeepers entirely. The pipes changed, and so did the pressure.

Forget waiting for quarterly reports. These assets trade on global sentiment, technological breakthroughs, and a collective bet on a different financial future—one that's transparent, programmable, and ruthlessly efficient.

What the Charts Scream (That Headlines Whisper)

The data paints a stark picture of preference. It's a referendum on trust, speed, and sovereignty. Each percentage point gained in these arenas represents a vote of no-confidence in the sluggish, intermediary-riddled status quo.

It’s the ultimate market signal—capital voting with its feet, sprinting towards higher velocity and clearer ownership rules. The old guard is left debating spreadsheets while the valuation rockets have already launched.

The Bottom Line: Adaptation or Irrelevance

This wealth transfer isn't a blip. It's the new tectonic plate of finance, shifting value from centralized vaults to decentralized networks. The genie isn't going back in the bottle.

The cynical jab? Wall Street spent decades perfecting the art of charging fees for moving money slowly. Now, open-source code does it better, faster, and for pennies—and the irony is so thick you could hedge against it.

Wealth didn't evaporate. It upgraded its operating system. The question is, are your assets still running the legacy version?

The Leading 3 Assets Shifting the Wealth Narrative As Of Late

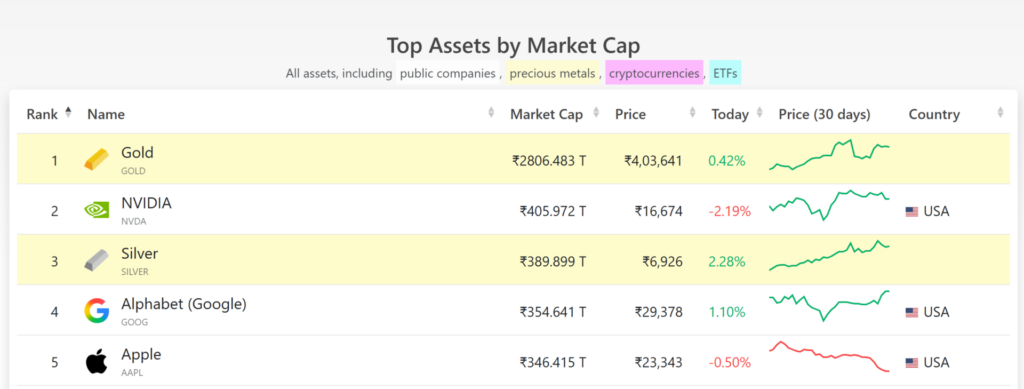

According to the latest update by Companies Market Cap, gold has become the leading top asset by market cap, defeating the dollar in the race. Gold has become a safe-haven hedge as geopolitical uncertainty continues to drive the metal to new highs. With predictions of the asset hitting $5K in the NEAR future, gold continues to lead the top asset radar with glory and pride.

Other than gold, Nvidia and silver are the next two trending assets by market cap that are now creating a new wealth narrative. With the boom of AI tech, Nvidia is leading the rally with its chips powering the budding AI domain. Silver, on the other hand, is also the third largest asset by market cap, rising steadily amid brewing geopolitical mayhem and uncertainties.

I'm highly bullish on gold and silver mining stocks and believe that they are like buying Amazon, Google or Nvidia in 2010 just before their massive surge.

My theory is that miners will truly take off once the S&P/TSX Venture Composite Index, which tracks Canadian micro-cap… pic.twitter.com/q4Pzu4kMAT

The Other Two Trending Assets

Apart from gold, Nvidia, and silver, Alphabet (Google) and Apple have secured the fourth and fifth spots, respectively, when it comes to owning up to the current wealth narrative. Shares of these firms have been projecting a bullish stance, with Alphabet’s market cap surpassing that of Apple’s for the first time since 2019. These 5 top-performing assets have long paved the way for investors to extract maximum gains and may continue to do so in the near future.

BREAKING: Alphabet, $GOOGL, officially surpasses Apple to become the second largest public company in the world, worth $3.96 trillion. pic.twitter.com/Tam3jigD45

— The Kobeissi Letter (@KobeissiLetter) January 8, 2026Alphabet shares ROSE 65% in 2025, its best year since 2009. The stock outpaced gains from NVIDIA, Microsoft, & Apple, rebounding 116% from an April low of $144.70. By year-end, Alphabet reached a market capitalization of approximately $3.78 trillion. pic.twitter.com/UerqwjrpbE

— Earn Your Leisure (@EarnYourLeisure) January 1, 2026